Trading Watchlist

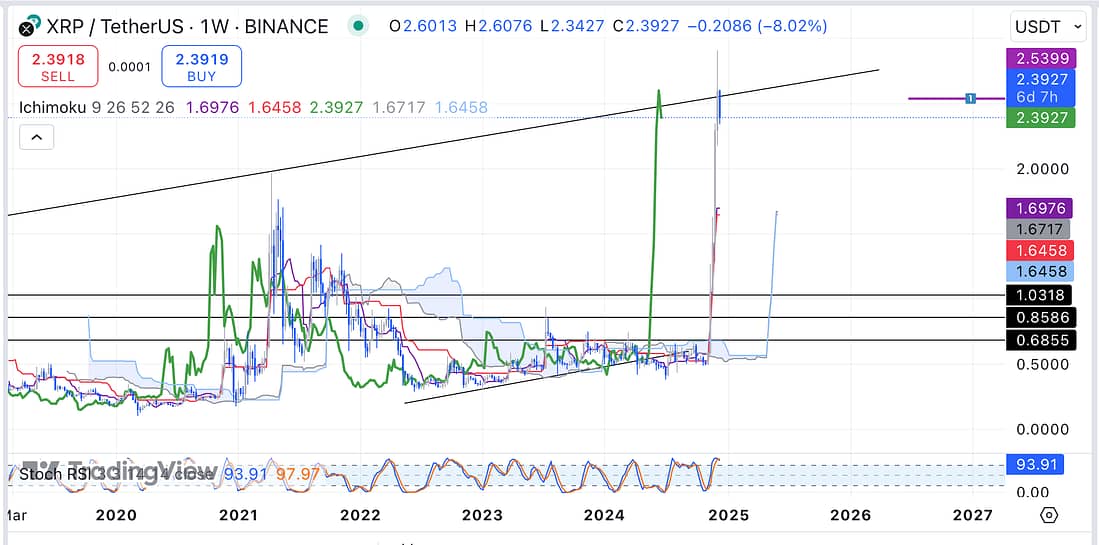

1. XRPUSDT – analysed:

2. BTC – analysed.

3. BTC.D – analysed: continue analysing the percentage movement everyday.

4. MARA – analysed.

5. RUT – analysed: still bullish structure.

6. CMG – analysed.

7. SFM – analysed: starting to decline.

8. COST – analysed: prices starting to decline.

9. AXP – analysed.

10. JETS – analysed.

11. UAL – analysed.

12. FDX – analysed.

13. DG – analysed.

14. UVXY – analysed.

15. US10Y – analysed.

16. US10 – analysed.

17. TLT – analysed.

18. TIGR – analysed.

19. BIDU – analysed.

20. DXY – analysed.

21. VLVLY – analysed.

22. SOXX – ranging.

23. MU – analysed.

24. INTC – analysed.

25. XAUUSD – ranging.

26. ONDOUSDT – analysed.

27. LINKUSDT – analysed.

Learning Point

- The price action, on the larger timeframes, always seems to respect the key technical levels without fail.

- TIGR and BIDU rallied extremely hard today: seek to add capital to these trades when there are significant pull-back (ideally at least 2 times).

- Today, I carried out my trading analyse poorly because I did it whilst I was also in conversation.

Next Action

- Remember to monitor the price action of some longer term crypto investments like ONDO, and CHAINLINK.

- Carry out further research in relation to ONDO, CHAINLINK, and XRP.

- Place more trust on technical analysis in regard to larger timeframes.

- Continue to analyse the markets everyday (watchlist) in silence and solitude.