Trading Watchlist:

1. FDX – analysed: take 2/3 profits from the position as it has almost reached your take profit target level, and this stock has the tendency to gap violently and tremendously (so do not be greedy):

2. UVXY – analysed: it truly is a good hedge against a bullish stock market. Therefore, it makes sense to always have a small losing position on UVXY if necessary to ensure that I am always hedge in relation to my long stock market trades.

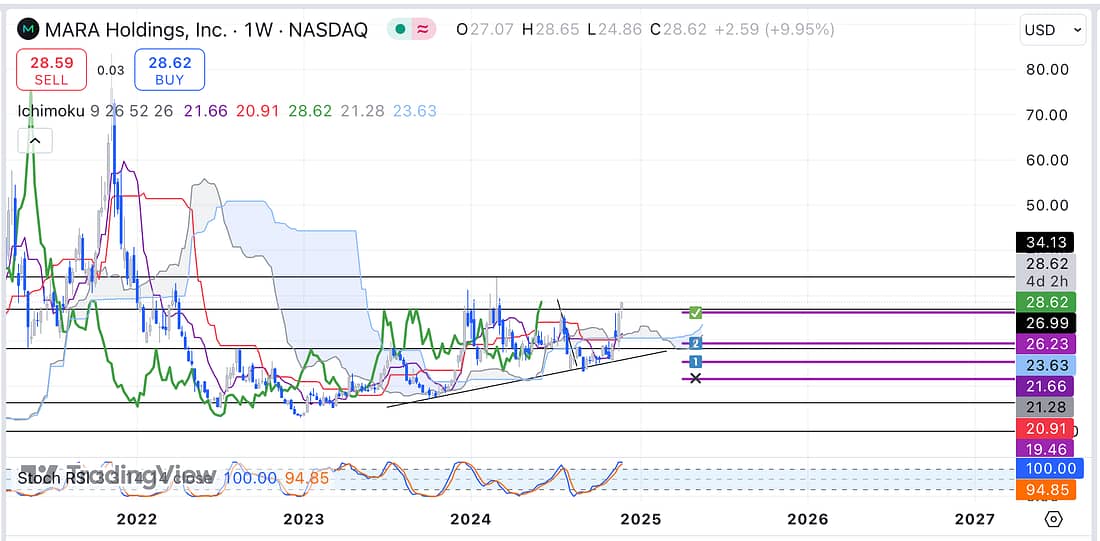

3. MARA – has shot through the roof (broke right through the current resistance level at 26.99) and my initial take profit target level. So now it is important for me to analyse what BTC is doing exactly? Assess MARA again in the next two hours (set timer):

Decided to take 2/3 profit as there is a good likelihood that BTC will pull-back substantially. If so, this will enable me to add additional capital to my current active 1/3 MARA position. Let us see how this all plays out:

4. BTC – looks due for a pull-back at some point, but it could still rally higher before declining substantially. I guess the key thing is to not be greedy.

5. CMG – analysed.

6. INTC – when adding additional capital, it may be important to give the price action room to pull back below the previous entry level:

7. DG – analysed.

8. BIDU – analysed.

9. JETS – analysed.

10. SFM – analysed.

11. COST – analysed.

12. AXP – analysed.

13. WMT – analysed.

14. UAL – analysed.

15. SOXX – analysed: ranging.

16. RUT – broke through current resistance level at 2240. Let’s see if this holds.

17. US10Y – the price action has closed below the Kumo Cloud on the 4 hour timeframe, so now time to enter a long using TLT:

18. TLT – enter a TLT long to take advantage of a possible, continuous, declining US10Y:

19. NATGAS – analysed.

20. USOIL – analysed: ranging.

21. PALL – still in no man’s land: ranging.

22. TIGR – analysed.

23. LIT – analysed.

24. X – analysed: ranging.

25. XAUUSD – analysed: ranging.

26. MU – analysed: ranging.

27. QQQ – analysed: still bullish price action structure.

Learning Points

- The importance of analysing the charts everyday to ensure that I do not hold a position for longer than will be advantageous, offering me the possibility of also being able to take partial profits early.

- INTC – when adding additional capital, it may be important to give the price action room to pull back below the previous entry level.

Next Actions

- Take 2/3 partial profits from FDX trade as soon as possible.

- Update new trading spreadsheet with latest FDX winning trade.

- When adding additional capital, make sure the price action has enough room to pull back below the previous entry level if necessary.

- Enter a TLT long as soon as possible to take advantage of a declining US10Y.

- Take 2/3 partial profits from MARA trade as soon as possible.

- Update new trading spreadsheet with latest MARA winning trade.

- Watch Gareth Soloway’s “Trading the Close”.