Trading Journal

“First learn to trade then the money will follow!”

DXY

Analysing the DXY on several different timeframes (4 hour, daily, and weekly), we can see that the price of the US dollar is bearish, and is likely to continue declining to the next major support line at around 103.00.

If this plays out as expected, then it’s likely to cause the stock market to continue rising or to start moving sideways (as some of the prices of certain stock are exhausted as they move slowly towards their previous all time highs).

However, the weekly stochastic RSI is near the oversold position. As soon as it turns upwards, then this is likely to be the most ideal time to short indices like the Nasdaq and companies like Amazon which are heavily overbought on their weekly.

Next Action

- Analyse SPY, AMZN, MSFT, QQQ, and NVDA in order to prepare short trades.

- Enter shorts for SPY, AMZN, MSFT, QQQ, and NVDA

US10 YEAR YIELD

Analysing the US10 Year on the 4 hour, daily, and the weekly timeframe; it appears that the US10 Year will soon change direction and turn upwards.

This can be seen by the fact that

- stochastic RSI on the weekly has entered the oversold area,

- the price action on the daily has stopped its decline within and at the bottom of the Kumo Cloud, and

- the 4 hour chart shows that the price action has started moving sideways.

Learning Point

- If the US10 Year starts to move upwards, then the TLT is likely to stop rising. Therefore, it may make sense to move up my stop-loss to ensure that I lock-in some profit.

Next Action

- Assess the US10 Year and TLT on the daily timeframe tomorrow to determine whether to move-up my stop-loss.

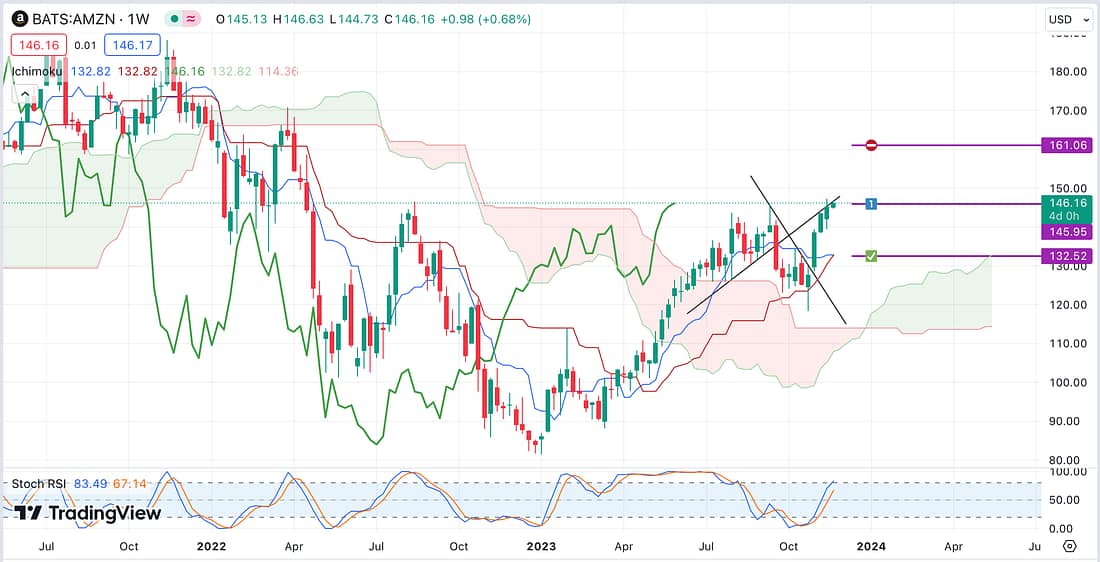

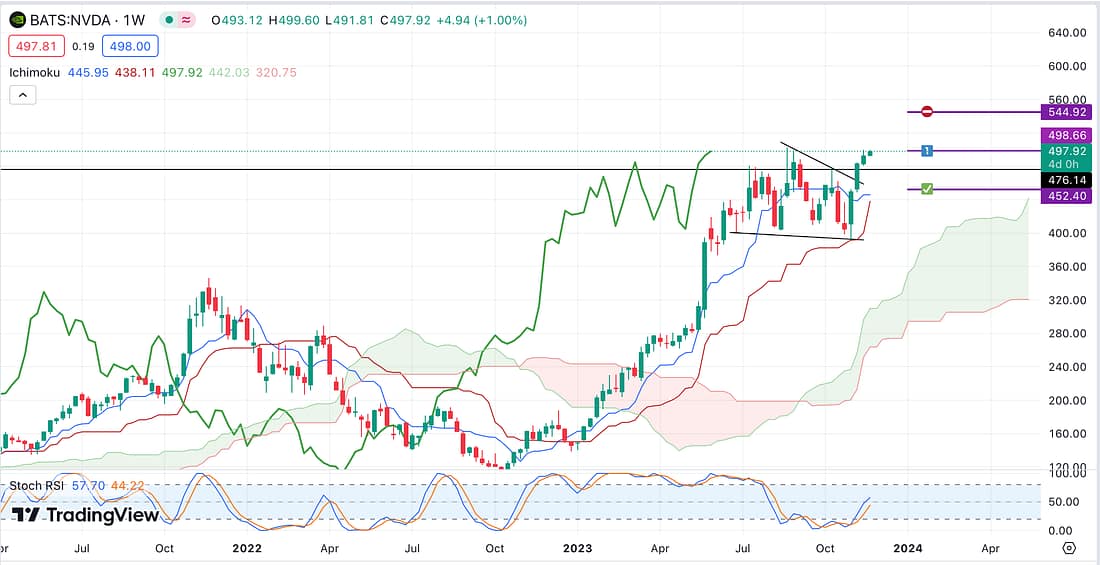

As a result of my analysis above, I decided to enter short trading positions on the following assets risking only 1/10 of my risk capital (1% Rule) for each trade (purple line number 1 is my entry, the purple line with the no-entry sign is my stop-loss level, and the purple line with green box is my take profit area):

SPY

QQQ

AMZN

NVDA

MSFT

The reason why I am only risking 1/10 of my capital per trade is because there is still a strong likelihood that the price action will continue to rise.

If the price does increase then, worse case scenario, it will only result in a small loss of capital. And allow me to make another small entry to add to my existing position without seriously damaging my trading portfolio.

Alternatively, if the price action turns, then this increases the odd of it being a profitable trade with a high risk to reward ratio because I would have got in early.

Next Action

- Tomorrow, assess the weekly and daily timeframes of my active trades to determine if I should apply additional capital to my existing positions.

- Evaluate USOIL / USO trade.

- Assess TLT trade.

IVG (Involgize)