Trading Watchlist

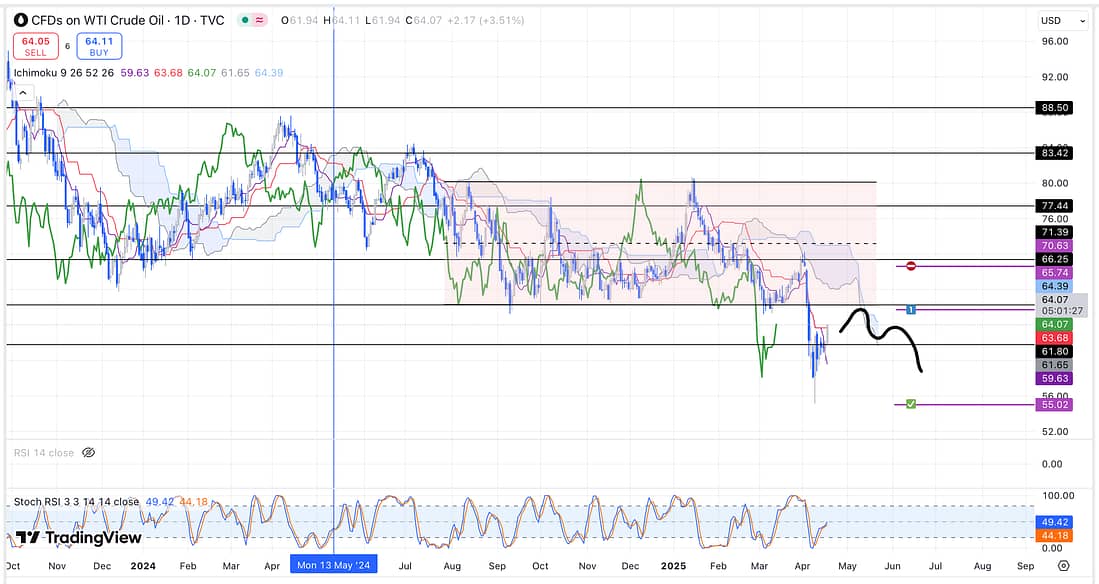

1. USOIL

Using limit orders, start scaling into USOIL exchange traded fund (USO) short as soon as possible:

2. USO

3. SAP – analysed.

4. QQQ – analysed.

5. BABA – analysed:

6. GFI – analysed.

7. US10Y – analysed.

8. TLT – analysed.

9. IWM

Start scaling into a IWM short position as soon as possible (including a limit order).

10. RUT – analysed.

11. XAUUSD – analysed.

12. SFM – analysed.

13. NATGAS – analysed.

14. PALL

Exit PALL long trade, as soon as possible, because my use of parallel channel now reveal that my entry level was extremely weak.

15. DECK – analysed.

16. TTD – analysed.

17. TIGR – analysed.

18. 000001 – analysed.

19. SMCI – analysed.

20. HOOD – analysed.

21. FDX – analysed.

22. FFIV – analysed.

23. COST – analysed.

24. JETS – analysed.

25. UAL – analysed.

Learning Points

- SAP – Checking the markets 30 minutes before they close is highly likely to provide many more good trading opportunities.

. - In theory, I only need to carry out one trade per day to achieve twice my monthly trading target (10 minimum trades).

Next Action

- Start scaling into a USO short position as soon as possible (including a limit order).

- Start scaling into a IWM short position as soon as possible (including a limit order).

- Watch today’s “Trading the Close”.

- Exit PALL long trade as soon as possible.