Trading Watchlist:

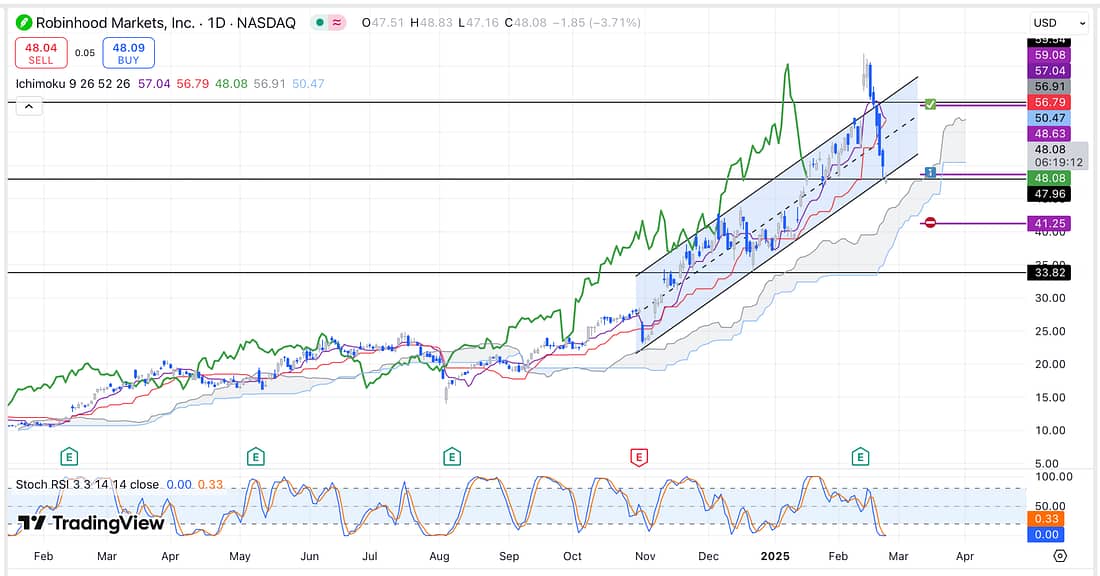

1. HOOD

Start scaling into HOOD as soon as possible.

2. HOOD – HOOD’s price action has started to decline faster and stronger than anticipated; therefore, it is no longer worth the risk so exit the position (at a small loss) immediately:

