Trading Watchlist:

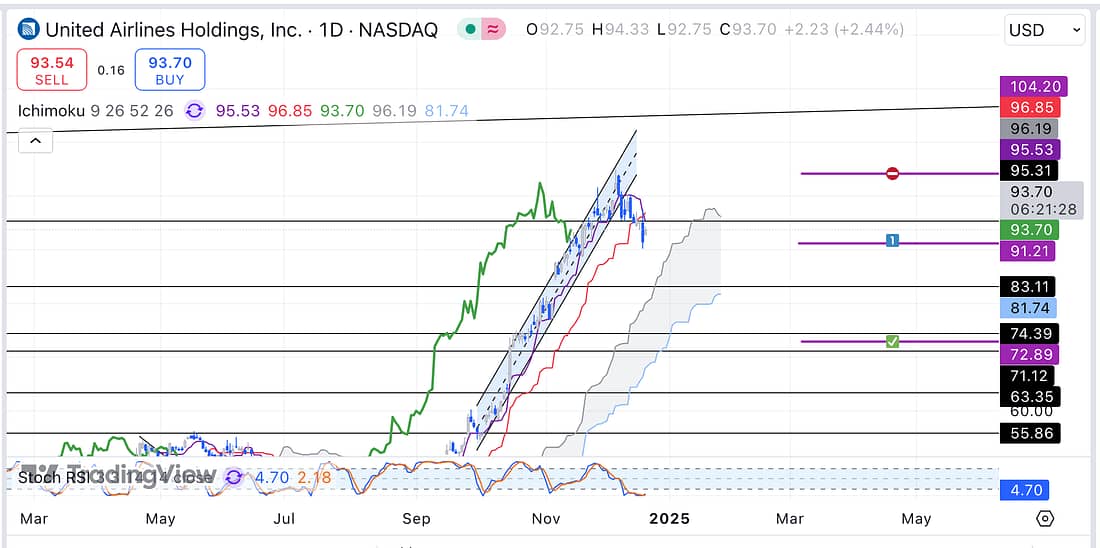

1. UAL – start scaling into a UAL short in accordance with the weekly timeframe as soon as the markets open tomorrow:

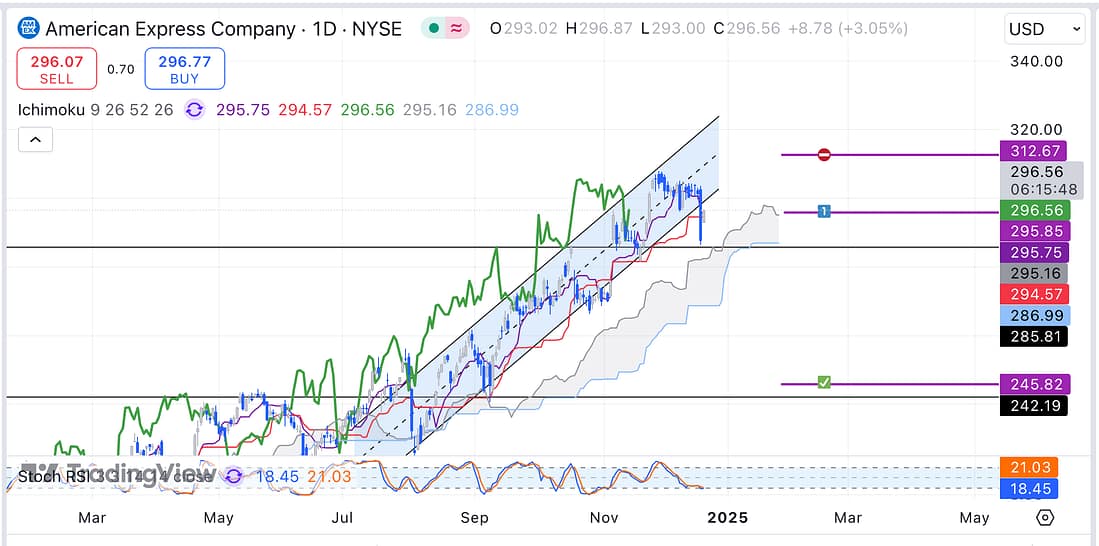

2. AXP – start scaling into AXP short in accordance with the weekly timeframe as soon as the markets re-open tomorrow:

3. WMT – scale into a WMT short in accordance with the weekly timeframe as soon as the markets re-open:

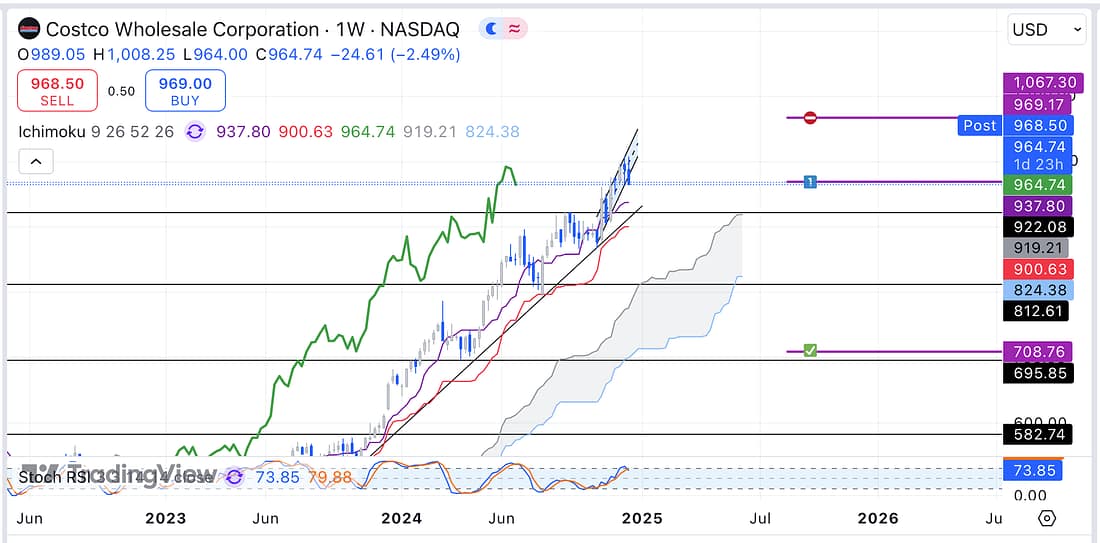

4. COST – start scaling into a COST in accordance with the weekly timeframe as soon as the markets re-open tomorrow:

5. SFM – start scaling into SFM in accordance with the weekly timeframe as soon as possible:

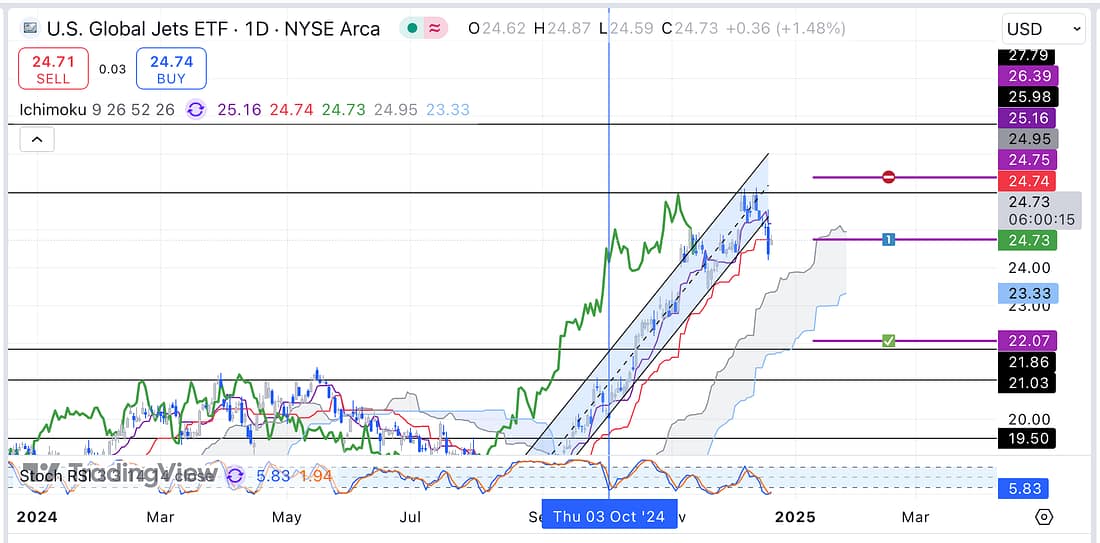

6. JETS – start scaling into a short position in accordance with the weekly timeframe:

7. BIDU – exit BIDU because the broader US market is declining.

8. TIGR – exit TIGR as soon as possible because the broader US market is now declining.

9. CMG – analysed.

10. UVXY – analysed.

11. MARA – Bitcoin is declining strongly, and is likely to continue declining to the next support level as the lagging span has broken below the parallel trendline on the 4 hour timeframe. As a result, exit MARA as soon as possible:

12. RUT – RUT has declined greatly so exit CMG as soon as possible as the broader market is declining.

13. CMG – exit CMG:

13. INTC – analysed: broader market declining.

14. DG – analysed: broader market declining.

15. SOXX – price action has declined to the lower support level concerning the daily timeframe range.

16. BTC – analysed.

17. BTC.D – analysed.

Learning Points

- Remember, in order to not be manipulated into chasing the price action in accordance with the weekly timeframe, using the 4 hour lagging span to ascertain if there is a false or genuine breakout or breakdown.

- Once the direction is established, then seek to add additional capital to your trade as you have been practicing doing.

