Trading Watchlist:

1. LTC

Swap (in Singapore) some LTC for LTCN as intended:

2. UVXY – analysed.

3. BTC – analysed.

4. NATGAS – analysed.

5. UNG – analysed.

6. COST – analysed.

7. UAL – analysed.

8. BIDU – analysed.

9. 000001 – analysed.

10. JETS – analysed.

11. PLTR – analysed.

12. DG – analysed.

13. DJI – analysed.

14. GE – analysed.

15. WOLF – analysed.

16. SAP – analysed.

17. INTC – analysed.

18. PALL – keep a close eye on PALL, considering adding additional capital to the long trade in accordance with the weekly timeframe:

19. HOOD – analysed.

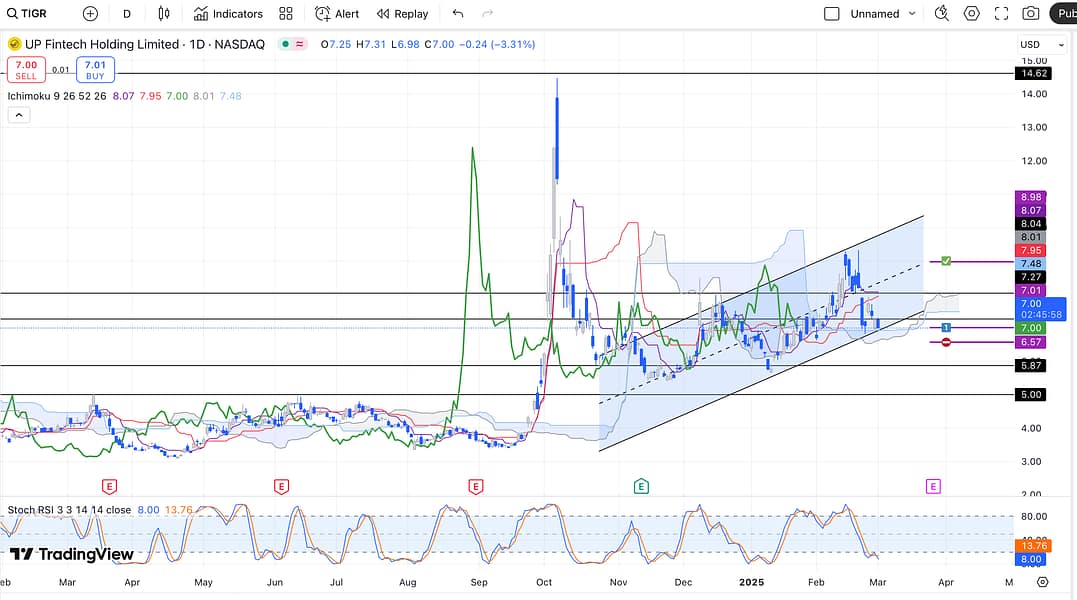

20. TIGR – considered starting to scale into a TIGR long:

But I am mindful that the US broader market is in a general decline, which usually has the effect of bringing the global (Chinese) markets down with it.

As a result, let us hold off from going long TIGR, until the SPY and QQQ looks like they will start rising again (important of inter-market analysis).