Trading Watchlist:

1. SFM – analysed:

Intriguingly, as to be expected the price action rebounded off of the lower parallel channel trend line. Let’s see what happens next (will the price action continue to rally to the next resistance level)?

Continue to closely monitor SFM everyday.

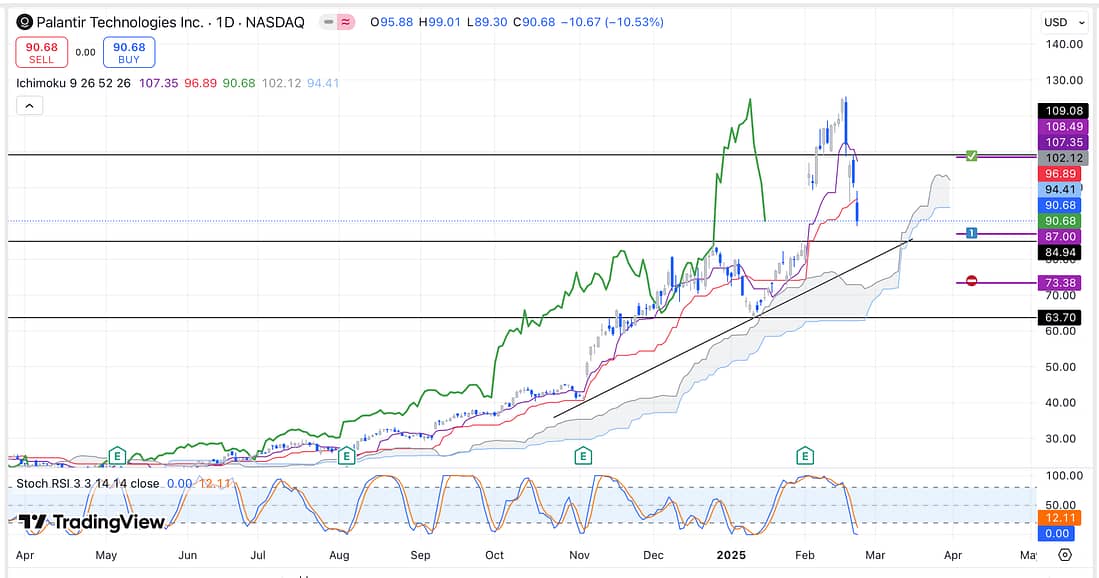

2. PLTR – analysed:

Using a limit order consider going long PLTR if the price action reaches the next major support level.

3. HOOD – consider scaling into a HOOD long as soon as the market re-open tomorrow:

This is because there are two strong factors. The first is that the price action has reached a major support level on the daily timeframe, with the second being that it has hit the lower trend line on a parallel channel.

A third factor is that the Ichimoku lagging span on the 4 hour timeframe is still far away from (the possibility of breaking through) the lower trendline of the parallel channel.

As a result, there is a high probability that the price action will rebound to the upside.

4. CVNA

Continue to monitor CVNA everyday for a possible high-probability long entry.

5. BIDU – analysed: consider add additional capital to BIDU long trade.

6. 000001 – analysed (Chinese stock market still bullish overall which should be favourable for BIDU).

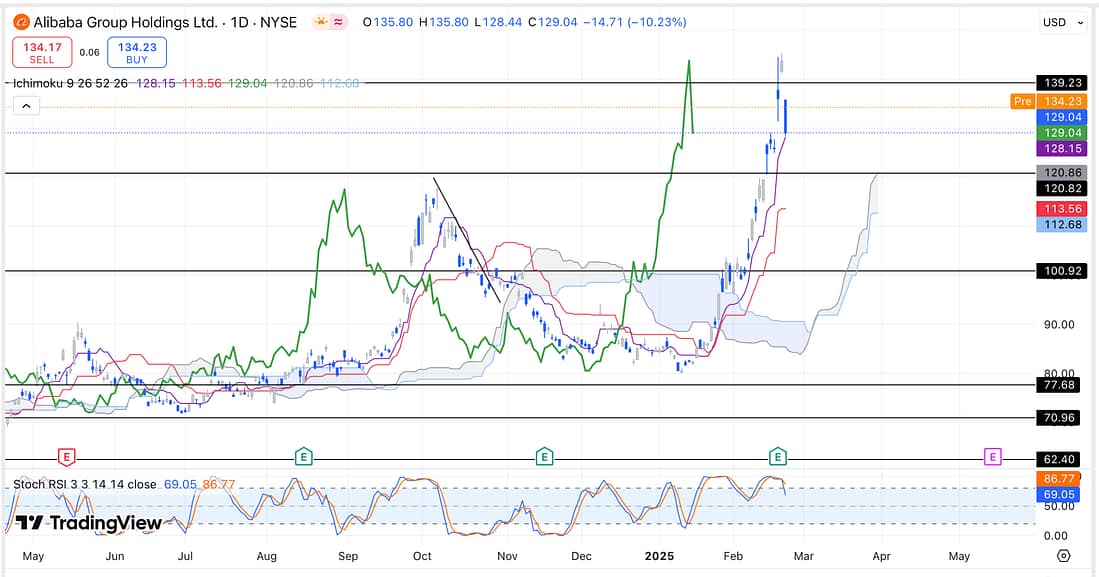

7. BABA – declined on the daily timeframe after its very violent price rally (as to be expected):

Learning Point

- On the weekend it took me 4 hours to update my trading spreadsheet.

Fundamentally, I learned that I have been making excellent progress in the respect that I have managed to keep my trading account at break-even whilst I continue to iron out the major flaws in my trading ability.

It also revealed to me that trading does require an extreme level of discipline and consistency, because without it, there is no-way I would have been able to spend 4 hours just adding trades to my database.

Significantly, without updating my spreadsheet (knowing the numbers), it would have been impossible to know if I am, actually, making decisions that will take me towards becoming an extremely profitable trader.

Next Action

- Continue to monitor SFM closely everyday.

- Consider using a limit order to go long PLTR.

- Consider scaling into a HOOD long as soon as the markets re-open tomorrow.

- Continue to closely monitor CVNA, everyday, for a possible long entry.

- Consider adding additional capital to BIDU long trade.

- Watch today’s “Verified Game Plan”.