Trading Watchlist:

1. UVXY – analysed.

2. BTC – analysed.

3. BTC.D – analysed.

4. UAL – analysed.

5. WOLF – analysed.

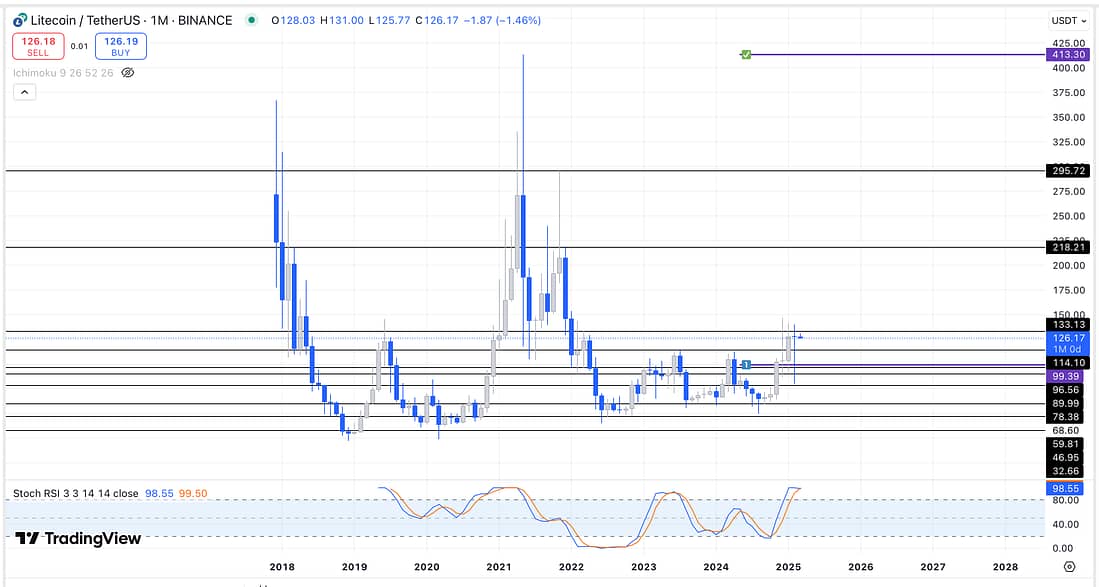

6. LTC – analysed:

7. LTCN – analysed:

Consider converting another quantity of LTC into LTCN.

8. SOLUSDT – analysed.

9. BIDU – analysed.

10. GE – analysed.

11. DG – analysed.

12. COST – analysed.

13. JETS – analysed.

14. PLTR – analysed (keep monitoring this stock closely).

15. HOOD – analysed.

16. TIGR – analysed.

17. 000001 – analysed: Chinese stock market still grinding upwards. Therefore TIGR and BIDU should still expect a price action rally to the upside.

18. NATGAS – still declining as expected.

19. UNG – Price action currently near take profit level. Continue to hold active trade until NATGAS reaches the next expected major support level.

20. BIIB – consider scaling into BIIB as soon as the markets reopen on Monday:

Learning Points

- LTC – Watched Coin Bureau’s latest video on Litecoin which was very insightful.

Essentially, LTC is going to receive an ETF as we have been anticipating, and has lots of institutional interest in light of its appreciation potential in comparison to Bitcoin.

What Coin Bureau failed to mention is that LTC is the crypto used most for transactions whilst having one of the most reliable, and secure, networks since the birth of the industry due to its proof-of-work consensus mechanism.

These are all things that are highly valuable to institutional investors, which are also absent from many of the most popular crypto-currency projects.

So, the moral of the story, hold on to your current stash of LTC, as you seem to made a great strategic investment decision in this regard.

Another interesting fact is that it has been almost a year since I decided to convert some BTC to LTC, and I must not forget that Richmond also has a quantity of my LTCN.

To tell the truth, it may make sense to convert some more of my LTC to LTCN in light of it current LTCN price. I will definitely give it some more thought.

Next Actions

- Watch today’s “Verified Game Plan”.

- Continue to hold on to your current quantity of LTC.

- Consider converting another good quantity of LTC to LTCN.

- Monitor PLTR closely when the markets reopen.

- Consider scaling into BIIB (long) as soon as the markets reopen on Monday in accordance with its weekly timeframe.