Trading Journal

“First learn to trade then the money will follow!”

Today, my watchlist using the daily timeframe consists of the following:

Looking for Trading Entries

- GLD / XAUUSD

- NATGAS / UNG

- BTC

Monitoring of Current Trades

- USOIL / USO

- TLT / US10 Year Yield

- BAX

- UAL

- LUV

GLD / XAUUSD

The Gold Spot price still seems to be holding up around it current support line on the daily timeframe.

Therefore, I have decided to place another 1/6 position order (purple line number 4), below my current entry level (purple line number 1) on the Gold ETF (GLD). The hope is that if the Gold price further declines today, because the daily Stochastic RSI is still heading towards the oversold position, then that will give me an opportunity to benefit by obtaining a better entry for my GLD Long trade.

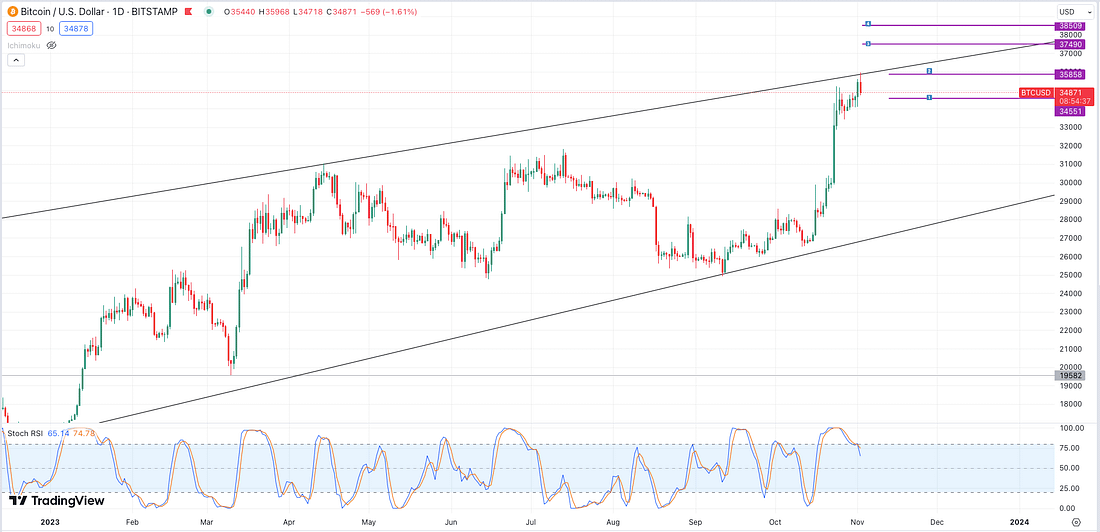

BTC

As shown above, BTC looks almost ready to decline back to the bottom parallel trend line on the daily timeframe. Therefore, it makes sense to start looking to Short an Altcoin that has been trending heavily with BTC price rally.

After looking at various Altcoins to Short such as SOL, ADA, MANA, GALA, and ENJIN, I decided to choose ADA because its price action on the daily timeframe appears to be more predictable. And it allows me to place a stop-loss around 10% away without a high probability of it being triggered by market noise.

If this trade plays out according to plan, then it should be as much as a 20% move to the downside. It had taken me about 1 hour and 30 minutes to analyse the various different cryptos coin, and prepare and carrying out this trade.

BAX TRADE

Today, my BAX trade hit my take-profit target quickly.

As implied from the backtesting that I had carried out on the chart, the stock re-bounded aggressively from its support level trend line.

This is the first time that I have applied this trading strategy successfully.

Learning Point

- In an ideal scenario, I would have liked to allow a percentage of my profits to still run. I would have probably taken about 66% of my profit out of the position, allowing 33% to continue to run as the Stochastic RSI on the weekly timeframe still shows buying strength. The re-backtesting that I have just carried out right now confirms that the price is likely to make it way to the next major resistance line at the least. Therefore, it would have been the best move to let a percentage of my profits run in the future.

Next Action

- When setting take-profit levels, set them to around 70% below or above the next major resistance or support lines using the daily timeframes.

- Continue to monitor BAX to learn more about the price action from this trade.

- Double check that the take-profit level concerning LUV and UAL also correspond with the next resistance line on their daily timeframes. Or remove the take-profits as I will be reviewing these trades everyday.

- Tomorrow run through the trading watchlist again at 2.30pm when the markets open, but this time place emphasis on monitoring outstanding trades first before you consider putting on any new ones.

IVG (Involgize)