Trading Watchlist:

1. WOLF

Continue to keep a close eye on WOLF every single day.

2. UVXY – analysed.

3. SOXX – analysed.

4. MRNA – analysed.

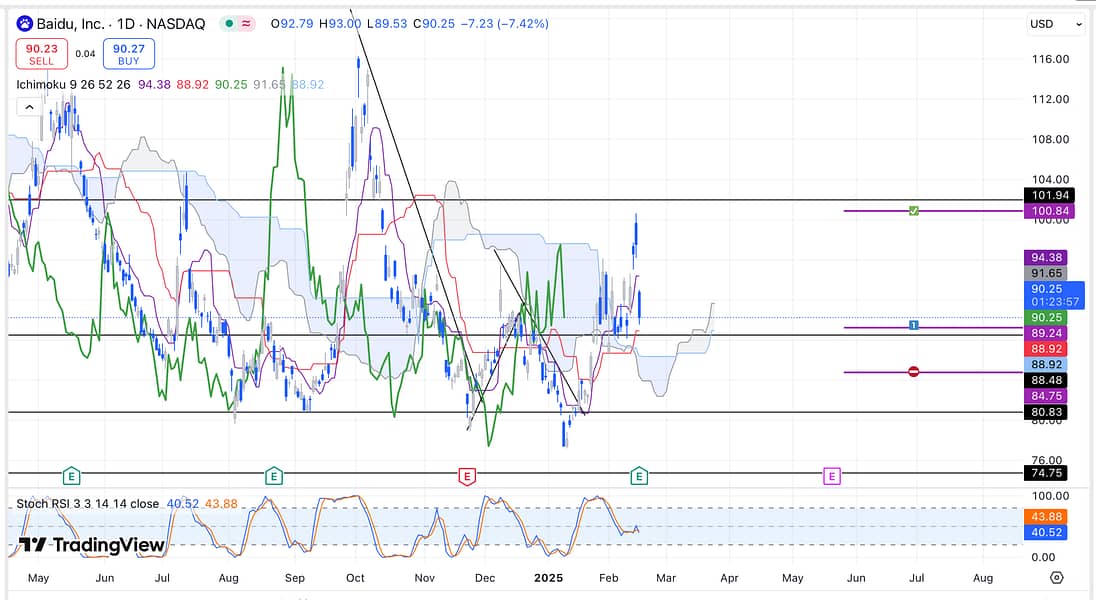

5. BIDU

Almost time to start scaling into a BIDU long trade again (use a limit order).

6. TIGR – continue to monitor TIGR everyday.

7. FFIV – analysed.

8. DJI – analysed.

9. GE – analysed (remember that this trade was commence in light of its inter-market relationship with DJI).

10. DG – analysed.

11. INTC – analysed: continue to monitor INTC’s price action everyday.

12. USOIL – analysed.

13. UCO – analysed.

14. PALL – analysed.

15. JETS – still refusing to roll over (stubbornly). Let’s see how it plays out.

16. UAL – analysed.

17. COST – price action has now re-entered the parallel channel. Let’s see how this plays out also.

18. BIIB – analysed.

19. QQQ – analysed.

20. SFM – analysed.

21. RUT – analysed.

22. US10Y – analysed.

23. CMG – continue to monitor CMG everyday as it looks like a good candidate for a swing trade re-bounce off the next support level.

24. SAP – analysed.

25. TSM – analysed.

26. NATGAS – analysed.

27. XAUUSD – analysed.

28. BTCUSDT – analysed.

29. BTC.D – analysed.

Learning Points

- Following the price action of 20+ charts everyday has, really, revealed to me the importance of waiting for the price action to pull-back significantly before even considering making a trade.

Next Action

- Start scaling into a BIDU long trade again using a limit order.