Strategic Next Actions

- Continue to demonstrate the power of using advanced personal-development knowledge and know-how to learn how to become a professional trader super fast (Second and Third Brain).

- Continue to use trading as a vehicle to enhance and accelerate your personal-development (spiritual, financial, and business intelligence).

- Continue to learn about how to become a better price action trader.

- Continue to seek to put on about 3 to 6 trades only every week to practice trading with patience and spiritual balance (a trading edge).

- Specifically focus on your trading development for the next 3 months (12 weeks).

- Update your trading spreadsheet more frequently to remove from your mind any painful memories of losing trades.

- Update your trading spreadsheet sooner to avoid psychological shocks that stop you identifying trading opportunities.

- Consider trading re-test only when trading the DXY and the US10Y.

- Continue to focus, solely, on learning how to trade as this will enable the money to follow.

- Prioritise pursuing 1:3 risk to reward ratio trading opportunities.

- Continue to focus on using weekly and daily timeframe for high-probability trading opportunities.

- Continue to trade in the direction of the weekly timeframe Stochastic RSI to prevent unnecessary trading losses and good risk to reward ratios unless trading a trend reversal.

- Continue to submit trading entries in the area of the resistance and support levels as opposed to only on the lines.

- Remember that you have already become quite a sophisticated trader due to your knowledge and use of the Ichimoku, Elliott Wave, Stochastic RSI, Relative Strength Index, Trendlines, Support and Resistance Levels, and Fibonacci (so all you have to do, now, is continue your learning process).

- Insert chart from page 62 into this book review.

Strategic Learning Points (Elaboration)

- This text has reminded me that everything comes down to good organisation skills (weekly planning, daily productivity activities, and so forth) in then end. With good organisation skills a person can become extremely effective and productive over a 20 year period; however, with great organisation skills an individual can become a phenomenon or supernatural.

- Also, this book reminded me that everything in life is about optimization. Whether it is how to speak, listen, negotiate, trade, write, read… it is all about making the best use of what we have in every area of our lives in the present whilst we seek to incrementally improve those things for the future.

- Overtime, it seems that the majority of the trading books that I have read seem to indicate that price action trading seems, by far, to be the best approach to trading the markets. I guess this is primarily due to the fact that price action trading with the use of support and resistance level on larger timeframes acts as a reliable leading indicator.

- This text has helped me to confirm that I’ve become a price action discretionary trader, or a discretionary trader who uses price action as part of my trading style.

- The writer stated that… “trading setups based on price action analysis don’t appear very often, but once they are present on the chart, chances are that they are well worth careful monitoring and analyzing.” In support, this is why, strategically, I have discovered that it make sense to trade multiple markets (at least 10) using the daily and weekly timeframe. This is because by doing so, a trader will likely find at least one good price action trade every few days. Without trading multiple markets, a trader will have to wait a relatively long time to be presented with good trading setups slowing down the rapid accumulation of trading experience.

- “… before employing any trading systems or strategies, it is important that we understand the importance of an appropriate mindset in trading and how it should become second nature to us.” Hence the significance of my Mind Movies, Second Brain, and Third Trading Brain. I’m curious to discover how this will all turn out another six months from now (god-willing, I suspect my growth and development will be amazing)!

- “One single loss or even a number of losses will not tell you anything about your analysis and your system. In fact, the best systems still generate many losing trades. It is how you remain disciplined and objective in the market that matters most. Strict compliance with rules will help to free you from unexpected pains resulting from losses.” In support, I am now experiencing the importance of updating my trading spreadsheet regularly to protect my minds against the pains resulting from inevitable trading losses.

- “The better you are at avoiding psychological shocks, the better you are at identifying opportunities via candlesticks.” This is exactly what my current trading experience is revealing to me. Psychologically, when I updated my trading spreadsheet, I saw that I was incorrectly thinking that my numerous small loses had been worser to trading accounts than they actually were (causing me to question my trading ability). Once I become aware of the truth: that my trading development has been going brilliantly, it enable to me to better see (psychologically) new trading setups or opportunities immediately.

