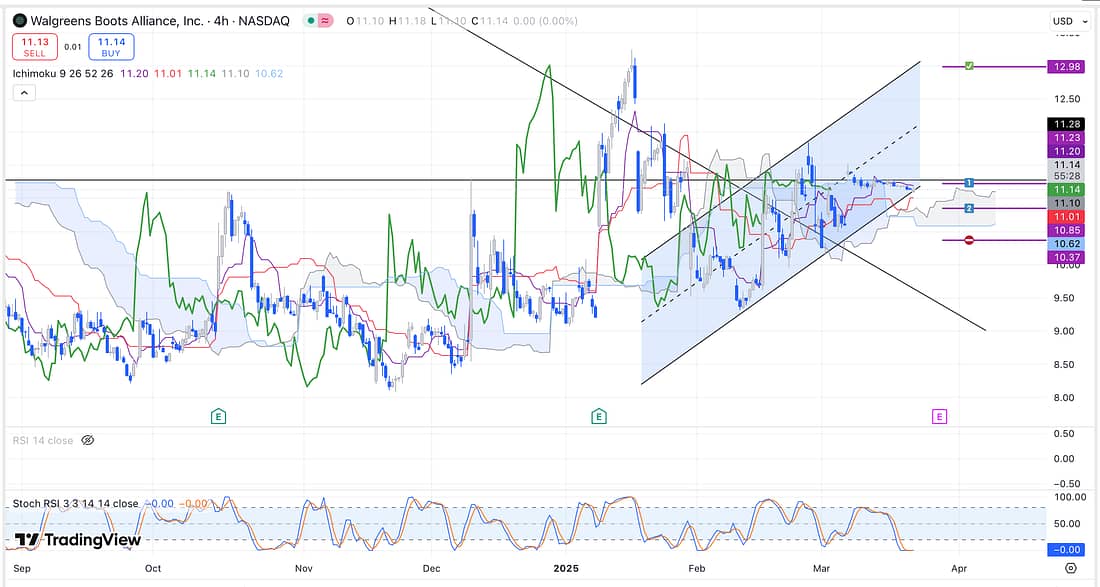

1. WBA

As can be seen above, the price action of WBA suggests that it should start moving towards the upper range of the parallel channel at some point.

2. UVXY – analysed.

3. QQQ – analysed.

4. RUTS – analysed.

5. SPY– analysed.

6. BTC– analysed.

7. WOLF – analysed.

8. BIDU – analysed.

9. NATGAS – analysed.

10. US10Y – analysed.

11. XAUUSD – analysed.

12. GFI – analysed.

13. DJI – analysed.

14. UAL – analysed.

15. JETS – analysed.

Learning Points

- Watched a video about the financial affairs of WBA, and it looks absolutely horrible. They appear to be in a lot of trouble, which has caused them to be acquired by a private equity firm.

As a result, it is to be expected that the private equity firm will slash and burn everything that is draining the company’s profits in order to turn it around in 3 to 7 years, and exit with a substantial profit.

Hold on, therefore, to your current WBA long position.

Let’s see how this plays out.

. - The more experienced traders (that I follow) seem to be failing to see what I can see in the markets at the moment.

I see that there is a good possibility that the markets, in general, will move sideways then upwards, as oppose to coming to a holt, then resuming their decline.

Let’s see how this all continues to play out as I’m really curious whether I am missing something fundamental in my analysis.

Next Actions

- Look into what is happening with WBA as soon as possible.

- Continue to assess the broader markets today on their 1 hour timeframes.