1. TIGR – Go long TIGR on the weekly timeframe (bought TIGR shares at around $6.03):

2. BTC – analysed.

3. LTCUSDT – analysed.

4. LTCN – analysed.

5. SFM – analysed.

6. MARA – analysed.

7. DG – analysed.

8. SOXX – analysed: ranging.

9. MU – analysed: ranging.

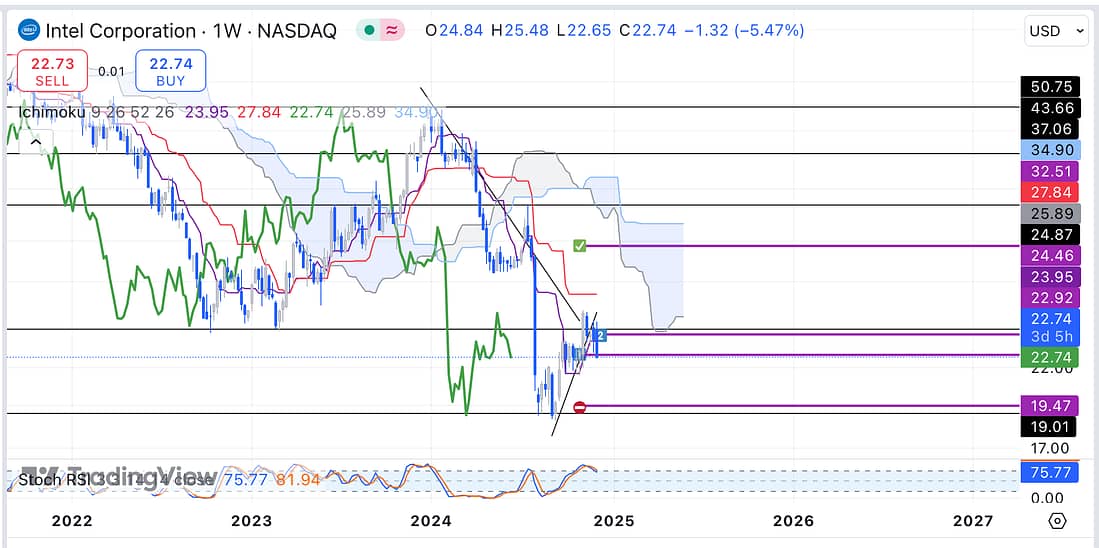

10. INTC – analysed: ranging. Decided to exit INTC because the weekly timeframe shows that there is strong selling pressure to come. The price action no longer favours a bullish price action as it is moving sideways; therefore, I choose to exit the trade:

11. CMG – analysed: still wait for the price action to reach the daily timeframe support areas before making an entry.

12. RUT – analysed: likely to pull-back before rallying again. Continue to pay close attention everyday to the price action.

13. BIDU – analysed.

14. US10Y – analysed.

15. US10 – analysed.

16. TLT – analysed.

17. AXP – analysed.

18. COST – analysed.

19. WMT – analysed.

20. UAL – analysed.

21. JETS – analysed.

22. USOIL – still ranging.

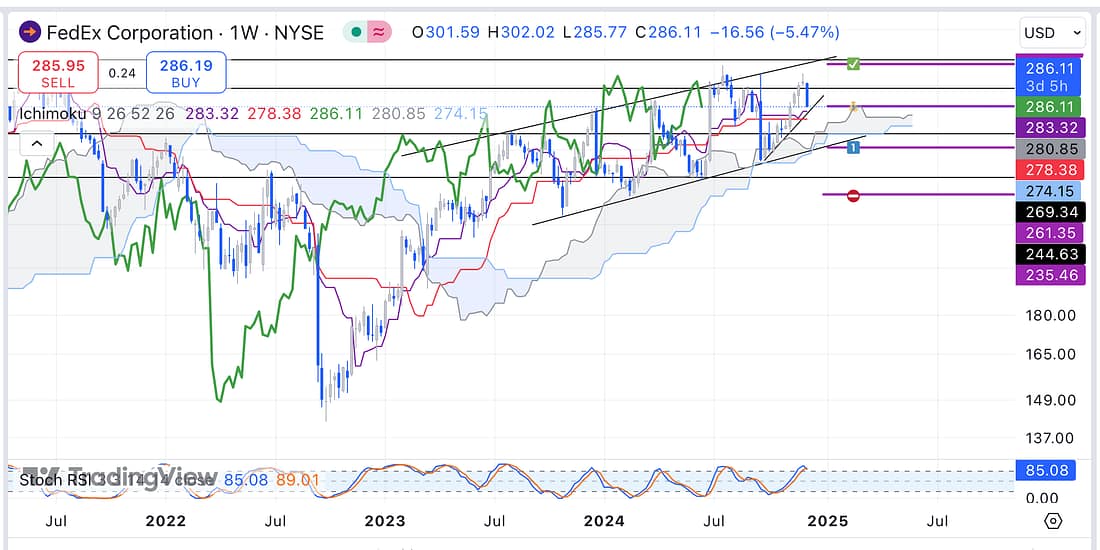

23. FDX – decided to exit my remaining 1/3 profit on FDX because the weekly timeframe Stochastic RSI indicates that there may be some strong selling pressure to come in the next few days or week:

24. NATGAS – analysed.

25. X – analysed.

26. XAUUSD – analysed.

27. PALL – analysed.

Learning Points

- FDX – I was right to have taken 2/3 profit last week, as its price did collapse tremendously and unexpectedly as I anticipated.

Next Actions

- Close FDX trade as soon as possible in order to bank the remaining 1/3 profit.

- Go long TIGR as soon as possible.

- Close INTC as soon as possible.

- Update new trading spreadsheet with winning and losing trades.