Trading Journal

“First learn to trade then the money will follow!”

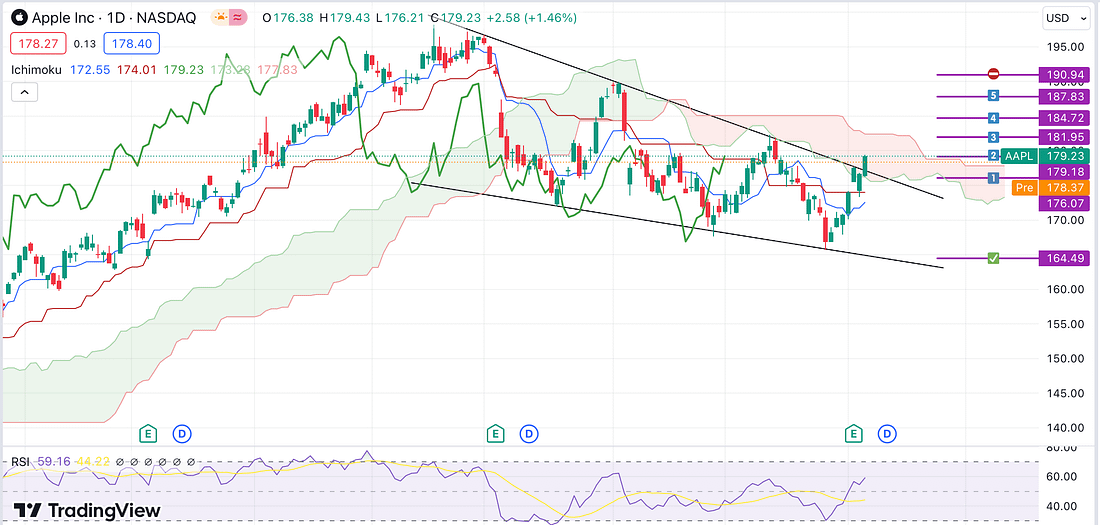

Today, I was able to make my entries into AAPL and NVDA at more favourable prices when the markets opened earlier today.

As can be seen above, a red bearish Kumo Cloud above the price action, with the lagging span failing to break through the relevant trend lines, suggest that probabilities favours the price declining over the next couple of days. All that I need to do now is be disciplined and patient (qualities that I have been honing my entire life).

Learning Point

- Using the daily timeframe, it seems that marking-up the charts in advance in terms of exactly how I am going to stagger into the relevant Short or Long positions makes trading decisions relatively very easy.

- What I need to do now is accumulate more experience concerning the movement of the price action when I mark-out a 1:1 risk to reward trade.

- Currently, I feel that marking out a 1:1 is necessary in order to avoid market manipulators from easily identifying where my stop-loss area is most likely to be, then causing it to be triggered.

- I found that slowly, but surely, I am becoming addicted to looking at the charts, as I am beginning to start looking at them too frequently.

Next Action

- Become more disciplined with your frequency reviewing the charts: review the charts twice a day maximum.

IVG (Involgize)