Trading Watchlist:

1. COST

Take 50% profits out of COST trade as the price action has blown past your take-profit level. Now, expecting the price action to retrace back to “the scene of the crime” (see yellow brush mark above) before resuming its decline.

2. DG – analysed.

3. UAL – analysed.

4. JETS – analysed.

5. NATGAS – analysed.

6. UNG – analysed.

7. WOLF – analysed.

8. RUT – analysed.

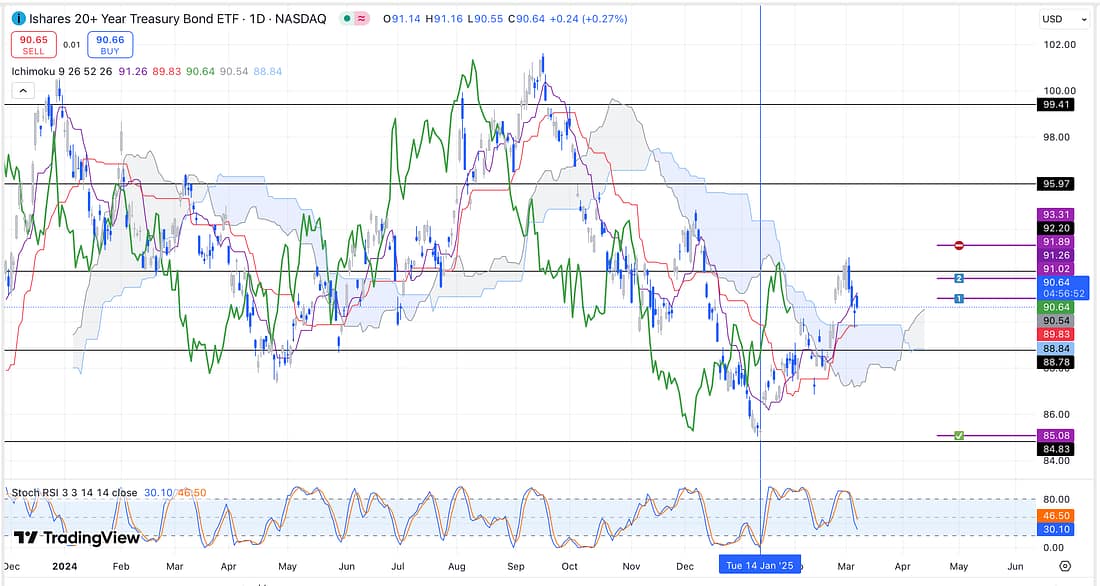

9. US10Y – analysed:

10. TLT – analysed:

Start scaling into TLT short position as soon as possible because the US10Y appears to be rising as anticipated.

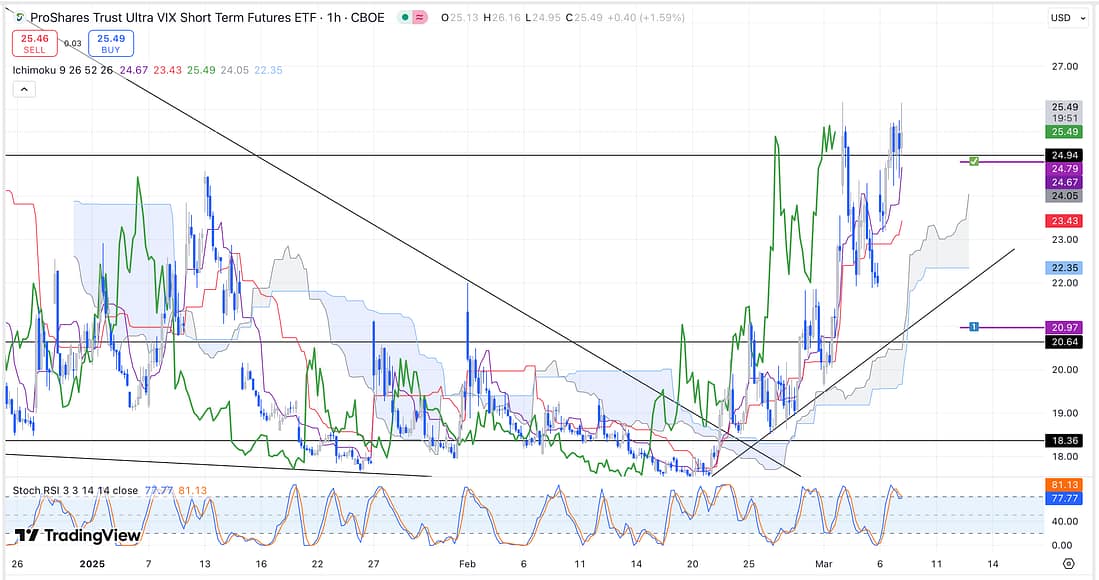

11. UVXY – analysed:

The Stochastic RSI on the 1 hour timeframe appears to be a great indicator for anticipating when the price action of UVXY is most likely to decline or rally hard.

As a result, wait patiently for the Stochastic RSI to enter the oversold position before considering whether to enter another UXVY long trade.

Next Action

- Exit COST short with 50% profit as soon as possible.

- Start scaling into TLT short position as soon as possible.

- Wait for UVXY Stochastic RSI to enter the overbought position on the 1 hour timeframe.

- Watch today’s trading “Weekly Wrap-Up”.