Trading Watchlist:

1. WOLF (analysed):

2. BTC – analysed.

3. UVXY – analysed.

4. QQQ – analysed.

5. SPY – analysed.

6. RUTS – analysed.

7. DG – analysed.

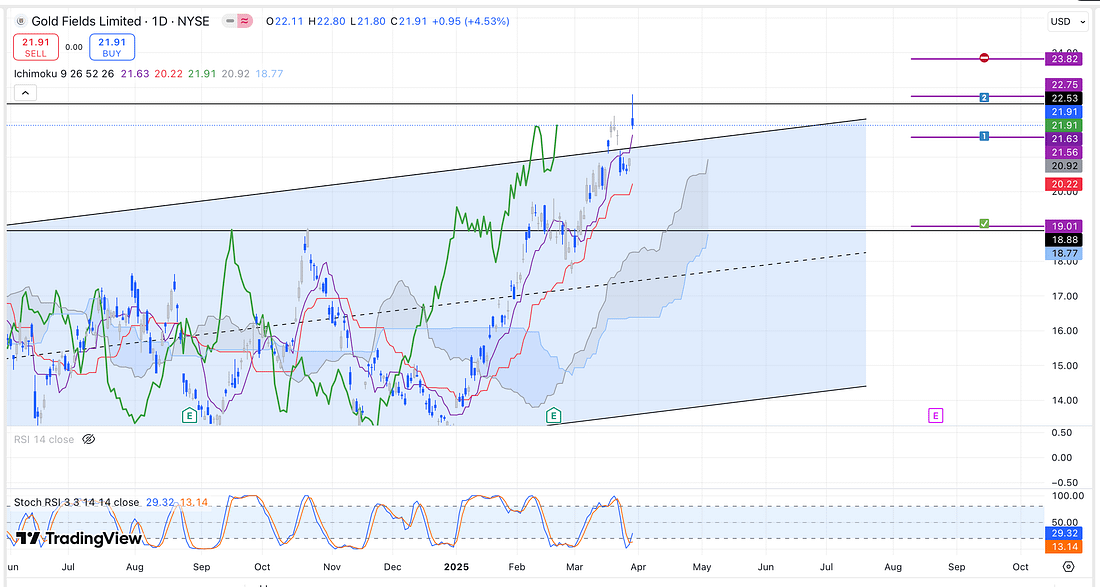

8. GFI – it appears that GFI’s the price action has now triggered my additional capital short entry:

9. XAUUSD – analysed.

10. DECK – analysed.

11. TTD – analysed.

12. WBA – analysed.

13. NATGAS – analysed.

14. UNG – analysed.

Learning Points

- WOLF – today, WOLF gapped down unexpectedly, causing me to sustain a very substantial small loss.

This reminded me of the importance of ensuring that each trade does not have too much capital at risk.

Unfortunately for me, my WOLF trade had to have more capital at risk than I would typically prefer.

That said, on the plus side, I passed the test so to speak because I was very conscious of this fact.

And to reduce my risk, I even exited an additional capital long WOLF position a few days ago.

I now know that if I hadn’t had done so, I would have sustained a tremendous loss instead.

. - WOLF – moreover, after sustaining a substantial small loss, I immediately went into action to submit a long WOLF position.

On further analysis, however, I saw that it was not a good time in light of the overall price action conditions (using the Ichimoku) on the lower timeframes (15 minute and 5 minute).

It really is not about falling into the trap of revenge trading after suffering a loss.

. - GFI – it appears that ensuring that I add a larger amount of capital when the price rises, and I am scaling into a short position, was the right decision.

It has now caused me to be in profit with the GFI trade as oppose to currently being at a small loss with my initial entry level.

This has also revealed to me the importance of making sure that I have active limit orders set in order to be able to exploit these type of trading opportunities when they arise without my knowledge.

Next Actions

- Continue to keep a close eye on DECK.

- Continue to keep a close eye on TTD.

- Watch today’s “Weekly Wrap Up”.