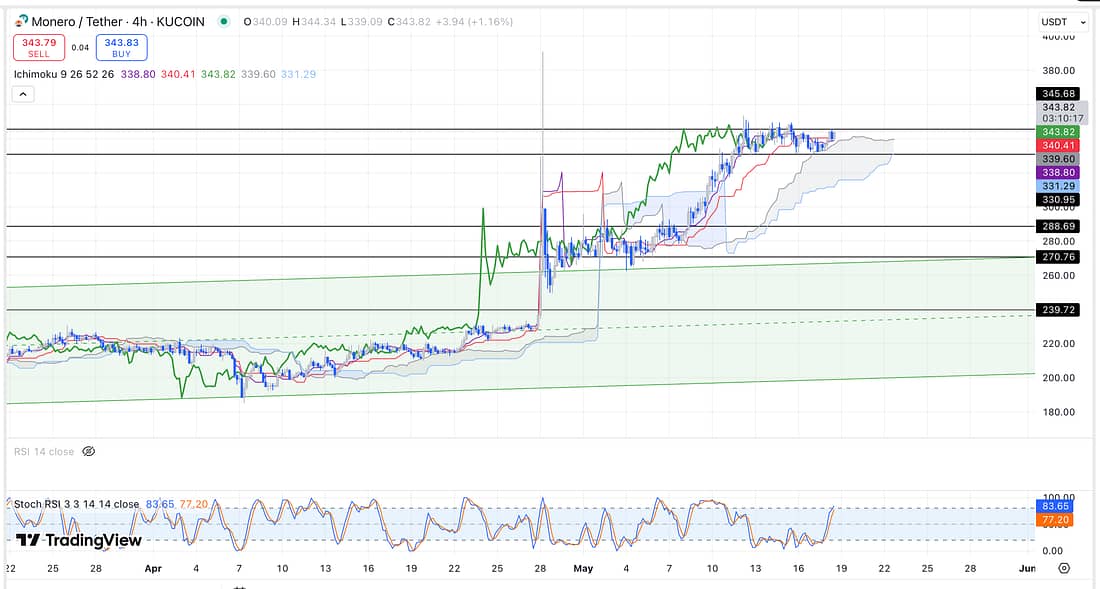

1. MONERO (XMR)

Yesterday, I was looking for a crypto-currency that runs inverse to Bitcoin. Unfortunately, there appears to be nothing except ETF’s that are not 24 hour trading instruments.

That said, I came across information that claimed MONERO does not move in correlation with BTC, therefore, I am going to look more into this right now.

Quick online research seems to reveal that MONERO had an inverse relationship to BTC in 2023, which makes sense in the respect that whenever it looks like BITCOIN will be destroyed by global governments, crypto investors would seek protection by flocking to privacy coins.

The latest info, however, seems to indicate that MONERA is now (2025) 0.83 correlated with BTC’s price action movements, which appears to be the case when I carried out a quick backtest.

My online search highlighted that another crypto-currency, MAKER (MKR), may have an inverse relationship with BTC – let me take a quick look.

Yes, Perplexity AI states that MKR is only 0.24 correlated with BITCOIN’s price action movement in the last three months.

The question is when BTC is going up, is MKR likely to be going down?

My backtesting seems to reveal that when BTC is rallying, then MKR will rally to the upside also. However, when BTC is subsequently moving sideways, this will cause MKR to decline greatly like most other Altcoins:

2. MAKER (MKR)

3. BITCOIN (BTC)

4. XLM

Place a stop-loss under your XLM transfer to see if you can gain more USDT because BTC.D currently has a bearish price action structure on the 15 minute timeframe.

If the bearish price action structure continues, then this should result in XLM increasing in value.

In this respect, continue to monitor BTC.D on the 15 minute timeframe:

5. BTC.D

6. ONDO

Buy a small quantity of ONDO as soon as possible because the price action is now at the bottom of the parallel channel.

Due to the volatility of crypto-currency, (1) buy spot, (2) in general use a mental stop-loss, and (3) continue to analyse the altcoin charts every single day.

