Trading Watchlist

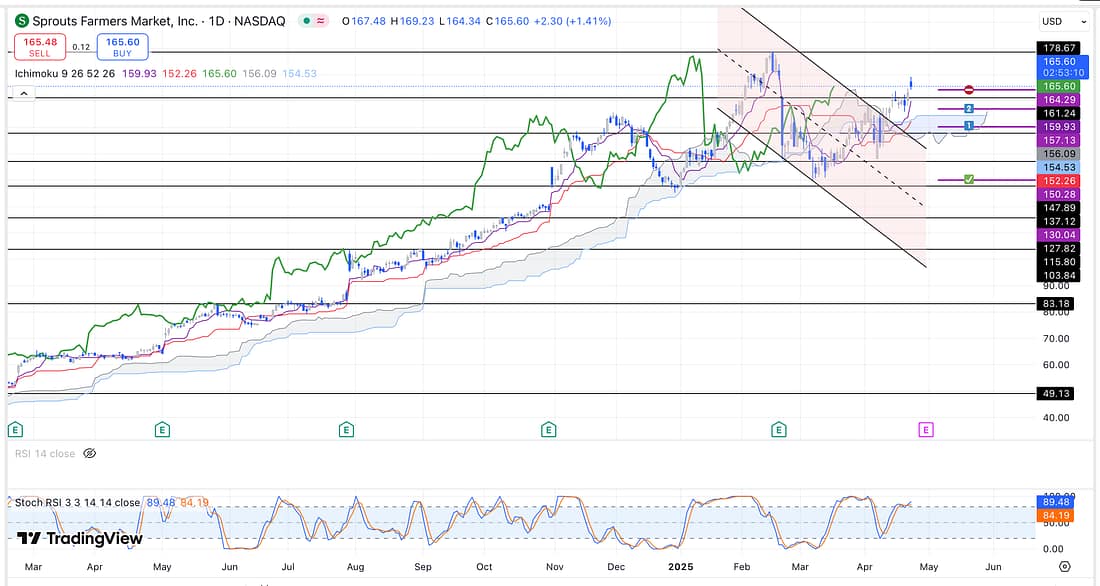

1. SFM

Today, I sustained another small trading lose in relation to my SFM trade as the price action did not decline as expected for.

The suggestion is that SFM is just a very popular safe-haven stock that tends to rally when there is any signs of weakness concerning the broader US market.

All in all, this reminds me of the importance of always carrying out intermarket analysis, and assessing the intermarket relationship between any stock or market before carrying out any trade – if I intend for the trade to have the highest probability of success possible.

2. DECK

Today, rightfully, I got punished for placing my stop-loss at a predictable price action level. Instead, my stop-loss should of actually been a second entry.

3. NATGAS

It is time to exit UNG (NATGAS) trade as the price action is now within the vicinity of a major support level after experiencing an astronomical decline.

And it is extremely important that I continue to practice not being greedy when deciding to take profits.

This because it is important to refuse to try to squeeze every ounce of profit from every single trade.

4. UNG

Take full profits out of UNG as soon as possible.

5. XAUUSD – analysed.

6. GFI – analysed.

7. BIDU – analysed.

8. UAL – analysed.

9. JETS – analysed.

10. USOIL – analysed.

11. USO – analysed.

12. US10Y – analysed.

13. HOOD – analysed.

14. QQQ – analysed.

15. FFIV – analysed.

16. SAP – analysed.

17. BABA – analysed.

18. TIGR – analysed.

19. IWM – analysed.

20. PALL – analysed.

21. WBA – analysed.

22. COST – analysed.

Learning Points

- I have got to completely ignore my account profit and loss in order to achieve mind mastery.

. - I have got to increase my learning time horizon in order to ensure that I do not get distracted by my profit and loss account.

. - DECK – stop-loss was tiggered as a result of placing it in an obvious area next to its parallel channel. I knew that this was a possibility, but thought that their would be less likelihood of a stop-loss hunt because it was not a popular stock like APPL or GOOG. Clearly, I was wrong. Next time, consider creating at least two scaling in entry levels.

. - SFM – continues to be a safe-haven stock. When there is uncertainty in the global markets, SFM tends to rally to the upside.

. - Continue to assess the direction of the broader market (Inter-market Analysis) before making any trades: QQQ, SPY, RUT, and BTC.

. - Before carrying out trades, I have to become more conscious of where each trade fits into my overall trading position in relation to the broader US market:

Overall Trade Strategy (Hedge) 10 trades per month means:

5 trades if US broader market is bullish

(GFI, TLT, BIDU)

5 trades if US broader market is bearish direction

(FFIV, UAL, JETS, SAP, UNG, HOOD, SFM, DECK, IWM, USOIL/USO)

Next Action

- Take full profits out of UNG as soon as possible.

- Continue to prioritise your reading of “The Disciplined Trader” today in 30 minute slots.