1. DG – DG seems to be moving bullish as anticipated. Continue to monitor the position in the next hour to confirm that it is not a false breakout (better safe than sorry). In the meantime, start to scale in by entering a very, very, small position using the 4 hour timeframe:

2. BTC – Bitcoin has a bullish bias, but I still have to wait for confirmation on the 4 hour timeframe to see if it is ready to break through the current resistance level. Currently, the price action is moving sideways on the 4 hour timeframe. This would suggest that it is not a good time to enter any active trade in either direction. It is now all about being extremely patient until the price action shows a clear trend again (this is a key learning point).

3. MARA – due to the uncertain price direction of BTC, MARA is also moving sideways on the 4 hour timeframe. So, continue to do nothing, other than wait patiently for Bitcoin to be on the move again.

4. RUT – analysed: still has a bullish price action structure on the 4 hour timeframe.

5. CMG – has risen past my initial price target level. I will continue to hold on to my position as its bullish trend does not appear to be weakening as of yet. Keep up your monitoring of CMG on the 4 hour timeframe.

6. FDX – analysed: continue to stay out of these type of markets that present a lot of uncertainty.

7. SFM – analysed: still bullish.

8. WMT – still bullish: consider making a long entry if there is any substantial pull-back to the Ichimoku Kijun.

9. COST – still bullish: consider making a long entry if there is any substantial pull-back to the Ichimoku Kijun.

10. AXP – submit a very small long position as the price action appears to have sufficiently pulled-back:

11. USOIL – analysed: still ranging.

12. JETS – analysed: still bullish.

13. UAL – submit a small long entry:

14. LTCN – analysed.

15. LTCUSDT – analysed.

16. SOXX – analysed: ranging.

17. INTC – analysed: still declining strongly.

18. BIDU – analysed.

19. TIGR – analysed.

20. X – still ranging.

21. XAUUSD – analysed.

22. PALL – still no man’s land.

23. US10Y – analysed.

24. US10 – analysed.

25. TLT – analysed.

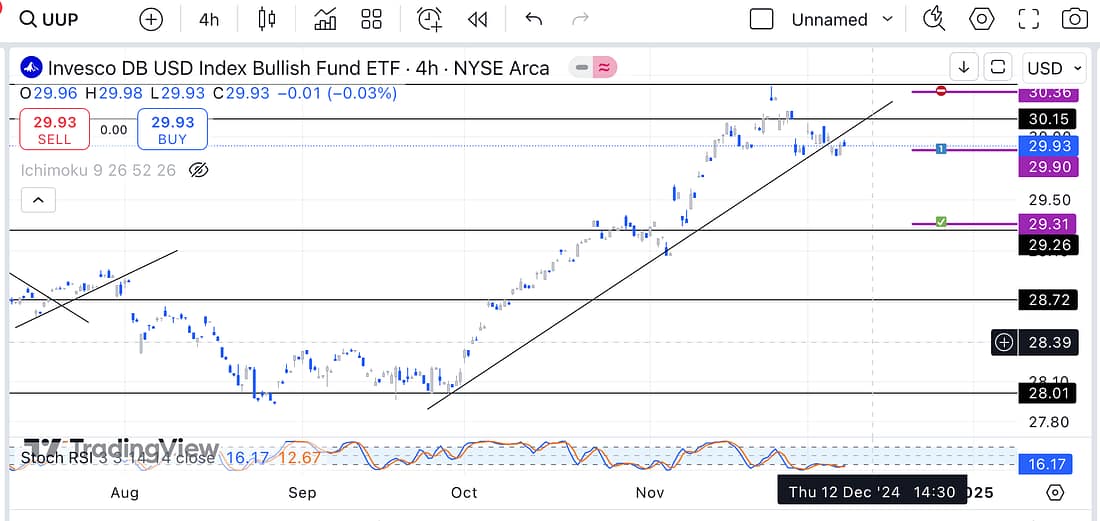

26. DXY – appears to be declining on the weekly timeframe so consider scaling in with a short position using UUP.

27. UUP:

Learning Points

- After tracking SFM, WMT, UAL, JETS, AXP, and COST for weeks; and (to my surprise) watching the price action steadily grind higher and higher and higher everyday; I decided that it is time for me to enter a long position on the ones that have had a good pullback already. This is because it may still take many more days or weeks before these stock experience a significant pull-back. And if this occurs, then I will be ready to go short. However, until then, it makes strategic sense to ride the market higher until things eventually change, because nobody really knows how long the current bullish run will last for. I am very surprised that it has lasted this long already.

- In order to anticipate a possible take profit target level for AXP, as it forms new all time highs, I decided to use the Fibonacci Extension. I found that using the 4 hour timeframe price action waves to come up with a level seemed more that effective. I am curious to see how this one plays out.

Next Action

- Scale into a DG long position as soon as possible.

- Scale into a AXP long position as soon as possible.

- Scale into a UAL long position as soon as possible.

- Scale into a UUP short position as soon as possible.