- Intriguingly, the writer states that he only submits trading entries within the stock market on re-tests of the price action only, revealing that he is a very conservative trader. At some point, I will analyse (backtest) his approach when carrying out technical analysis of all markets other than crypto to test its validity. He argues that the upside is that it enables him to (1) obtain better risk to return ratios as there is more certainty regarding the placing of stop-losses, and (2) practice being patient (a patience is a trading edge for sure).

- Reminded that “… many traders, if not most, join the market for one reason – money, and that is the problem (obstacle to learning).” However, from a strategic standpoint, this is an advantage for committed people like myself as it acts as the perfect barrier separating those who are serious from those who most likely will only ever become good amateurs. This is why I have adopted the saying we must “first learn to trade then the money will follow!”

- This text really reveals that it is not about the amounts traded at all. Rather, it is all about the “risk to reward ratio.” If we are making “1:3s” whilst losing numerous “1s” only, then we are well on our way to being profitable and successful traders. The reverse is also true. If we are making “1:1s” or “1:2s” then it will be harder to become a successful trader because we will still be losing many “1s” (small trading loses) along the way. Therefore, it is all about the risk to reward ratio. “1:3s” to “1:5s+” would be the best state of affairs. Thus, less is more. It better to have three or four trades that will grant you a 1:3 than it would be to have numerous trades that provide you with a 1:3: at the expense of sustaining numerous small loses. That said, the writer states that his favourite ratio is 1:2.5, and he does also trade 1:2s and 1:1.5s.

- Counter intuitively, “if we are losing without understanding the reasons, we must ask ourselves whether we are too concentrated on making money (profits) as opposed to mastering the trading process (One Good Trade).

- Similarly, the writer states that finding good trading setups requires a trader to wait hours if not days, and he uses the daily timeframe as the focus of his trading style.

- “From my experience, patterns not present on any key levels are often false signals which may cause a disastrous outcome. They might be an indication that the dominant side is recharging its energy and a correction is occurring, but then the prevailing trend strongly continues.” In support, my current experience analysing Bitcoin and the DXY indicates that the writer is correct. As a result, I now purposely wait for the price action to reach its major resistance or support level before I decide on my next course of trading action.

- Reminded that the number one reason for trading losses is trading in to opposite direction to the larger timeframe (i.e. weekly) trend.

- “Notice I use the word “area” instead of a specific price level. Using a price area gives us a wider range of price movement on the chart and saves us from missing good opportunities amid wild fluctuations of the price.” This is a strong reminder that I should make small entries in the area of the support and resistance level as opposed to precisely on its line.

- This book confirms that (1) it is advisable to jump into a price action trend during its beginning as opposed to in the middle or at the end. And (2) it is not so easy to do so. This is because it requires a trader to know how to interpret overbought and oversold situation possibly with knowledge of resistance and support areas, and the use of suitable indicators.

- I was right to conclude that “… a change in the market structure is a “must” to better increase the chances of picking up a high probability reversal setup.” In practice, this is highly likely to mean the following… (1) waiting patiently for the Stochastic RSI, and (2) the RSI to hit overbought and oversold positions… (3) waiting patiently for the price action to reach the next key support or resistance area… (4) determining that the price action is in the 5th Wave of a Motive Phase, or (5) a Wave A, B, or C in the Corrective Phase… (6) waiting for the price action to reach the relevant trend line without the lagging span breaking through on the 4 hour timeframe.

- My initial impressions is that the writer’s 3MS principle (three conditions for a market structure change) is too conservative for my trading style (suggesting that I’m an aggressive trader). He is talking about waiting for two lower lows and a new lower high, and visa versa if trading the other way. Whereas, I would prefer to anticipate when the market structure will change by (1) ascertaining if the price action is well over-extended in any direction… (2) making small entries at the major resistance or support levels in anticipation of a change in price direction… (3) using indicators like the RSI, Stochastic RSI to see if they support the intended price reversal trade.

- Reminded of the significance of looking for at least two confirmation signals from the indicators, trendlines, resistance and support levels, and so on before placing a high-probability trade. The more the better.

- Price action alone will never be enough to detect price reversals (insert chart from page 62 into your book review).

