Trading Watchlist:

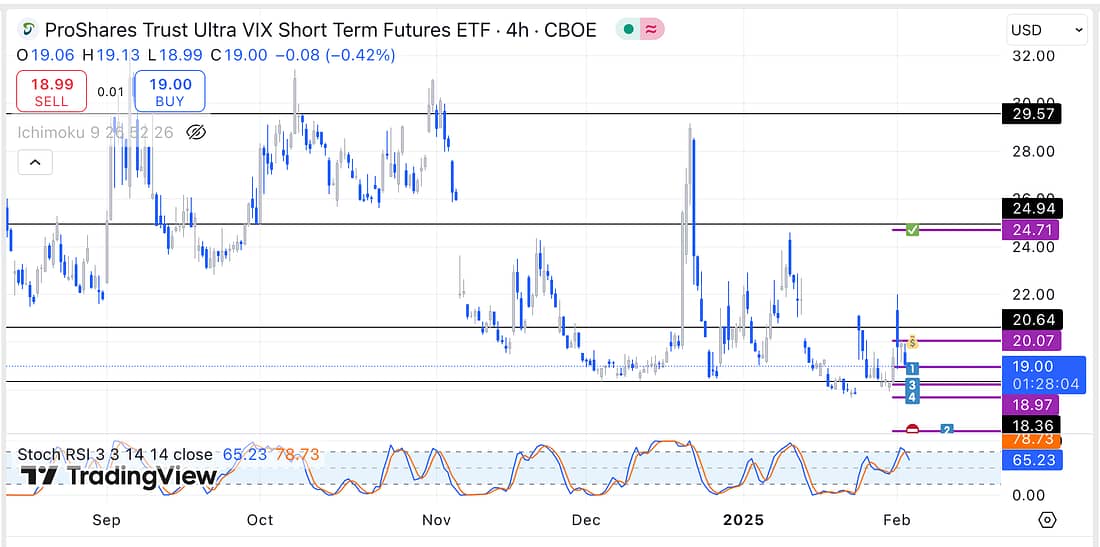

1. UVXY – missed the opportunity to exit UVXY yesterday with a tremendous amount of profit at the daily timeframe resistance level:

2. QQQ – analysed.

3. RUT – analysed.

4. SOXX – analysed.

5. FFIV – analysed.

6. UAL – analysed.

7. GE – analysed.

8. UCO – analysed.

9. USOIL – analysed.

10. BIDU – analysed.

11. SAP – analysed.

12. INTC – submit a long limit order as soon as possible:

13. JETS – (analysed) still expecting JETS to fall in line with its monthly timeframe trendline.

14. HOOD – analysed.

15. DG – analysed: remember that this is a monthly timeframe trade.

16. QQQ – analysed.

17. WOLF – analysed.

18. BIIB – analysed.

19. MRNA – analysed.

20. RL – analysed.

21. SFM – start scaling into a SFM short position using its parallel channel and limit orders:

22. AXP – close AXP long trade as soon as possible:

23. PALL – analysed.

24. WMT – analysed.

25. TSM – analysed.

26. CMG – analysed.

27. BTC – analysed.

28. SPY – analysed.

Learning Points

- Trading UVXY ultra successfully will mean making sure that I always assess its price action as soon as the markets re-open everyday.

- Hedging my AXP short trade by also going long also has proved to have been a successful strategy. However, it would have been even more effective if I had used its parallel channel to plan when to enter and exit the hedge.

- WMT – I previously submitted a lot of short entries with a low-probability of success because I did not know about the effectiveness of using the parallel channel to assess the price action.

- To become more efficient, continue to carry out my trading analysis everyday starting with my list of active and pending trades.

Next Action

- When you have an active UVXY trade, make sure that you assess the market as soon as they open everyday (2.30pm).

- Submit a long limit order in relation to INTC as soon as possible.

- Start scaling into SFM using limit orders as soon as possible.

- Close AXP long trade as soon as possible.

- Consider using the parallel channel to plan when to enter and exit a hedging trade.