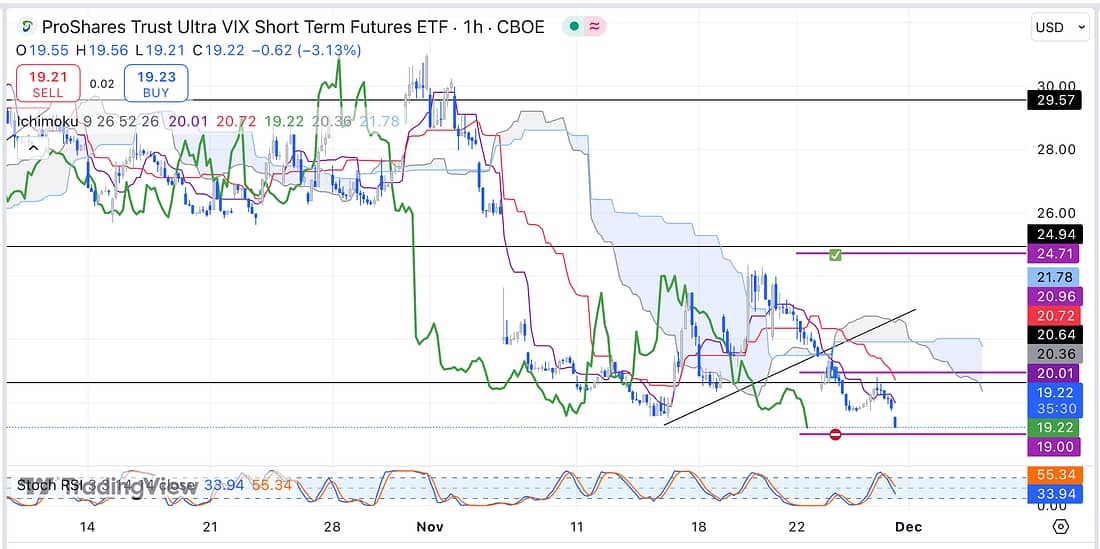

1. UVXY – it appears that the price action may have hit my stop-loss level. Therefore, consider submitting a long entry at this level also:

Submitted a limit order at my stop-loss level as there is a good possibility of another stop-loss hunt before, eventually, experiencing a violent price rally:

2. BTC – analysed.

3. MARA – surprising bullish price action: look to add additional capital on any possible, and substantial, pull-back.

4. US10Y – still declining as anticipated.

5. TLT – analysed: still assessing the best time to add additional capital to these types of trades. If my analysis is correct, the price action should pull-back substantially at some point, providing me with a good opportunity to add more capital.

6. BIDU – analysed.

7. CMG – analysed: still waiting patiently for a good opportunity to add additional capital.

8. UAL – just continuing to grind upwards relentlessly: very intriguing. Keep watching the price action every single day.

9. JETS – as per above.

10. SFM – as per above.

11. COST – as per above.

12. WMT – as per above.

13. AXP – as per above.

14. INTC – its bullish price action is becoming weaker and weaker, so I may need to exit my position very soon. Let’s see what SOXX is doing, and how this plays out!

15. SOXX – still ranging on the 4 hour timeframe so stay in INTC trade.

16. RUT – still bullish price action.

17. FDX – analysed.

18. DG – really consider going long DG if the lagging span on the 4 hour timeframe reveals that it will be a good risk to take.

19. XAUUSD – analysed.

20. PALL – analysed.

21. DXY – analysed.

22. USOIL – analysed: ranging.

23. NATGAS – analysed: still bullish price action on the 4 hour timeframe.

24. X – analysed.

25. MU – analysed.