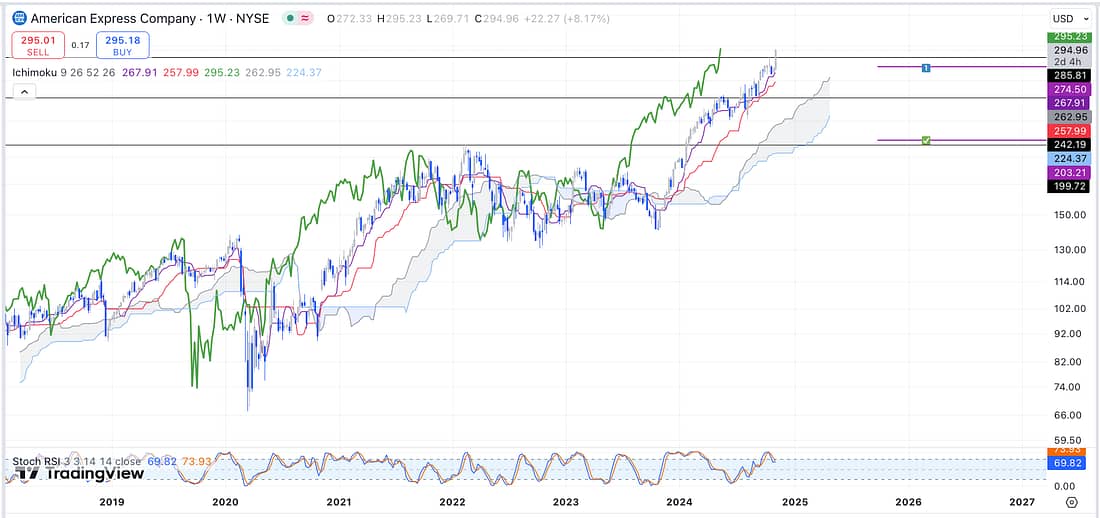

AXP

Today, I decided to exit my AXP short for the following reasons:

- I have recently sustain several small losses in relation to similar trades shorting SFM, JETS, and UAL.

- AXP, and the stock market in general, has been rallying very hard off the back of Trump’s election win.

- In light of my recent losses, I want to re-evaluate my shorting price action strategy, to workout how I may be able to increase their odds of success (create higher probability).

Learning Point

- I re-learned the importance of not taking any trading losses personally. Instead, I will continue to assess my trading style in a detached way after sustaining any losses.

- To increase the probabilities of my shorts on the weekly timeframe, I can wait for a confirmation signal on the 4 hour timeframe using a diagonal trendline and the lagging span or, alternatively, I could use Gareth Soloway’s confirmation candle technique on the daily timeframe.

Next Action

- Continue to assess the price action of AXP everyday in order to continue progressing your learning and trading experience.

- Continue to assess the potential effectiveness of using the 4 hour timeframe lagging span as a confirmation signal for weekly timeframe shorts.

- Continue to assess the potential effectiveness of using Gareth Soloway’s daily candle confirmation signal on the daily timeframe.

- Update your new trading spreadsheet with your latest trading losses.

UVXY

To my surprise, the UVXY experienced a tremendous, and unexpected, decline today.

I decided to make another long entry, as a consequence, as the price action has now reached my previously desirable entry level on the weekly timeframe (purple line numbered two).

Let’s see how this plays out.

Next Action

- Continue to monitor the price action of UXXY on a daily basis to continue your learning process.

- Continue to work your way through the trading watchlist everyday to keep up your rapid learning process.