Trading Journal

“First learn to trade then the money will follow!”

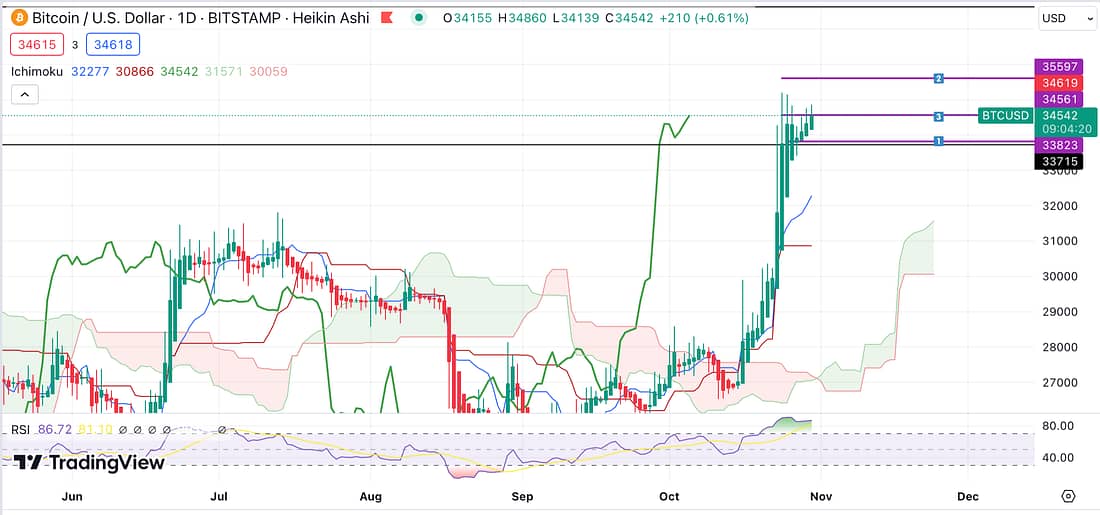

BTC TRADE

Today, I just took profit on my Bitcoin trade that I had accidentally carried out going Long.

I expect Bitcoin’s price to decline in light of it latest exhaustive rally. The Heiken Ashi candles suggest that the current price run has almost topped out.

Another reason is that it has now become 50/50 whether Bitcoin will continue to go up or come down. They say that when a 50/50 scenario arises, it is best to take full profits as we are not gamblers. We are traders. We are looking for probabilities to always be in our favour. Whether that be 80/20, 60/40, 70/30, as soon as the probabilities turn to 50/50, then it may be best to exit the market.

Once the Heiken Ashi candles signal a reversal, I will consider carrying out a short on an Altcoin like MANA, and then once this has played out, I will look for another Long entry (swing trade).

NVDA TRADE

It seems like big money went hunting this morning, at market open, and flushed out all the Shorts (like mine) with a predictable stop-loss level.

In support, it seems like the original price decline has now resumed. The price of NVDA is now back under the support level. As a result, I will enter another small Short position and monitor how the trade is playing out later today (purple line number 1 is my entry, and purple line number 2 is my stop-loss).

As shown above, this time, I have given my stop-loss level enough room to avoid the market noise, and predatory big money traders.

GLD / XAUUSD TRADE

Currently looking for a great entry price into the gold ETF (GLD) in light of the expectation that the price of gold is likely to rally due to geopolitics and the state of the world economy (purple line number 1). In support, it has been claimed by reputable traders that Central Banks around the world have been accumulating gold for months, creating a strong expectation that the price of gold is set to rally substantially.

TQQQ / QQQ TRADE

Soloway’s latest trading video discussed the idea of trading the QQQ as the price has re-traced back to the trend line.

As a result of carrying out my own technical analysis, I have decided to trade an ETF of the QQQ (TQQQ) on eToro.

Learning from my previous trade, I’ve decided to use a very wide stop-loss (a 1:1 stop-loss) to avoid market noise and any predatory trading whales who seek to take-out predictable stop-loss levels. If the trade moves in my favour, in a week or two, then I will adjust my stop-loss accordingly (purple line number 2). For the sake of completeness, my entry level is marked not the chart as purple line number 1.

VOO / SPY TRADE

Soloway’s latest trading video featured the idea of trading the SPY.

As a result, after analysing the charts, I looked into trading an ETF (VOO) that tracks the SPY.

In light of the above, I put on a small trade with an entry at purple line number 1, stop-loss at purple line number 2, and a take profit level at purple line 3.

USO / USOIL TRADE

Soloway’s latest trading video also featured the idea of swing trading USOIL in light of its daily timeframe head shoulders pattern formation.

After carrying out my own technical analysis of the USOIL chart, I decided to trade an ETF that tracks USOIL (USO), submitting an order with about 1/4 of my risk capital for the position.

Because this swing trade is being carried out in accordance to the daily timeframe. It is to be expected that this trade will play out over the course of one to two weeks.

Next Action

- Update trading spreadsheet with latest BTC win.

- Update trading spreadsheet with latest NIVDA loss.