VLVLY

“A” informed me that the liberals that she knows who would ordinarily drive a Tesla electric car are now switching to driving Volvo due to their strong dislike of Elon Musk.

As a result, she asked me to look into the company (VLVLY) to determine if it would be worthwhile making an investing.

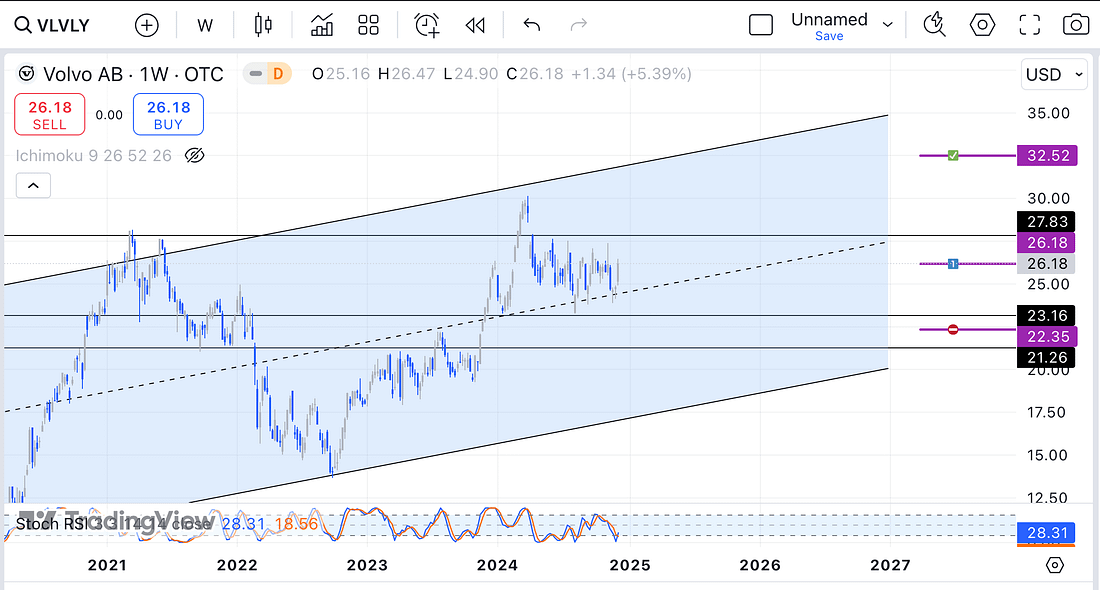

As can be seen above, the price action of VLVLY seems to be follow a parallel trendline on the weekly timeframe; therefore, it may make sense to buy a few shares as a long-term investment for about 3 months or so. Especially as when Trump takes office in January, this is likely to upset existing Tesla car owners to such a great extent that they will immediately start to ditch their Tesla’s on mass favouring Volvo.

That said, trading discipline and expertise would suggest that a trade or investment should be made only when the price action reaches the current resistance level or moves back down to the support level. At present, the price action is positioned in no man’s land. So, let’s wait patiently before we consider making an entry.

Learning Point

- No matter what appears to be going on at ground level, the charts always appear to provide us with a more accurate picture of what is happening now in the short to medium-term.

- Watching Gareth Soloway’s daily trading video has enable me to draw parallel channels and trendlines, and anticipate price action movements with supreme confidence.

Next Action

- Consider making a long-term investment (to run for at least 3 months: 12 weeks) into Volvo.

- Monitoring the price action of VLVLY everyday to ascertain when it reaches the resistance or support level (a major train station).

- Continue watching Gareth Soloway’s trading videos everyday to keep progressing your trading ability exponentially.

XRP

After watching a few YouTube videos concerning XRP (the bankers’ crypto project), I was considering making a small long-term investment. On analysing its charts (above), however, it looks due for a strong correction on the monthly timeframe as indicated by the diagonal trendline.

In an ideal scenario, the price action would consolidate above the diagonal trendline before it would be prudent to submit a long entry.

What I suspect is going to happen though is that the price action is going to decline strongly (return back to the scene of the crime) before any upside potential rally resumes.

Learning Point

- My accumulating experience of carry out technical analysis everyday is providing me with a better and better trading and investing edge.

Next Action

- Continue carrying out technical analysis (go through your trading watchlist) everyday as a central part of your trading development.

- Continue to monitor the price action of XRP everyday to advance your trading expertise and experience.