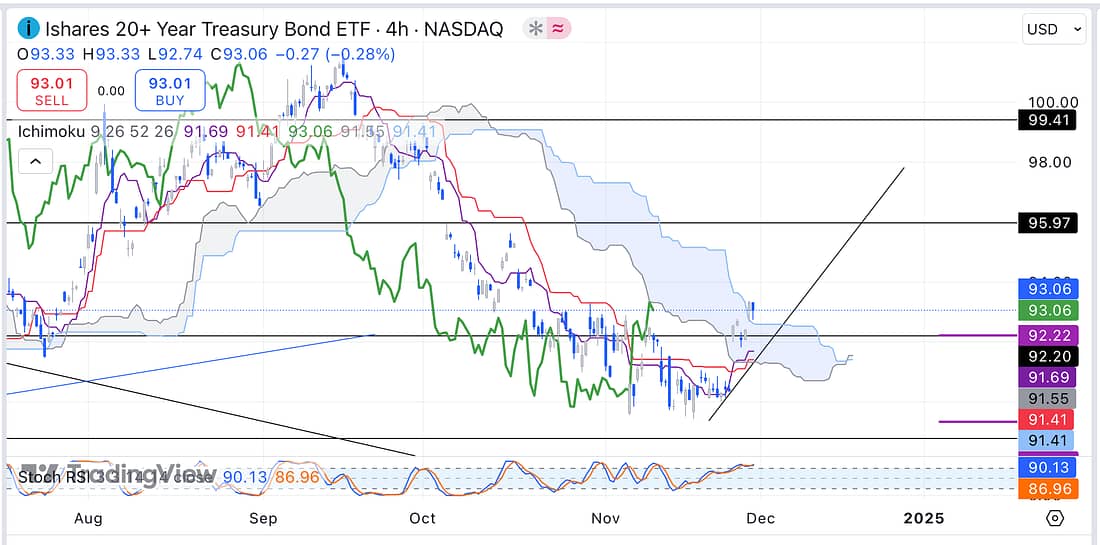

1. US10Y – look like it is almost time to start adding additional capital to the TLT trade, in due course, in light of US10Y declining as anticipated:

2. TLT:

3. BIDU – analysed.

4. SFM – analysed.

5. COST – analysed.

6. WMT – analysed.

7. JETS – analysed.

8. UAL – analysed.

9. AXP – analysed.

10. BTC – analysed.

11. MARA – analysed.

12. PALL – analysed.

13. CMG – analysed.

14. UVXY – analysed.

15. DG – analysed.

16. INTC – analysed.

17. SOXX – semi-conductors looks very weak even though the price action is still ranging.

18. MU – analysed.

19. AMD – analysed.

20. QCOM – analysed.

21. XAUUSD – no man’s land on the daily timeframe: in other words, do not trade.

22. LTCUSDT – analysed: seems like money is leaving Bitcoin to go into the Altcoins (the start of Altcoin season I wonder?).

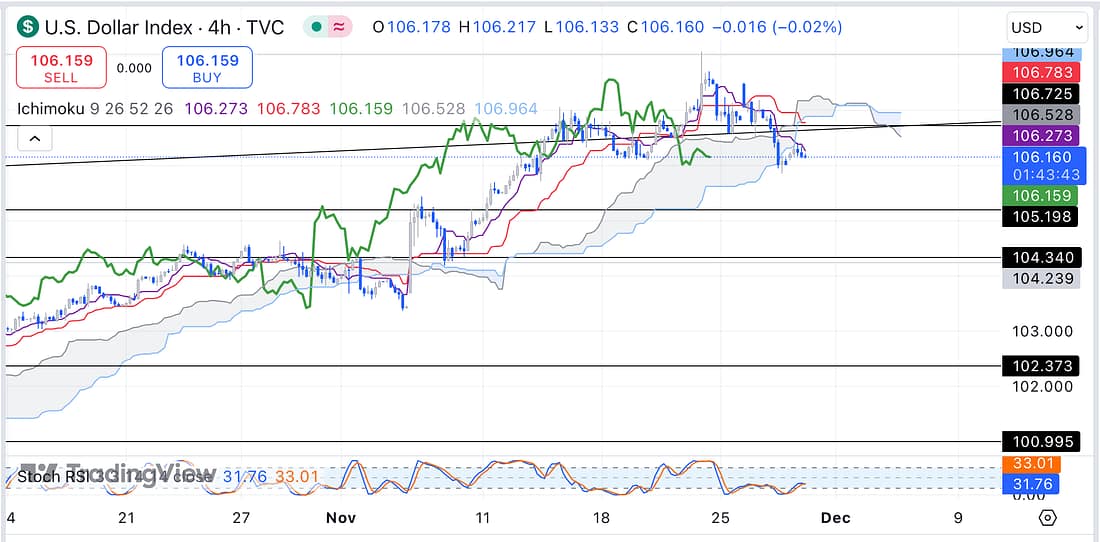

23. DXY – keep an eye on the DXY and UUP as a possible great short entry may present itself:

24. UUP:

25. RUT – analysed: still bullish.

26. FDX – analysed.

27. NATGAS – surprisingly still bullish in relation to the 4 hour timeframe.

28. USOIL – ranging.

29. LIT – wanted to open a LIT short position, but eToro would not enable this to happen at the moment:

Learning Points

- TLT – very important to wait patiently for the TLT to pullback before adding additional capital to the trade.

- LIT – eToro will not allow traders to short some ETFs or stocks when the relevant market is extremely volatile.

Next Actions

- LIT – Consider scaling into a short position in relation LIT if eToro allows this type of trade to be possible.

- Update new trading spreadsheet with your latest winning or losing trades.