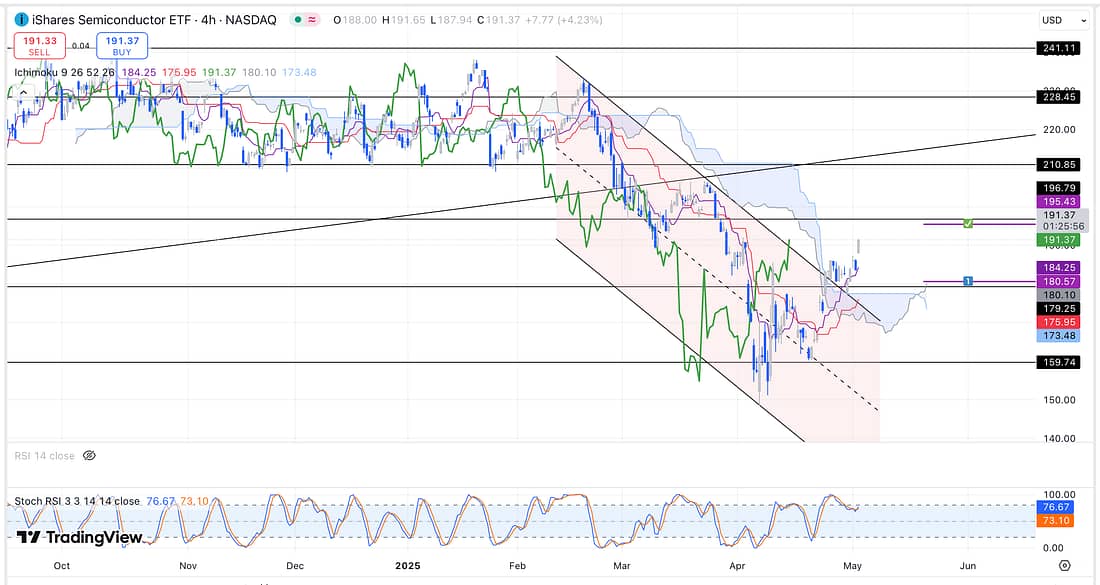

1. SOXX

As shown above, SOXX’s has clearly broken out of it bearish price action structure.

In light of the saying “where the SOXX goes, the rest of the market follows” I have decided to exit most of my short trade positions (sustaining a few small losses) immediately.

2. UAL

Exit UAL with a small loss, as soon as possible, in light of the fact that SOXX now has a bullish price action structure.

3. AXP

My stop-loss was triggered, otherwise, I would have sought to exit AXP as soon as possible.

3. JETS

Exit JETS immediately in light of the fact that SOXX now has a bullish price action structure.

4. COST

Exit COST, as soon as possible, in light of the fact that SOXX now has a bullish price action structure.

5. PLTR

Start scaling into a PLTR short position, as soon as possible, because I am expecting SOXX to start pulling back as some point next week.

6. QQQ – analysed.

7. SPY – analysed.

8. RUT – analysed.

9. BTC – analysed.

10. GFI – analysed.

11. TIGR – analysed.

12. BABA – analysed.

13. NATGAS – keep a close eye on NATGAS for a possible long trade:

Learning Points

- In truth, I actually had a major short position in play (in relation to the overall broader market) as a result of having the following seven open short positions:

(1) JETS

(2) FFIV

(3) COST

(4) HOOD

(5) AXP

(6) SAP

(7) UAL

Therefore, as soon as the market turned bullish, it was always going to result in me sustaining more of a loss overall.

In hindsight, I should have ensure that I also had at least seven long positions open in order to ensure that my risk was sufficiently hedged.

This would have made sure that, in theory, my trading account would always end up on top as long as my trades always have about a 2:1 risk to reward ratio.

. - Re-acknowledged today the importance of only entering trades when the price action reaches market extremes (lower or upper part of its parallel channel). This will ensure that all of my trades have the highest probability of success possible.

. - COST – key importance of using intermarket analysis to determine when and when not to remain or exit trades. I was able to avoid a tremendous loss this week by apply this method to my HOOD trade. In hindsight, I now know that I should have applied same method to my COST trade as well.

. - All that I have to do is assess the price action in relation to its existing parallel channel, followed by analysing the current channel that it is forming, then trade accordingly.

In this respect, I was able to clearly see that many of the trades which I thought were ready to trade short or long to where, in actual fact, not ready to be traded at all.

Also, I was able to see that many of the potential trades would not be worth commencing because the price action was unlikely to move substantially.

. - All of the above learning points allowed me to re-acknowledge the power and importance of writing my trading journal every single day if I intend becoming a master trader.

Next Action

- Keep a close eye on NATGAS for a great potential long trade.

- Exit COST short trade as soon as possible.

- Exit UAL short trade as soon as possible.

- Exit JETS short trade as soon as possible.

- Exit AXP short trade as soon as possible (if the stop-loss has not been triggered).

- Start scaling into a PLTR short trade to commence hedging your long positions.

- Exit FFIV short trade will full profits as soon as possible.

- Watch today’s “Weekly Wrap-Up“.