- The writer recommends a trading ratio of 10 trades per month with risk to reward ratios of minimum 1:2.5. That in affect means about 2 to 3 trades per week in order to not only enhance our patience but also help us keep a balanced state of mind. Intriguingly, my trades per week are double his recommendations. I put on about 5 to 6 trades per week, providing me with double the amount of trading experience (possibly evidence that I am more of an aggressive trader). However, I take his point onboard completely: it is all about keeping a balanced mind and developing our ability to be patience, as this is the one thing that many, if not most, traders will struggle to achieve (providing an advantageous trading edge).

- Take a look at the writer’s spreadsheet templates (link on page 86) to determine if they can improve my current record-keeping in any way.

Key Strategic Sentences and Paragraphs from ‘Secrets on Reversal Trading‘

INTRODUCTION

“Like any other endeavor, good trading should be simple. In other words, you shouldn’t employ too many systems or indicators at the same time. But, success in financial trading goes hand-in-hand with good organizational skills (p. 4).”

“Think about it… You must optimize everything in your life, from basic skills, like how to speak, how to listen, how to negotiate with others, etc. We are taught to implement things in a way that generates the best possible results (p. 4).”

“However, the fact is that we cannot perform well until lots of effort has been made. We learn from mistakes, understanding which attempts can be improved and which should be retained to achieve better results while suiting our style. In short, we need to optimize strategies, techniques, and tips via “trial and error” to find a way to sustainable success (p. 4).”

“Bear in mind that all good things in life take time, and success in trading is not an exception (p. 4).”

CHAPTER I: PRICE ACTION TRADING

“Put simply, price action is a trading style that enables traders to read market signals and make trading decisions based on recent historical data, instead of relying wholly on complex technical indicators (p. 6).”

“This trading style takes many technical analysis tools into account, including but not limited to charts, support/resistance, trend lines, price ranges, swing highs and swing lows. Which tools to use depends on each trader’s preference, but a price action trader generally keeps the chart simple (p. 6).”

“The trader then assesses, based on the aggressiveness of the buyers, whether the trend is likely to continue before identifying a trade setup and trigger (p. 6).”

“Trading setups based on price action analysis don’t appear very often, but once they are present on the chart, chances are that they are well worth careful monitoring and analyzing (p. 7).”

CHAPTER II: SHAPE YOUR MINDSET FOR SUCCESS IN TRADING

“Hence, before employing any trading systems or strategies, it is important you understand the importance of an appropriate mindset in trading and how it should become second nature to you (p. 8).”

“Basically, trading in its purest form is a field of probabilities. If you join each trade with a high probability of stacking the odds in your favor, you are likely to win in the long term (this book will focus on how you can obtain such a high probability) (p. 8).”

“Yet, we must keep in mind that we cannot avoid losses all the time. Even the most successful traders in the world suffer from losses, and sometimes the losses are high, to be frank (p. 9).”

“This is also my first advice when it comes to trading in any market. When you are in an environment with lots of uncertainties, the adoption of a proper mindset is a MUST (p. 9).”

“One single loss or even a number of losses will not tell you anything about your analysis and your system. In fact, the best systems still generate many losing trades. It is how you remain disciplined and objective in the market that matters most. Strict compliance with rules will help to free you from unexpected pains resulting from losses (p. 9).”

“The better you are at avoiding psychological shocks, the better you are at identifying opportunities via candlesticks (p. 9).”

“Always be open-minded and listen to what the candlesticks want to tell you. In trading, flexibility is a MUST (p. 11).”

“Successful trading in the financial market is closely aligned with analyzing the correlation between buyers and sellers. It can only be done by analyzing the charts yourself. No robot can replace a human to do this task (p. 11).”

“In reality, I rarely enter any trade without correction (also referred to as a retest), except for some highly volatile markets such as cryptocurrency. This not only helps me reap greater profits but also allows me to acquire a better risk/reward ratio and cultivate patience (p. 12).”

CHAPTER III: EVERYTHING STARTS WITH THE WAY YOU THINK

“However, many traders join the market for another reason – MONEY. The majority of traders join the market with “profits” as the TOP reason, and that is the problem (p. 13).”

“Concentrate on the risk/reward ratio. The market is a game of probabilities. It is not important if you win or lose in any individual trade. It is important how much you earn when you win and how much you lose when your trade hits the stop-loss level. This also emphasizes the importance of the risk/reward ratio. More on that in the next chapter (p. 17).”

