Trading Watchlist

1. BTC – analysed.

2. AVAX – analysed.

3. BTC.D – analysed.

4. CMG

Continue to keep a close eye on CMG, and consider starting to scaling into a long trade early when the markets re-open.

5. SOL – analysed.

6. US10Y – analysed.

7. SOL

Submit a limit order to buy another small quantity of SOL immediately.

8. AVAX

Submit a limit order to buy another small quantity of AVAX immediately.

9. POLUSDT

Submit a limit order to buy another small quantity of POL immediately.

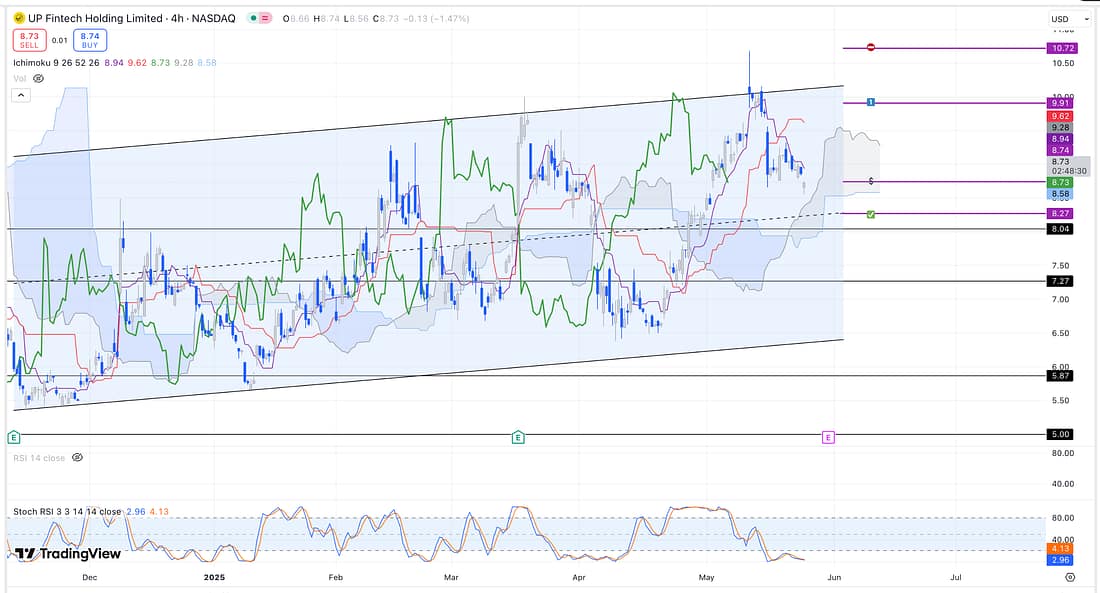

10. TIGR

Take 50% profit out of TIGR as soon as possible, because the price action has dropped considerably from its recent high, even though it has not reached midway point on its parallel channel.

11. SOXX – analysed.

12. QQQ – analysed.

13. SPY – analysed.

14. RUT – analysed.

15. GDX – analysed.

16. BABA – analysed.

17. GFI – analysed.

18. XAUUSD – analysed.

19. NFLX – analysed.

20. SFM – analysed.

21. FDX – analysed.

22. UPS

Start scaling into a UPS long as soon as possible.

23. CMG

Start scaling into a CMG long trade as soon as possible.

Learning Point

- BTC – SOL – AVAX – the current and strong short-term decline of BTC reveals that it is truly dangerous to enter a trade at the midway point of a parallel channel.

Alternatively, a trader should wait for the price action to reach the top or the bottom of the parallel channel in order to submit a higher probability trade.

I decided to submit limit orders to buy SOL and AVAX because they are more blue chip (higher grade) crypto than the others (ONDO, LINK, TON, POL, and RENDER).

Next Action

- Monitor CMG price action when the markets re-open today.

- Using a limit order, buy a small quantity of SOL immediately.

- Using a limit order, buy a small quantity of AVAX immediately.

- Using a limit order, buy a small quantity of POL immediately.

- Take 50% profit out of TIGR as soon as possible.

- Start scaling into a UPS long trade as soon as possible.

- Scale into a CMG long trade as soon as possible.