- Reminded of the importance of checking the markets everyday at the open and the close.

- My UVXY hedge paid off; as without it, the market conditions would have caused my overall portfolio to sustain further losses. So, in the future, continue to ensure that all of my trading positions are sufficiently hedged in case of any surprise market movement.

- Catching the price action reversal is proving to be harder than I previously expected. It seems that practicing extreme patience and emotional discipline is key to being able to trade these setups successfully. In particular, having the patience to wait for the lagging span to cross the diagonal trendline on the 4 hour timeframe seems to be extremely important. As an alternative, entering a trade when the price action reaches the upper level of the parallel channel, alone, seems to not be sufficient. It may have to be done in conjunction with assessing the likelihood of a roll over in accordance with the weekly timeframe.

- Remember that we intentionally trade the weekly timeframe in order to avoid the market noise and inevitable market manipulation carried out by the smartest and most capitalised traders in the world.

- Time to get out of all long trades that require the broader market to be in a general weekly uptrend.

Next Action

- Continue to use UVXY to hedge all of your stock market positions.

- Exit MARA as soon as possible.

- Exit CMG as soon as possible.

- Exit TIGR as soon as possible.

- Exit BIDU as soon as possible.

- Scale into AXP as soon as possible.

- Scale into WMT as soon as possible.

- Scale into SFM as soon as possible.

- Scale into UAL as soon as possible.

- Scale into JETS as soon as possible.

- Scale into COST as soon as possible.

- Update new trading spreadsheet with all the latest winning and losing trades.

- Complete and edit latest trading journal posts.