Trading Watchlist:

1. QQQ

As can be seen above, it appears that the institutional computers have cleverly triggered the majority of stop-losses, then run the market-up.

It was truly a clever move, if I may say so.

I was curious with what would happen with the QQQ today, and it did not disappoint in terms of increasing my trading experience.

2. GOOG

Similar to QQQ, the institutional algorithms appear to have carried out a stop-loss hunt in regard to my GOOG and IWM trades:

3. IWM

4. GFI – analysed.

5. XAUUSD – analysed.

6. NATGAS – analysed.

7. UVXY – analysed.

8. GDX – analysed.

9. SFM – analysed.

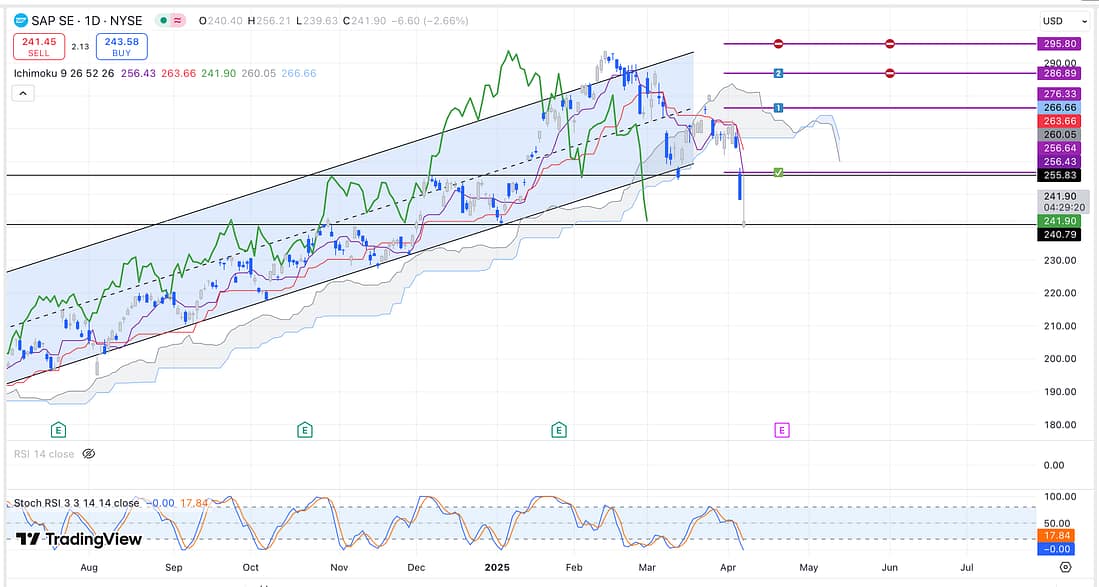

10. SAP – take 50% profits out of SAP as soon as possible:

11. FFIV – analysed.

12. BIDU – analysed.

13. FDX – analysed.

14. PALL – analysed.

15. WOLF – analysed.

16. BIIB – analysed.

17. UAL – analysed.

18. AVGO – analysed.

19. MRNA – analysed.

20. WBA – analysed.

21. SOLUSDT – analysed.

Learning Point

- The parallel channel trades that I carried out weeks earlier were able to withstand the short-term manipulation or volatility in the markets.

Also the trades that I entered into that involved less popular stock or markets did not experience the same levels of volatility or market manipulation.

So, the learning point: be very weary about entering trades in regard to popular markets or stocks when the markets are unsettled.

. - Today, those of use who are trading against the overall bearish trend on the larger timeframes, or submitted short only in the last week or so, paid the price today when the markets whipsawed.

The learning point: submitting relatively early parallel channel trades on the larger timeframes increases would seem to increase the odds of each individual trade being profitable.

Next Action

- Take 50% profit out of SAP as soon as possible.

- Watch today’s “Verified Game Plan”.

- Watch today’s “Trading the Close”.

- Consider, intentionally, staying out of the markets until they settle down.