1. SOXX

As shown above, SOXX appears to have started to rally so consider exiting all short position within your trading porfolio immediately.

2. UVXY

Remember that UVXY can easily gap down, so exit position immediately until probabilities favours SOXX no longer rallying to the upside.

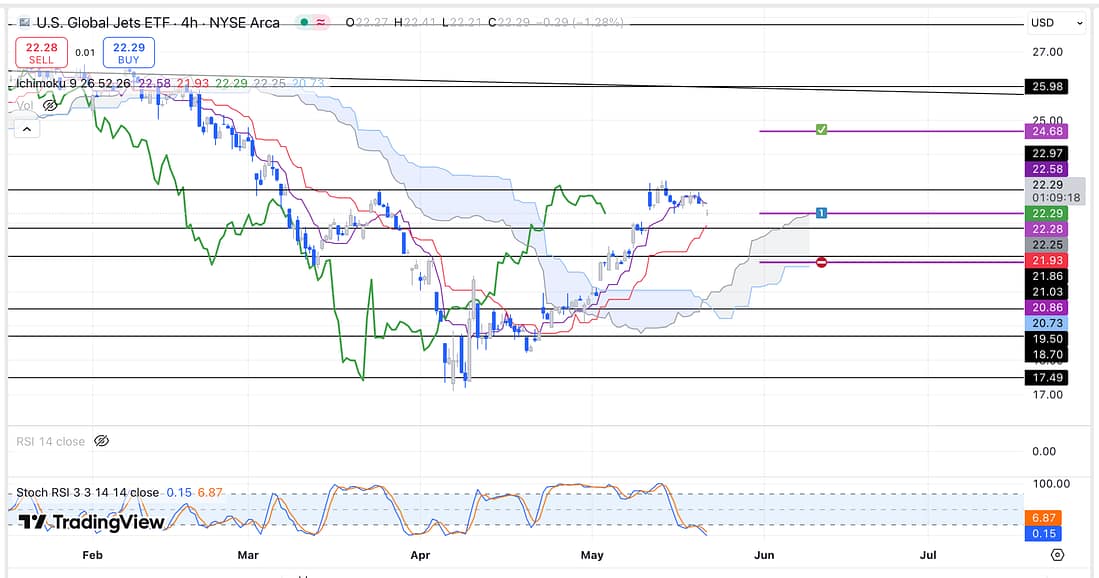

3. JETS

It appears that it is now time (SOXX rally) to enter a JETS’ long trade as soon as possible.

4. FDX

In light of SOXX’s rallying, exit FDX short trade as soon as possible.

5. AVGO

In light of SOXX rallying to the upside, exit AVGO short trade as soon as possible.

6. UAL

In light of SOXX rallying to the upside, start scaling into a UAL long position immediately.

7. SOXS

Exit SOXS long trade with a small loss for the following reasons:

(1) probabilities now favour SOXX (broader US market) continuing to move to the upside.

(2) similar to UVXY, SOXS has the capacity to gap down unexpectedly, so wait patiently for probabilities to favour SOXX moving to the downside before entering into a new long position.

8. GDX

Because probabilities now favour SOXX continuing to move to the upside, enter into a gold short position, immediately, using GDX.

9. TLT

Exit TLT position immediately (with a small loss) as the price action has now broken through the major support level on the daily and weekly timeframe.

10. AVAX

Buy a small quantity of AVAX (Spot) as soon as possible.

Learning Point

- Today, I got caught off guard when I saw the SOXX declining suddenly, after it had experienced a short-term rally.

The result is that I started exiting my new long position in a panic, and tried to re-instate many of old short positions.

However, as I was carrying this out, the market then started to rally again – causing me to sustain many unnecessary small losses.

It was a very valuable experience, nonetheless, for the following reasons (in terms of trading, it is teaching me how to drive brilliantly):

(1) it reminded me of the extreme importance of ignoring the lower timeframes when putting on all of my 4 hour and daily timeframe trades.

Once I have carried out my technical analysis on the higher timeframes, then I should simply ignore what seems to be happening in the very short-term. Generally speaking, I know this already; but today taught me that I must really stop entertaining the idea that I should concern myself with variation of small entry points, otherwise, I will keep falling into this trading emotional trap.

(2) I may really have to have two entry levels in mind, as a minimum, when scaling into any trade. This is because without doing so, I am liable to panic emotionally if the price action rises or declines very suddenly, and unexpectedly, past first entry level.

However, further reflection reveals that my second entry level would usually be at the exact the place where I would typically place my stop-loss on the daily timeframe.

This is problematic for the following reason:

If the price action reaches the level of my stop-loss, then this typically means that its bullish or bearish price action structure has been broken. Therefore, I would be seeking to wait patiently (at this point) to see what the market wants to do.

In other words, I would avoid making any additional entries. Thus it seems that make only one entry seems to the approach that works best for me when assessing the price action in relation to the daily timeframe.

. - Once I have made up my mind as to which way probabilities favours in terms of the broader US market, then I should ensure that all of my portfolio trading positions reflect this insight. This is because counter positions can unexpectedly gap down or up, causing me to experience a big loss.

. - Using the Ichimoku indicators (Kumo Cloud) on the 4 hour timeframe is really the perfect tool for allowing me to see if the price action is still in a bullish or bearish price action structure.

. - BIDU – the price action of BIDU revealed today that I would have turned a profitable trade into a potential loss if I made an additional entry at the midpoint of the parallel channel. Therefore, this seems to confirm that entries made at the bottom or top of the parallel channel are necessary to ensure the highest probability of trading success possible.

Next Action

- Exit UVXY long position immediately.

- Start scaling into a UAL long position as soon as possible.

- Consider marking out two possible long entry levels on the UAL chart.

- Start scaling into a JETS long positiion as soon as possible.

- Exit FDX short trade as soon as possible.

- Exit AVGO short trade as soon as possible.

- Exit SOXS long position as soon as possible.

- Start scaling into a GDX short position as soon as possible.

- Exit TLT long position immediately.

- Buy a small quantity of AVAX immediately.