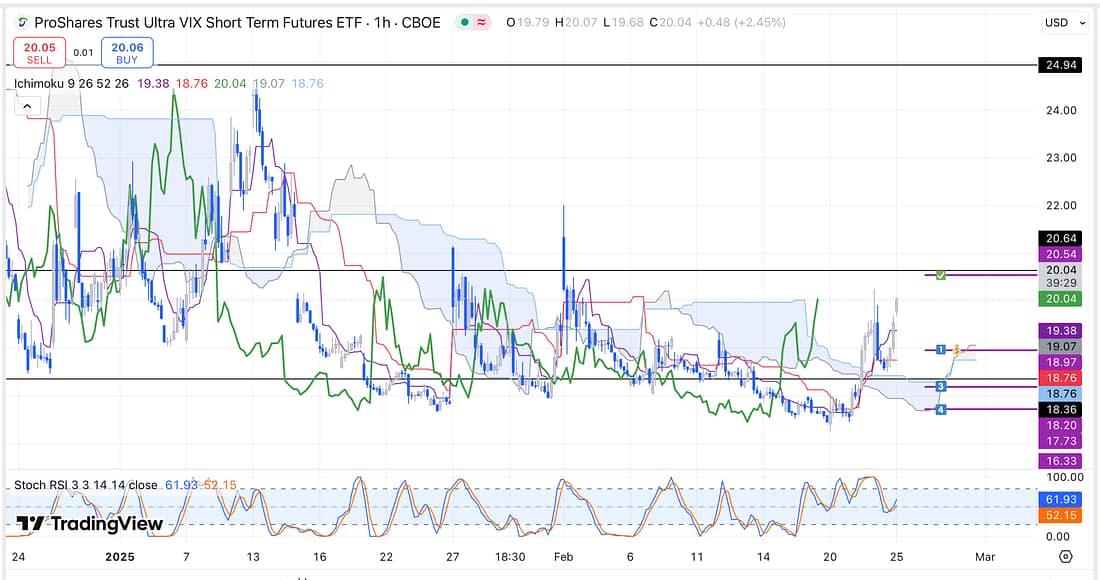

3. UVXY – UVXY is currently rallying to the next resistance level:

The Stochastic RSI on the 1 hour timeframe appears to act as a brilliant indicator of when the price action of UVXY is most likely to turn.

Generally speaking, when the Stochastic RSI reaches the overbought area on the 1 hour timeframe, this usually coincides with the price action changing direction.

That said, the price action of UVXY is now approaching a major resistance level; therefore, do not be greedy. As soon as it tags the resistance level, take full profits.

4. PLTR

Start scaling into the PLTR as, unlike HOOD, the price action is now at a major support level with several indicators revealing that it is highly likely to hold firm.

Also, stop trying to time all of your entries perfectly (be so clever). Instead, submit the trades at the relevant levels then move on immediately.

Be more patient, in turn, with your target entry levels.

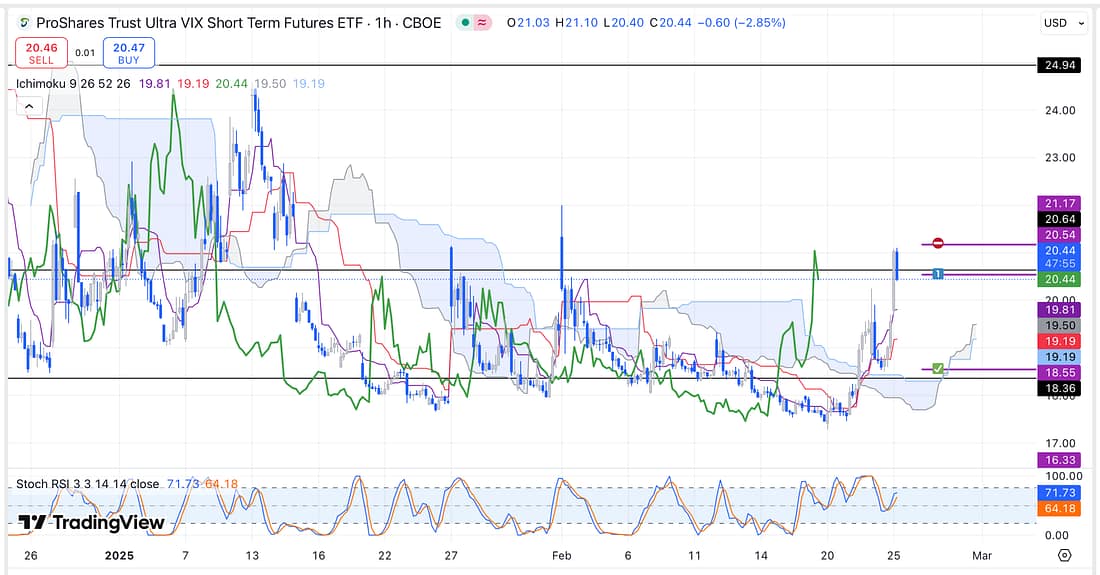

5. UVXY – I have decided to short UVXY as I believe there is now a strong likelihood that it will decline in price greatly. as it had risen more than 12% as anticipated.

That said, it is a very risky trade, because UVXY is very volatile. Therefore, I have decided to only risk a small amount of capital, and I am also mindful that my stop-loss my fail to trigger placing me at a greater loss than expected.

But this is what trading is all about: taking calculated risks.

Subsequently, I have decided to exit my UVXY trade at a small profit, because (on further reflection) the trade is too risky as UVXY is unpredictably volatile..