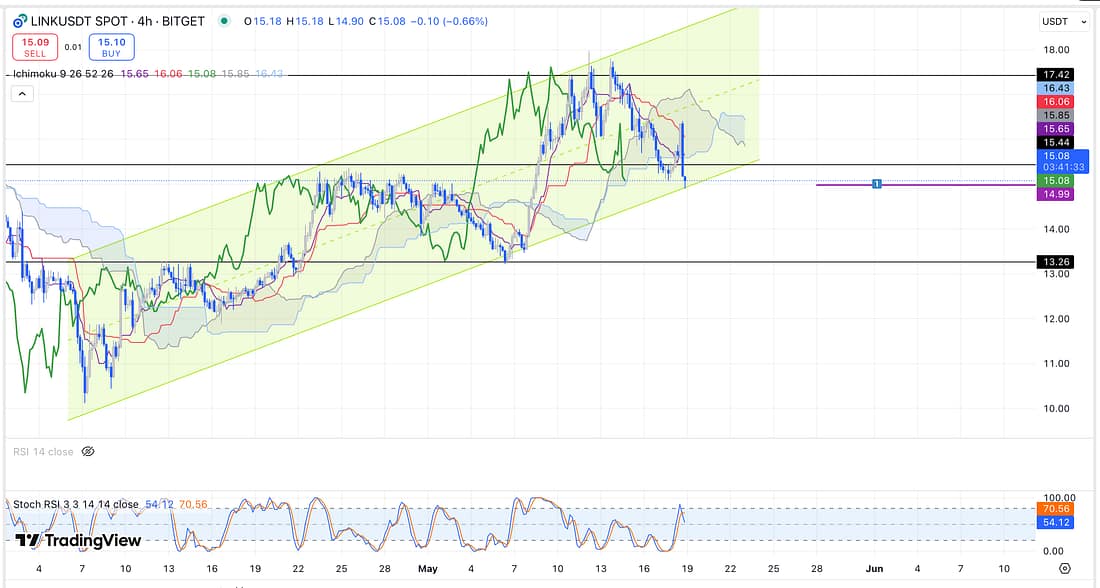

7. CHAINLINK

Buy a small quantity of LINK as soon as possible because the price action is now at the bottom of the parallel channel.

Due to the volatility of crypto-currency, (1) buy spot, (2) in general use a mental stop-loss, and (3) continue to analyse the altcoin charts every single day.

8. RENDER

Buy a small quantity of RENDER because the price action is at the bottom of its parallel channel on its daily timeframe.

9. SOL

Buy a small quantity of SOL immediately as BTC looks like it is almost ready to rip to the upside due to its increased price action velocity (volume) at the moment (2.20am).

Let’s see what happens in the next few hours.

Learning Point

- Blue chip crypto-currencies like SOL have as much as 0.90 correlation coefficient with BITCOIN, making it almost guaranteed that when BTC.D falls, these blue chip Altcoins are likely to rip to the upside.

. - Stellar Luman (XLM) is a well known crypto-curreny used to make international payments due to its low transaction fees.

. - Even though the percentage of BTC.D is rising, causing the price action of XLM to decline, if BITCOIN rallies then XLM will immediately rise also.

This is why it is still very important to keep a eye on BTC, and still buy small quantities of the key Altcoins, even though a rising BTC.D is causing the Altcoin to further decline. - My technical analysis today revealed that it is when BTC is moving sideways that the Altcoins can completely collapse in price.

. - It is important to carry out technical analysis everyday, and document the process, because this is the only way to become a good trader. It is truly equivalent to learning how to actually drive a car.

. - Trading crypto is more difficult than carrying out trades in the main financial markets, because a trader has to know how to deploy the following strategy:

(1) trade using a mental stop-loss,

(2) diversify their trade into several altcoins,

(3) keep a track of all outstanding altcoin trades,

(4) dollar cost average into positions over a relatively long period,

(5) keep an eye on the price of BTC,

(6) keep an eye on the price of BTC.D,

(7) keep up with daily crypto news,

(8) know how to deposit fiat into exchanges,

(9) know how to convert fiat into crypto-currencies, and

(10) know how to transfer crypto-currencies.

Next Action

- Monitor BTC, and Altcoins, every 4 hours.

- Monitor BTC.D every 4 hours.

- Buy a small quantity of LINK as soon as possible.

- Buy a small quantity of ONDO as soon as possible.

- Convert GBP into XLM, then transfer to Bitget exchange.

- Place a stop-loss under XLM on the 15 minute timeframe to see if you can gain additional capital from your transfer.

- Buy a small quantity of RNDR as soon as possible.

- Watch Sheldon’s latest crypto trading video.

- Progress latest trading book review.