Trading Journal

“First learn to trade then the money will follow!”

VIX / VXX

Reviewed (above) my VXX trade and it appears to still be moving as expected. However, it’s not quite ready for my stop-loss to be moved up to my entry position, or for 33.3% profit to be taken at the first approaching resistance level on the weekly timeframe.

Next Action

- Continue to review this trade tomorrow or Friday.

DXY

In light of the DXY continuing to decrease in price on the weekly timeframe, I decided to close all of my stock market trades. that I submitted on the basis that I thought there was a strong possibility that the stock market would turn bearish, generally, in the next week or so.

However, this still does not appear to be a real possibility in the next week or so, and the relevant stocks that I traded short, have all broke through their relevant resistance levels.

Therefore, I have decided to close all of my following active trades: AMZN, MSFT, DIA.US (US30), QQQ, NVDA, and SPY.

QQQ

Learning Point

- Monitoring what the DXY is doing on the weekly timeframe is so important when deciding to enter a trade relating to individual stocks and indices. If I can trade in the right direction (opposite to the DXY) then potentially my current experience suggest that I may be able to make a killing trading multiple different assets, instruments, and markets simultaneously.

- Because I limited my exposure to all of the active trades that I have just closed, it did not damage the profitability of my overall portfolio. Making the point: risk management is so, so, so important (I learned this lesson well from my previous multi-handed trades).

Next Action

- Continue to assess on a daily basis the weekly timeframe of the DXY to catch when it turns so that I can short all of the relevant indices and stock market companies.

US10 YEAR YIELD

In light of my latest experience trading financial assets that move opposite to the DXY, I have decided to close my TLT short.

This is because I, now, have a better appreciation for the movement of an asset in relation to its weekly timeframe. If the DXY or the US10 YEAR do not show a significant price movement that break their weekly trend, then it does not make sense to enter into any other trade that goes against their overall price direction (until this is no longer the case).

Now, it is just a case of waiting for this to occur, and acquiring actual trading experience of it doing so.

Next Action

- Continue to monitor the DXY and the US10 YEAR on a daily basis to detect when they are most likely to experience a change in trend, so that I can short the relevant other assets and markets.

- Close RNDR trade on the basis that BTC is likely to still rise due.

- Consider going long on an Altcoin on the basis that the DXY is still declining and BTC is likely to still rise.

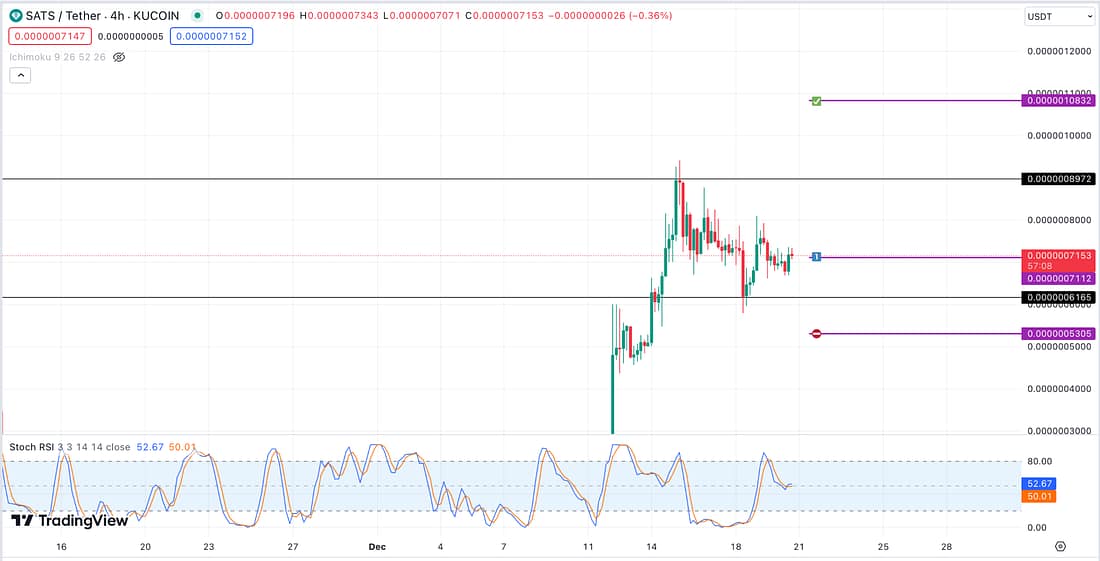

SATS

Today, I decided to enter into a long trade with SATS because it is an Ordinal that is on Kucoin, and, in my opinion, there is a good probability that Bitcoin will rally up to the next resistance level in accordance with its weekly and daily timeframe (this is because the DXY looks set to continue declining).

If Bitcoin does not rally, I have set a stop-loss to limit my downside risk.

This trade has been carried out purely as a Bitcoin play. Therefore, if BTC changes direction on the weekly and daily timeframes, or does anything unexpected, then that is likely to be a signal to immediately exit the trade.

Let’s see how this plays out!

Next Action

- Continue to monitor BTC on the daily timeframe to see if it is still likely to rally to the next resistance level.

IVG (Involgize)