Trading Watchlist:

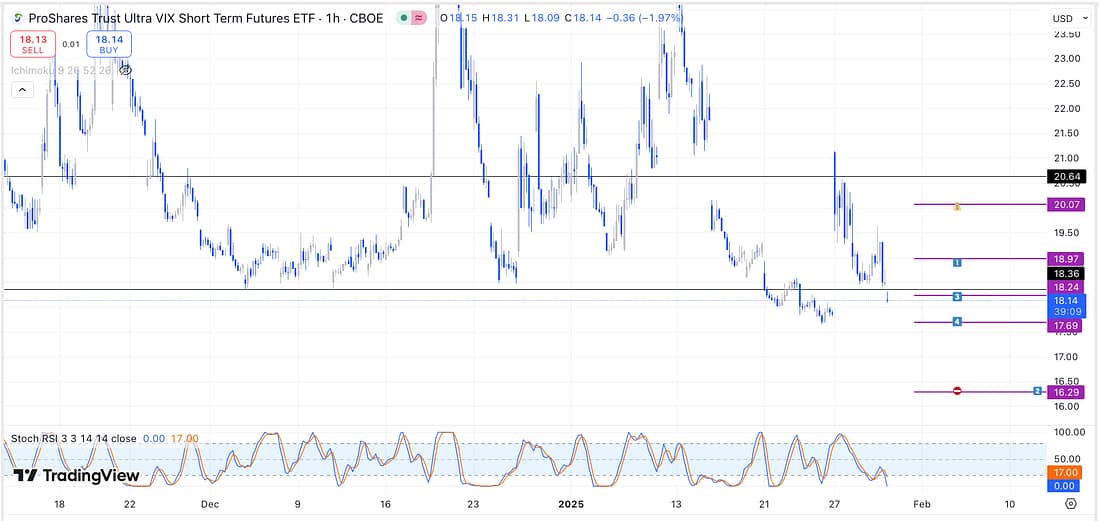

1. UVXY

Start scaling into the VIX long again (including limit order), this time with larger amounts, as I have now gained far more experience trading this market.

2. SAP

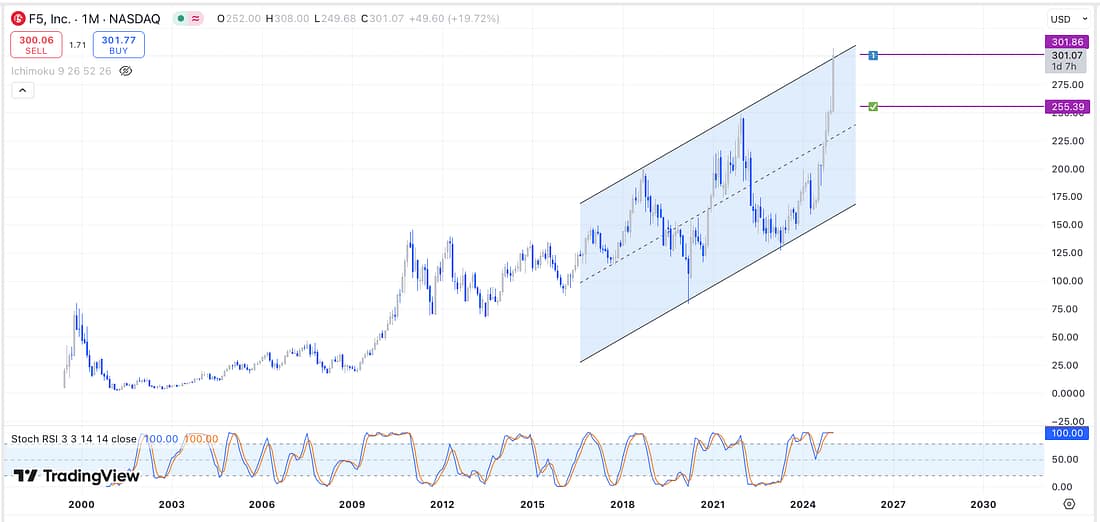

3. FFIV – start scaling into a FFIV short as soon as:

4. WMT – unfortunately, stop-loss level triggered and a limit order (that I forgot about) has now entered me into a short position:

Instead of immediately exiting the trade at a small loss, it is worth waiting patiently for a potential pullback (because I have a stop-loss in place), then exit the position. Let’s see how this plays out.

5. SOXX – still moving sideways (ranging) on the daily timeframe with a bias to the downside on the weekly and monthly timeframes.

6. QQQ – analysed.

7. RUT – analysed.

8. US10Y – analysed.

9. US10 – ranging.

10. TLT – analysed.

11. DXY – analysed.

12. XAUUSD – analysed.

13. DJI – analysed.

14. WOLF – analysed.

15. BIIB – analysed.

16. AAL – analysed.

17. UAL – analysed.

18. JETS – analysed.

19. BIDU – analysed.

20. TIGR – analysed.

21. SPY – analysed.

22. USOIL – analysed.

23. UCO – using a limit order, start scaling into a UCO long in light of USOIL’s price action movement:

Learning Points

- Using parallel channel has dramatically improved my trading ability. I now know when entries and exits have a higher probability of success, and it enables me to wait patiently for trade setups more effortlessly.

Next Action

- Start scaling into UVXY long with larger amounts (include limit order) as soon as the markets re-open.

- Start scaling into a FFIV short as soon as possible.

- Monitor WMT everday in order to exit current short position.

- Using a limit order, start scaling into a UCO long as soon as possible.

- Watch today’s “Verified Game Plan”.

- Watch today’s “Trading the Close”.