1. BTC – Bitcoin has cleared $100,000 and still looks bullish (wow). Let’s see what happens next:

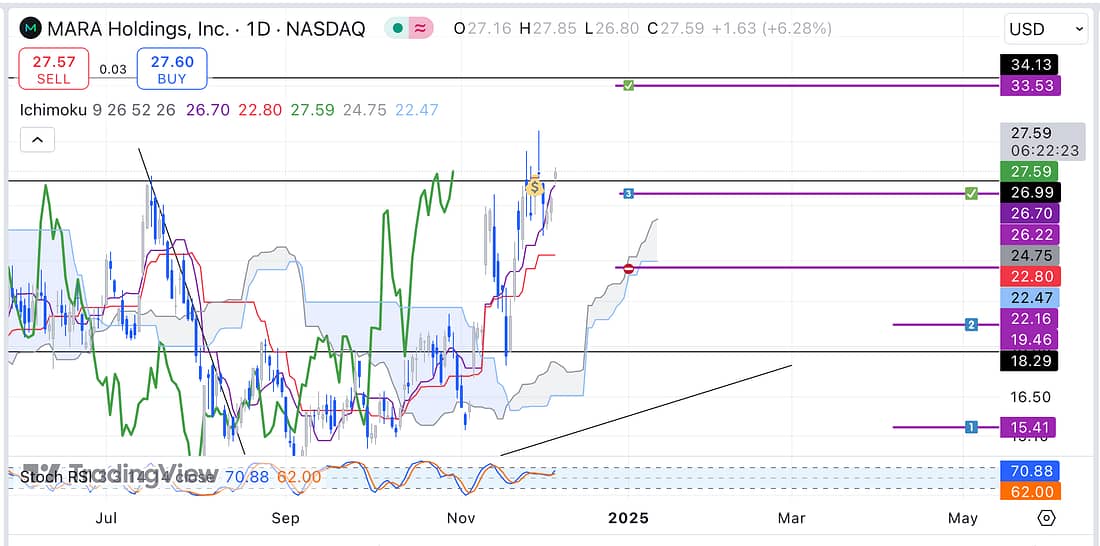

2. MARA – in light of Bitcoin’s bullish price action, add additional capital to MARA trade as soon as:

3. US10Y – analysed: still bearish price action structure.

4. US10 – analysed.

5. TLT – analysed.

6. RUT – still bullish price action structure.

7. CMG – analysed.

8. FDX – analysed: uncertain price action movement at the moment, so stay out of it.

9. SFM – analysed.

10. COST – analysed.

11. AXP – analysed.

12. WMT – analysed.

13. USOIL – analysed: still ranging.

14. JETS – analysed.

15. UAL – analysed.

16. UVXY – analysed.

17. DG – analysed: appears to be a false breakout. Let’s see how this continues to play out!

18. INTC – declining: there was not a substantial pullback that would have allowed me to make a good short entry (never chase price action – well done). And it was the right decision to exit the trade overall.

19. SOXX – analysed: still ranging.

20. MU – ranging.

21. BIDU – analysed.

22. TIGR – analysed.

23. NATGAS – do not trade until the price leaves no man’s land (the space between a major resistance and support level).

24. PALL – still in no man’s land.

25. XAUUSD – analysed.

26. DXY – US dollar is showing some strange sideways movement on the 4 hour timeframe.

27. X – analysed: still ranging.

28. AGQ – analysed AGQ charts after Richmond mentioned potentially looking into it for a long-term investment:

As shown above, it appears that probabilities favour more downside before any possible rally (decline to the $32.00 with some possible sideways price action).

Learning Point

- It really is all a test to see if we have got what it takes (systems in place) to successfully analyse the charts everyday before, actually, having millions at stake.

- MARA – exited add on position because MARA’s price action failed to find support at 26.99, and Bitcoin looks likely to experience a good pull back to its major support level in the next 24 hours – increasing the odds that MARA will also decline further to my stop-loss level:

Next Action

- Add additional capital to MARA trade in accordance with 3,2,1 add on ratio (no more than 50% of your previous position) if possible.

- Update new trading spreadsheet with latest winning and losing trades.