Trading Watchlist:

1. XAUUSD

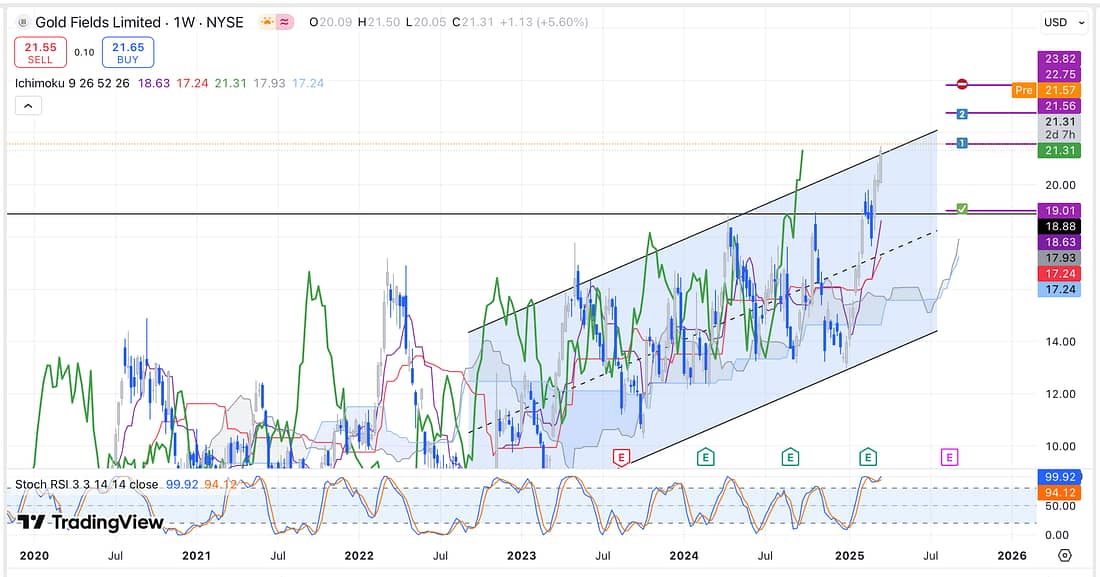

In light of the price action movement of the Gold, start scaling into a GFI short position immediately:

2. GFI

3. UVXY – analysed.

4. RUT – analysed.

5. QQQ – analysed.

6. SPY – analysed.

7. BTC – analysed.

8. WOLF – analysed.

9. GE

Today, I decided to close GE trade for the following reasons:

(1) the DJI (broader market) is now looking bullish,

(2) I submitted the GE trade because the DJI was looking bearish,

(3) GE did not declined as much as I anticipated when the DJI started falling (so it was not the best stock to trade concerning its inter-market relationship with the broader market).

10. DJI

Learning Points

- Today, I had to carry out online research to (1) ascertain the different gold mining stock and ETFs that are influenced by the gold price, then (2) find the gold mining stock or ETF that had the best chart pattern to trade.

I now acknowledge that what I did required a lot of intellectual brain power and experience. This is because I did it so quickly (within 30 minutes or so) that it caused me to experience a headache for the rest of the day.

. - As an anticipated (and hoped for) the markets, in general, appear to now all be moving upwards in the short-term.

In order to further assess how long the markets are likely to remain bullish, look up information regarding cycles on the Verified Investing website.

Next Actions

- Watch “Verified Game Plan”.

- Starting scaling into a GFI short immediately and using a limit order.

- Watch “Trading the Close”.

- Check Verified Investing website for information about trading cycles.