It just does not make sense, overall, to work so hard learning how to make profitable trades only to then allow myself to lose capital again easily.

6. SAP – analysed.

7. WOLF – analysed.

8. DG – analysed.

9. OKLO – analysed.

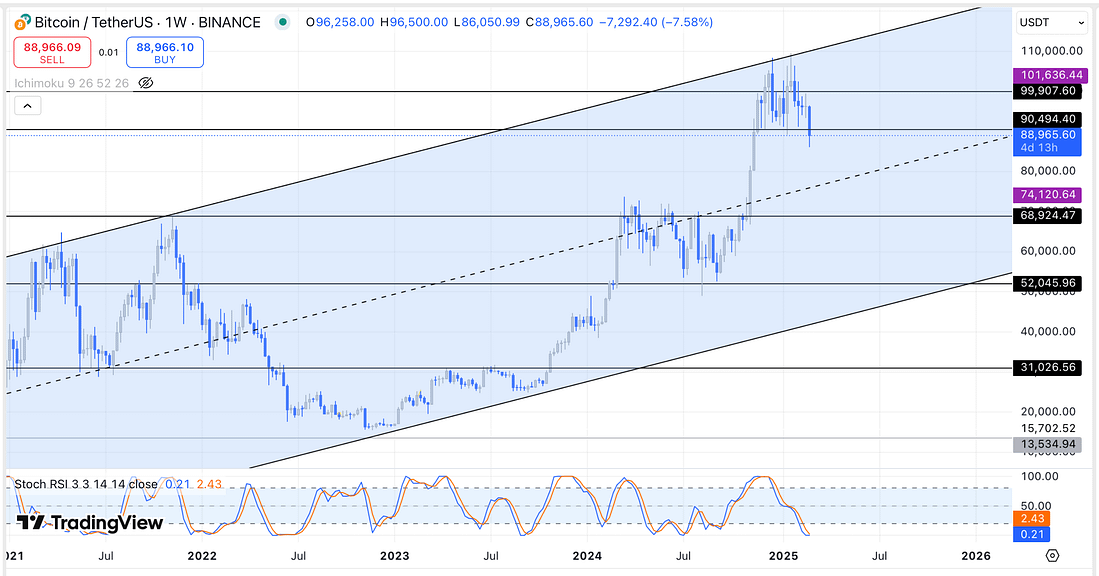

10. BTC – the parallel channel worked beautifully predicting the most probable price action direction of BTC:

Learning Points

- With my increased experience trading UVXY long successfully, it is now time to enter my future UVXY trade with larger amounts of capital.

. - Today, I was unreasonably frustrated that I have not been able to keep an eye on BTC, which declined substantially today.

The reality is that I will not be able to cover everything everyday. So, as long as I am making actual progress with my trading ability, day after day, then what I am actually trading is irrelevant.

.

The sooner that this sinks into your mind Tom, then the better. - BTC – Continue to intentionally not focus on fundamental news, and participating in social media chatter about market movements, in favour of longer timeframe technical analysis.

As there is just too many factors and variables in the world (at any given second) that cause an unpredictable impact on the markets. It is actually quite ludicrous to think that any form of fundamental news can accurately and consistently explain what is going to happen in the markets.

That said, noticing the extent to which some types of fundamental news is not moving the markets or changing the price action of a market is signifiant data that will improve our ability to carry out technical analysis.

Next Action

- Scale into HOOD as soon as possible.

- Check HOOD every 1 hour to consider adding additional capital to long trade.

- Exit HOOD trade (sustaining a small loss) immediately as decline stronger than anticipated.

- Close UVXY trade, taking full profits around the resistance level.

- Scale into PLTR as soon as possible (stop trying to be too clever by seeking perfect entries).

- Review UVXY short before the market closes today.

- Exit UVXY short immediately as price action too risky due to its unpredictable volatility.

- Watch today’s “Trading the Close”.

- Update trading spreadsheet with the latest winning and losing trades.