Trading Watchlist:

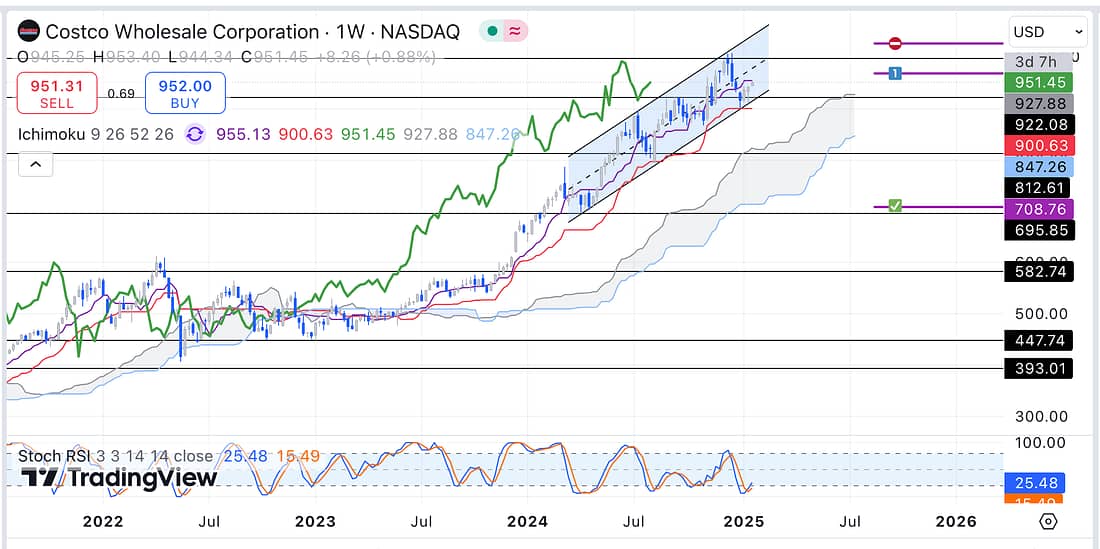

1. COST – exit COST as soon as possible as price action looks set to rise to the next resistance level on the daily timeframe, which will be at a higher price above my original entry level:

2. WMT – continue to hold on to your WMT short position as your original entry was at a good level.

3. CMG – CMG’s price action has now return to the major support level on the daily timeframe, so take out at least 50% profit:

4. DG – analysed.

5. MRNA – analysed.

6. UAL – submit an UAL short limit order as soon as possible in relation to its monthly timeframe:

7. JETS – analysed.

8. USOIL – analysed.

9. UCO – analysed.

10. SFM – analysed.

11. BTC – analysed: close BTC limit order short as, clearly, I missed the profitable short trade (next time).

12. UVXY – analysed.

13. BIDU – analysed.

14. TIGR – analysed.

15. LLY – analysed.

16. WBA – analsyed: as I thought may happen, the price action could not break free from the tremendous monthly timeframe selling pressure:

17. INTC – analysed.

18. WOLF – analysed. Continue to monitor WOLF everyday, as a priority, for a possible great long trade.

19. HOOD – analysed.

20. RL – start scaling into a RL short position in accordance with its weekly timeframe as soon as possible:

Learning Points

- Taking profits at the key daily timeframe resistance and support levels seems to be the key to ensuring that all trades remain profitable.

- Submitting brilliant entries at key support and resistance levels makes all of the difference in terms of knowing when to take profits, and when to keep trades active.

- WBA – the monthly timeframe trendlines are extremely difficult for the price action to breakthrough regardless of whether they are acting as support or resistance.

Next Action

- Exit COST’s short trade as soon as possible to lock-in some profit.

- Continue to monitor COST’s price action everyday.

- Take out 50% profit from CMG as soon as possible.

- Submit an UAL short limit order as soon as possibe in accordance with its montly timeframe.

- Continue to closely monitor JETS to possibly add to active short position.

- Close active BTC limit order short as soon as possible.

- Continue to closely monitor WOLF everyday for a great possible long trade.

- Watch “Verified Game Plan” to accelerate your learning process.”

- Watch “Trading the Close” to accelerate your learning process.”

- Scale into a RL short position as soon as possible in accordance with its weekly timeframe.