Trading Watchlist

1. PLTR

PLTR appears to be an excellent stock to trade as it is very volatile (moves around 20 to 30%).

Therefore, continue to keep a close eye on PLTR for a great shorting opportunitiy in the near future.

2. BTC

BTC appears to be moving as anticipated, proving that the 4 hour timeframe is still a very reliable indicator of the most likely direction of the price action.

3. QQQ – analysed.

4. SPY – analysed.

5. RUT – analysed.

6. HOOD – analysed.

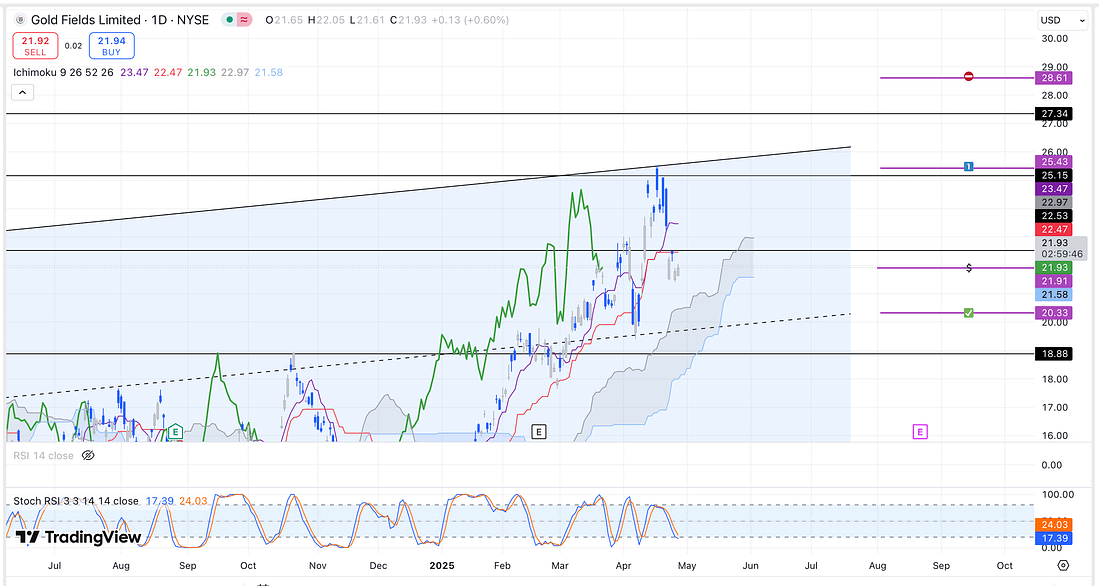

7. XAUUSD

I am expecting the US broader market to start declining.

This is likely to have the knock on effect of causing more money to start going into gold, which will then have the affect of causing the price of GFI to rise.

As a result, I have decided to take partial profits out of my GFI short:

8. GFI

Take partial profits out of GFI as soon as possible.

9. DG – analysed.

10. NATGAS – analysed.

11. UNG – analysed.

12. USOIL – analysed.

13. UNG – analysed.

14. SFM – analysed.

15. COST – analysed.

16. BIDU – analysed.

17. JETS – analysed.

18. DECK – analysed.

19. TTD – analysed.

20. FDX – analysed.

21. COST – analysed.

Learning Points

- I remembered that until the US broader market price action is at the upper or lower parallel channel trendline, then it is best to just sit on the sidelines and wait patiently for a high probability trading opportunity to emerge.

This is why it is important to assess the charts everyday.

In the meantime, if any other market (like Gold) is trading at an extreme in relation to their parallel channels, then this may be a good time to enter a trade in the opposite direction to the broader market, even though the broader market is not expected to move very much.

It becomes very important, in this respect, to pay close attention to the broader market everyday in order to ensure that we are not caught out by any short-term change in direction.

For example, currently, I am keeping a close eye daily on my Gold short (GFI) to ensure that I do not stay in the trade too long in light of the broader market’s increased likelihood to change direction in the short-term.

As soon as it seems that the broader market will start declining again, then it is going to be important for me to get out of the gold short position quickly.

. - I acknowledged today that making sure that I must not look at my profit and loss account – for as long as is necessary to ensure that my mind realigns itself with the trading process – is a mind mastery skill that I can easily take for granted.

Next Action

- Keep a close eye on PLTR everyday.

- Keep a close eye on the US broader market in regard to GFI trade (do not get caught out this time round).

- Take partial profits out of GFI as soon as possible.