“Use longer timeframes (monthly, weekly, daily, 4-hour charts). In my opinion, these timeframes offer more reliable signals than shorter ones (p. 17).”

“Moreover, you will realize that in trading, LESS IS MORE. Some newbies may believe that the more trades they enter, the more profits they will gain. However, the truth is the opposite. You must keep in mind that good setups do not appear very often in the market (p. 17).”

“To win in financial markets, you must be well-organized. In fact, one of the best ways to approach a trade execution is to build a potential scenario for the price movements (p. 17).”

“In short, if you are losing without understanding the reasons, ask yourself whether you are too concentrated on profits. It is the primary reason traders are constantly wiping out their accounts. If you are focusing on profits, try to pull yourself out of thinking this way. Instead, protecting your hard-earned money should be your top priority (p. 17).”

“You’ll have to wait for hours or even days to find a true opportunity in the markets, which serves to cultivate your patience as well. This helps you avoid over-trading, emotional trading, arbitrary trading, and helps protect your account. By opting for the very best trade setups, you put the odds more in your favor (p. 18).”

“Little noise: When trading short-term moves, traders can easily be affected by sporadic actions from Big Hands in the market. A large enough order can undermine your trade analysis quite easily (p. 19).”

“Among the frames mentioned above, the daily chart is the central timeframe in my trading (p. 19).”

“On the other hand, I don’t object to using the 1:1.5 or 1:2 ratios. Yet, my favorite ratio is at least 1:2.5, which I believe is worth our time waiting, scanning, analyzing, and finally executing trades (p. 22).”

“With a 1:3 ratio, for example, after you win a trade, it will take at least 4 losing trades to cause you to lose overall. Thinking this way, you can relax after each loss. Nothing makes you happier than a belief that you will be profitable eventually (p. 22).”

“From my experience, patterns not present on any key levels are often false signals which may cause a disastrous outcome. They might be an indication that the dominant side is recharging its energy and a correction is occurring, but then the prevailing trend strongly continues. Even though some of these patterns may work and the market reverses for some time, it is better to stay on the sideline (p. 23).”

CHAPTER V: LET’S DEFINE THE TRENDS CORRECTLY

“You should not think of buying an asset or instrument when the market is in a strong downtrend, and vice versa. Determining the trend incorrectly is the No.1 reason losses occur (p. 26).”

“Notice I use the word “area” instead of a specific price level. Using a price area gives us a wider range of price movement on the chart and saves us from missing good opportunities amid wild fluctuations of the price (p. 28).”

“For example, while we can see how strong the 118.80 was as a support area, there was one point where the price missed just a few pips for a validated visit to the price level. If you treat this level as an area and allow certain tolerance, chances are that you wouldn’t miss that buy opportunity (p. 29).”

“To me, the weekly and daily charts are the best ones for providing a better picture of the market (p. 30).”

“Also, it is important to note that no trend can last forever. It is always advisable to jump into a trend during its beginning so that we can have the chance to ride most of the trend. To do this, traders must first seek some reliable signals of a trend termination before looking for some signs of a new trend and going with the new trend (p. 30).”

“This is also known as detecting overbought or oversold areas in the chart, which is by no means an easy task (p. 30).”

CHAPTER VI: SECRETS ON IDENTIFYING RELIABLE MARKET REVERSALS

“Your task as a trader is to filter only high probability trade setups, which is what seasoned traders pay much attention to (p. 31).”

“First, the price needs to be presented in a key support or resistance area. (COMPULSORY) (p. 31).”

“Second, there is a change of the market structure, i.e., from an uptrend to a downtrend, or from a downtrend to an uptrend. (COMPULSORY). – Third, the candlestick pattern itself must carry a clear sign of a turnaround in connection with market structure analysis (more on this later) (p. 31).”

“First, finding key support/resistance is highly recommended, but not a “must” (p. 32).”

“Second, a change in the market structure is a “must” to better increase the chances of picking up a high probability reversal setup (p. 32).”

“In these cases, it is advisable to stay on the sideline and watch for other reliable market signals (p. 35).”

