Trading Watchlist:

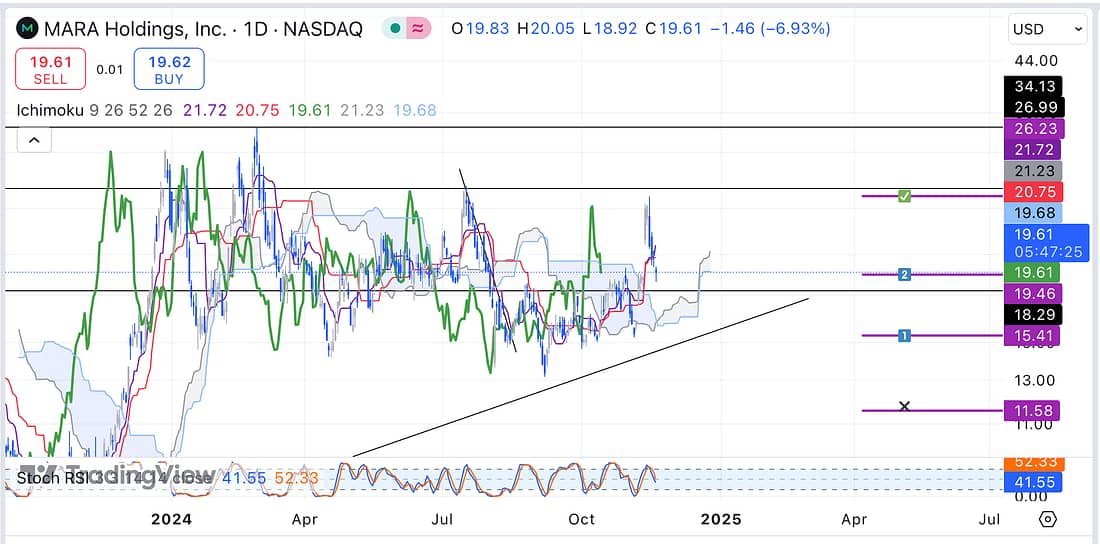

1. MARA – it is time to add additional capital to the MARA trade as it has pulled back nicely in regard to its bullish price action:

2. SOXX – the semi-conductor stocks (SOXX) collectively have broken their bullish price action structure and are now ranging. As a result, I decided to exit my MU trade as its price started to decline towards my stop-loss level.

3. MU – analysed.

4. WBA – exit WBA because it has broken its bullish price action structure on the 4 hour timeframe.

5. TLT – interestingly, TLT has hit my stop-loss level as the US10Y continued to rise after making my entry.

6. US10Y – continue to assess the US10Y on the 4 hour timeframe today as it seems almost ready for a major decline.

7. INTC – analysed.

8. FDX – analysed.

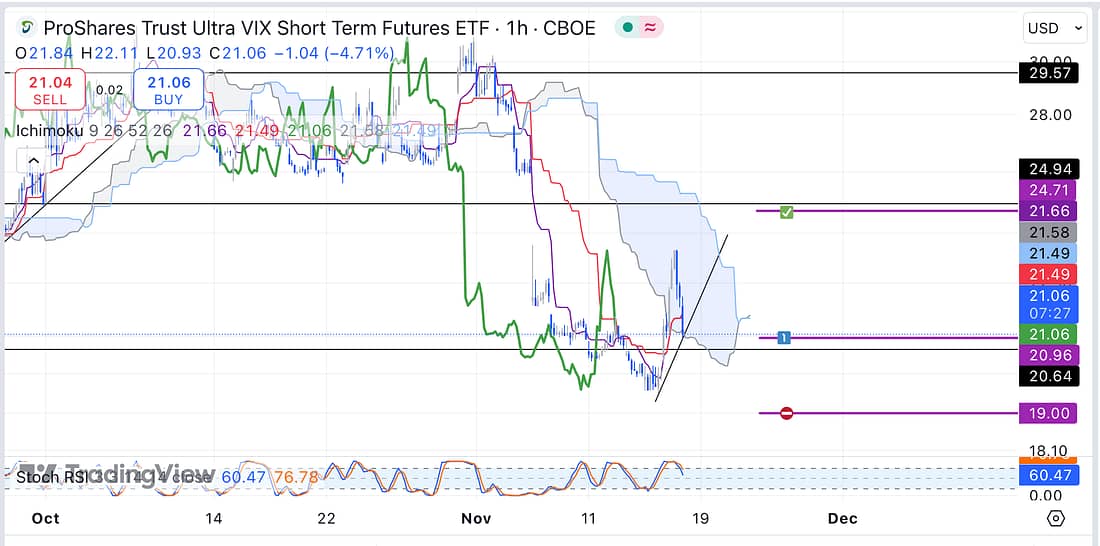

9. UVXY – enter a UVXY long (scale in) at these price levels making sure that you place your stop-loss out of reach of any foreseeable stop-hunt:

10. JETS – analysed.

11. UAL – analysed.

12. SFM – analysed.

13. COST – analysed.

14. AXP – analysed.

15. BIDU – wait patiently for 4 hour timeframe price action candles to close above Kumo Cloud, then make early entry.

16. TIGR – wait patiently for 4 hour timeframe price action candles to close above Kumo Cloud, then make early entry.

17. BTC – appears to be consolidating powerfully (bullish). Let’s see what happens next.

18. USOIL – still ranging (excellent that you have stayed out).

19. NATGAS – ranging.

20. XAUUSD – analysed.

21. PALL – analysed.

22. LIT – continue to monitor the price action on the 4 hour timeframe.

23. CMG – intriguingly, CMG’s price action has managed to remain bullish in a very rugged way. Continue to analyse the stock everyday to keep up with your learning process.

24. X – X is still continuing to range in an extremely volatile way.

Learning Point

- Using price action technical analysis, with the weekly timeframe support and resistance levels, is not a really good way to carry out high probability trades. Instead, to increase the probabilities of success, it is better to using the Ichimoku lagging span on the 4 hour timeframe to discover when the price action is most likely ready to decline or rise as it breaks through my drawn diagonal trendlines. This is what, today, my latest losing TLT trade has taught me.

Next Action

- Update new trading spreadsheet with the latest losing trades.

- Exit WBA as soon as possible because it has broken its bullish price action structure on the 4 hour timeframe.

- Add additional capital to MARA trade to practice, and perfect, this aspect of your trading ability and psychology.

- Scale into a UVXY long.

- Continue to monitor the price action of UVXY everyday to continue your learning process.