Trading Watchlist

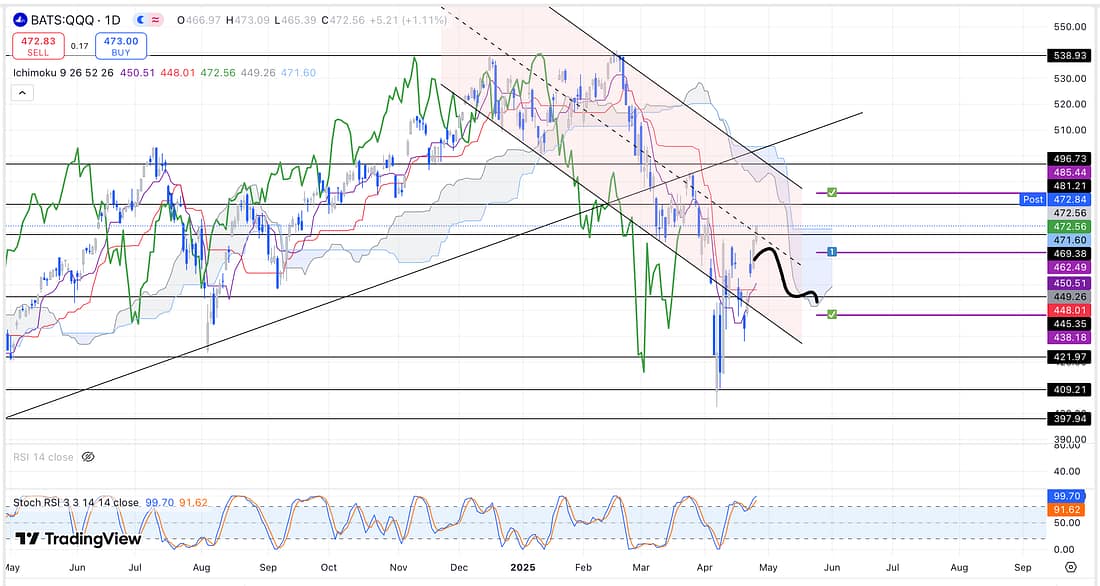

1. QQQ

As can be seen above the overall broader market is in a short-term up trend.

2. RUT – analysed.

3. BTC – analysed.

4. SPY – analysed.

5. HOOD – analysed.

6. IWM – analysed.

7. GFI – analysed.

8. BIDU – analysed.

7. XAUUSD – analysed.

9. SMCI – analysed.

10. UAL – analysed.

11. JETS – analysed.

12. SFM – analysed.

13. AXP – analysed.

14. COST – analysed.

15. UVXY – analysed.

16. SAP – analysed.

17. US10Y – analysed.

18. X – analysed.

19. FDX – analysed.

20. TTD – analysed.

21. DECK – analysed.

22. PALL – analysed.

23. TIGR – analysed.

24. USOIL – analysed.

25. BABA – analysed.

26. DG – analysed.

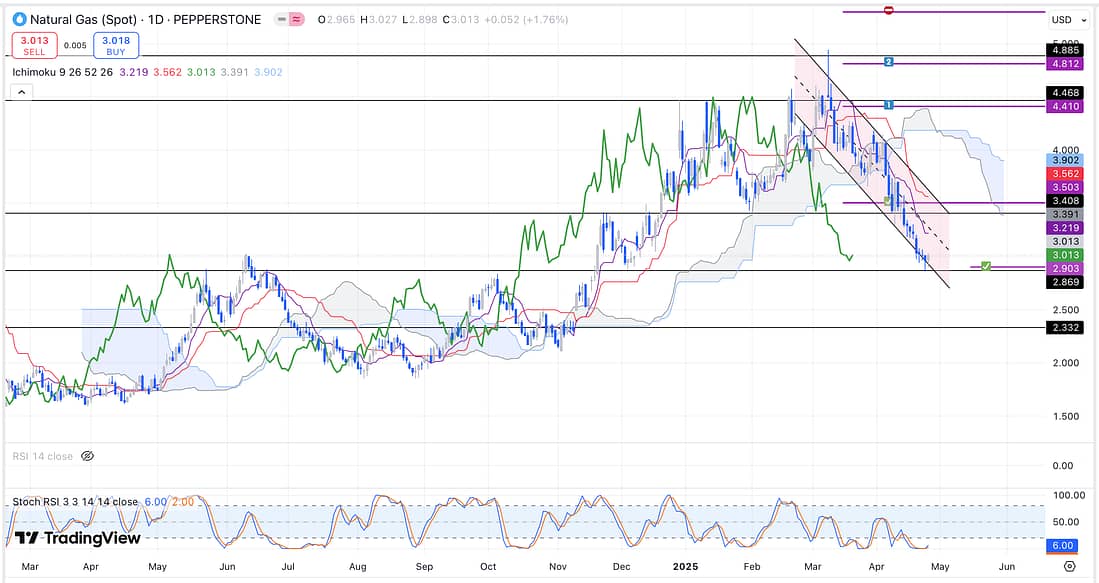

27. NATGAS – analysed:

28. UNG – analysed.

Learning Points

- Even though the broader market is in a short-term uptrend, I am able to still hold onto many of my short positions such as SAP, FFIV, UAL, and JETS; because I initially obtained excellent entry levels in regard to their parallel channels.

This confirms to me that trading really is all about analysing the markets everyday in relation to the parallel channels in order to determine when best to exit, enter, or take profit from a trade.

That said, it is always important for me to be mindful of whether a trade will add to my overall short or bullish position concerning the broader market.

. - NATGAS – NATGAS has started to rally from the major support level as I had anticipated. Let’s see how high it goes?

Next Actions

- Complete the latest book “The Disciplined Trader”.

- Record the completion of “The Disciplined Trader” on the websites.

- At some point, carry out a book review of “The Disciplined Trader” to continue accelerate your learning rate.

- Watch the latest “Trading the Close” or “Weekly Wrap-up”.