“But it formed a bullish head and shoulder? Suggestion head and shoulder low probability trade? (p. 35).”

“Later on, when I mention the “3MS principle”, just understand that I am referring to three conditions for a market structure’s change, either from up to down or vice versa (p. 36).”

“In terms of trading reversal, normally I won’t open a position until all the 3MS principles appear in the chart. This is not to refute the fact that sometimes, we just need two or even one out of the three components for a successful trade (p. 38).”

“Some traders may choose to trade sideways in these cases, but it’s quite dangerous because there won’t be so much room for the price to bounce upward and downward (p. 39).”

“Regarding the third criterion, which relates to the reversal signals within the candle itself, we will take a look at some real examples in the following chapters (p. 39).”

CHAPTER VII: ENGULFING PATTERN TRADING WITH 3MS PRINCIPLE

“Trading on retests has always been my favorite style regarding many types of assets or instruments (p. 47).”

“In trading, the more factors you collect in validating your setups, the more probability of success you will have. One of the most powerful tools to confirm a break of the market structure is a trend line (p. 49).”

“Yet, I’m in favor of a conservative style and that’s why I often (not always) consider entering a trade at D (p. 53).”

CHAPTER VIII: PIN BAR TRADING WITH 3MS PRINCIPLE

“As I always emphasize, an ideal pin bar (or any other candlestick pattern) should be present in a key support or resistance area before any further consideration (p. 58).”

“… chart. Take a look at the picture below (p. 63).”

“Price action is enough to spot trend reversals (p. 63).”

“A very interesting point of the market structure analysis method is that you can trade with pure price action without relying too much on candlestick patterns (p. 63).”

CHAPTER IX: INSIGHTS INTO DOUBLE TOP/BOTTOM TRADING

“In previous books, I emphasize the use of confirmation signals, in which a trade won’t be executed unless there are at least two indicators or tools approving the trade signal (p. 83).”

“Now comes the 7-step success formula in trading. Again, this is among the very few things I can guarantee and if you apply these consistently, your account will be safe for a long time. – Find an appropriate trading strategy. – Verify its effectiveness by doing back-testing. – Open a trading account with an appropriate provider (To me, it’s an account with a low spread – bid/ask difference). – Use the daily chart for your trading decision. – Risk per trade: 1% – 1.5% (highly recommended 1% for newbies). – Set a risk/reward ratio: at least 1:2.5 (ideally 1:3 or better). – Set a trade frequency: maximum of 10 per month (p. 84).”

“A spreadsheet which records all relevant information in connection with your strategy’s performance over past price behaviors is highly recommended. Click HERE to download two different powerful templates (for free) which took me a few hours to optimize for the best use in trading (p. 86).”

“In contrast, by limiting your maximum number of trades to only 10, you not only enhance your patience but also help keep a balanced state of mind (p. 87).”

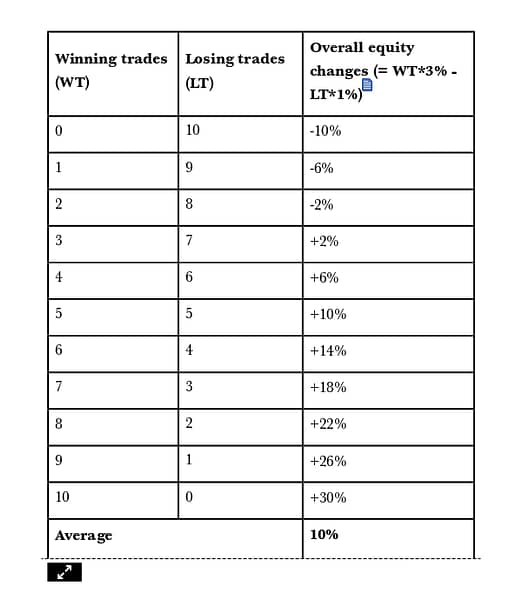

“Assume that you are applying the 1% risk management method in connection with the ideal risk/reward ratio (1:3), the table below shows the potential for your account to grow after the 7-step formula is applied consistently (p. 88).”

“Winning trades (WT) Losing trades (LT) Overall equity changes (= WT*3% – LT*1%) (p. 88).”

“Copy table for 10 winning trades (p. 88).”