UAL

Today, I decided to place another 1/3 entry limit order at the next resistance level (83.11) on UAL monthly timeframe, because the price action of UAL unexpectedly continued to rally, very, strongly.

Learning Point

Placing entries and stop-losses on the monthly timeframe support and resistance levels should, in theory, increase the probabilities of my trades playing out, because it is much harder for the price action to breakthrough these levels quickly (compared to the weekly timeframe), and without requiring tremendous buying or selling pressure.

Next Action

Continue to monitor the price action of JETS and UAL everyday to keep up the progress of your learning process.

AXP

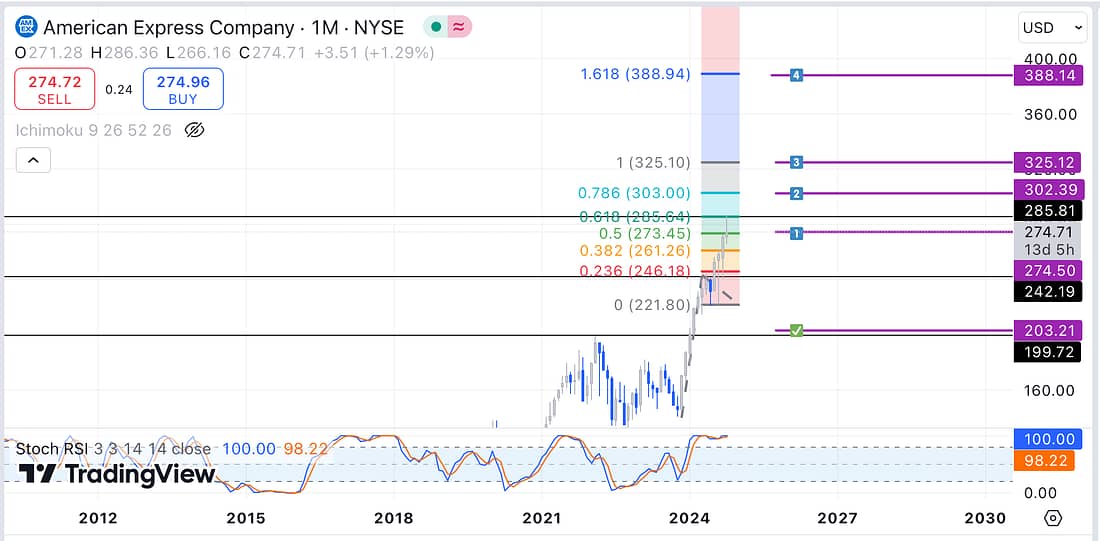

After Gareth Soloway drew my attention to the chart pattern of American Express, today, I decided to start shorting the stock with 1/3 scaling in position.

As can be seen above, because the price action of AXP is forming new all time highs, I needed to use the Fibonacci Extension to workout the most suitable entry and stop-loss levels.

Learning Point

Trading can be difficult in the respect that a trader may need to know when best to deploy non-frequently used indicators in order to take advantage of certain trading opportunities.

Next Action

- Continue to monitor the price action of AXP everyday.

- Continue to read trading books in order to keep up your continuous learning process.

- Continue to watch the daily trading videos of experienced traders.