Trading Watchlist:

1. CMG – following Soloway’s recommendation, I took 50% profit in regard to my CMG position because the price action is now at a major support level on the daily timeframe:

2. COST – if COST’s price action manages to rise above the current resistance level on the daily timeframe, then consider taking at least 50% profit out of the current trade:

3. WMT – analysed.

4. SFM – analysed: as foreseen, the price action of SFM bounced up at the daily timeframe support level. Therefore, in the future, I will always consider taking 50% profit off the table when the price action follows a similar pattern:

5. JETS – analysed.

6. UAL – analysed.

7. JPM – analysed.

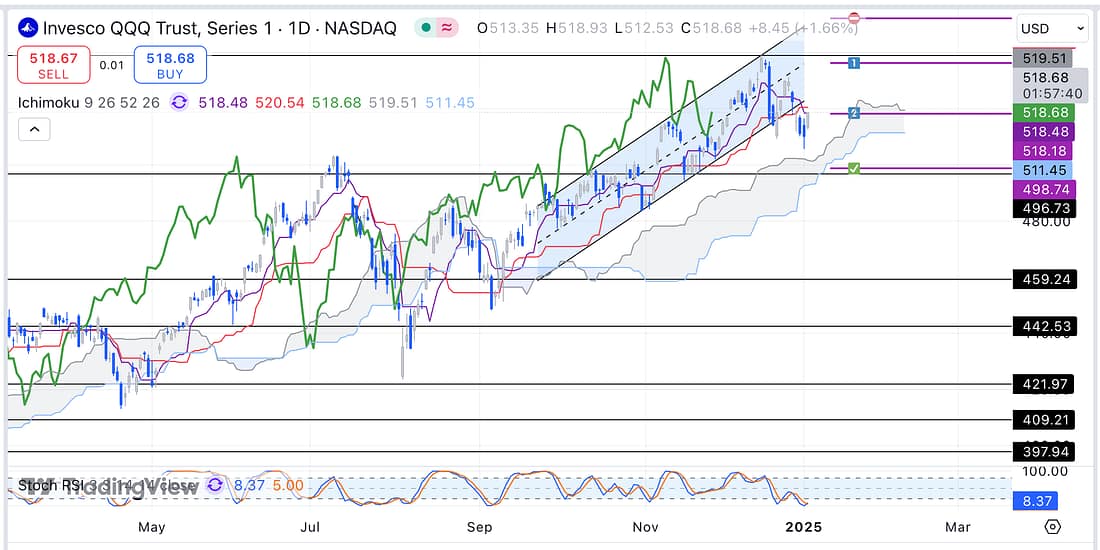

8. QQQ – add additional capital to QQQ trade as chart pattern suggests that the price action has pull-backed nicely to the parallel channel (scene of the crime), and the Tekan and Kijun:

9. UVXY – analysed.

10. AXP – analysed.

11. PALL – analysed.

12. BIDU – analysed.

13. TIGR – analysed.

14. XAUUSD – analysed.

15. GDX – analysed.

Learning Point

- Watching “The Game Plan” and “Trading the Close” everyday is making a big difference (speeding up my learning process) to my trading analysis and results.

Next Action

- Take 50% profit from CMG trade as soon as possible.

- Update new trading spreadsheet with latest trades.

- Keep an eye on COST in order to potentially add additional capital to the trade.

- Add additional capital to QQQ trade as soon as possible.

- Continue to watch “The Game Plan” everyday.

- Continue to watch “Trading the Close” everyday.