1. SOL

In light of Bitcoin’s possible reversal if the price action reaches the middle of the parallel channel (below), I have decided to trade Solana as it is an Altcoin that is likely to move up 20+% if BTC starts to rally to the upside.

As a result, I have started to scale into a SOL long position in accordance to the chart marking above (first entry level at purple line number 1, and so forth).

2. SPY

3. BTCUSDT

Learning Points

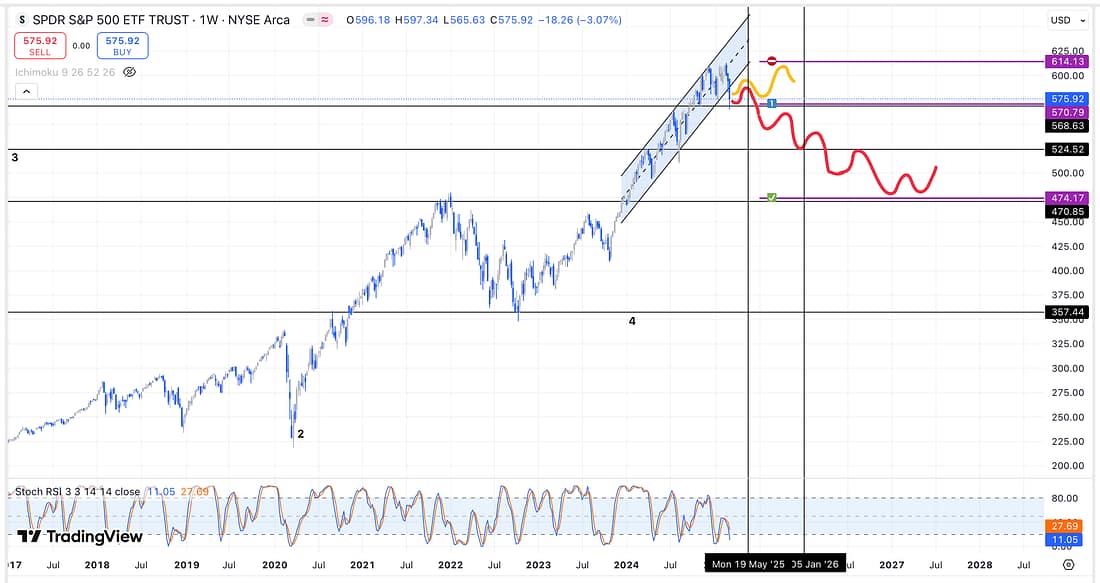

- As can be seen above, the SPY (representative of the US stock market) looks ready to enter into a general decline, with the price action moving sideways, if not straight down.

It is further anticipated that this will last until at least 2027 if the SPY makes a reasonable 20% price action correction.

The result is that that Bitcoin is likely to do likewise, with Bitcoin actually being the first to decline strongly due to it being considered (by investors) a riskier risk asset that is more volatile.

However, before a possible decline occurs, I am expecting there to be a short-lived relief rally in the coming weeks.

And burn this into your nervous systemThe short rally should cause the price action of the SPY to return back to the scene of the crime (near its previous all time highs) by late May/June 2025.

And if it does so, then I will be expecting Bitcoin to also rally hard to the upside of its parallel channel.

Significantly, this will probably be the last chance to take some capital out of Bitcoin before we experience another overall market decline that is likely to last a few years at the least.

This is all on the assumption, however, that the SPY declines instead of rises.

If, on the contrary, the SPY turns bullish again, then I will be expecting Bitcoin to start reaching new all time highs anew.

Let’s see how this all plays out.

. - Marking up the charts with the brush is a technique that I have started using again, and it seems to be making a tremendous amount of difference.

Specifically, it is revealing to me that I am really good at anticipating the most likely direction of a market or assets price action.

. - It is really all about inter-market analysis in order to make the highest-probability trades, as confirmed by my most recent ones:

(1) DJI and GE,

(2) US10Y and TLT,

(3) UVXY and QQQ,

(4) UAL and JETS, and

(5) NATGAS and UNG.

Next Action

- Continue to watch the US stock market (SPY) closely to make the best investment decisions possible.

- Continue to use parallel channels, as a brilliant simple indicator, to assess the most likely direction of market price action.

- Start scaling into a long SOL trade as soon Bitcoin looks like it will experience a price action reversal to the upside.