UAL

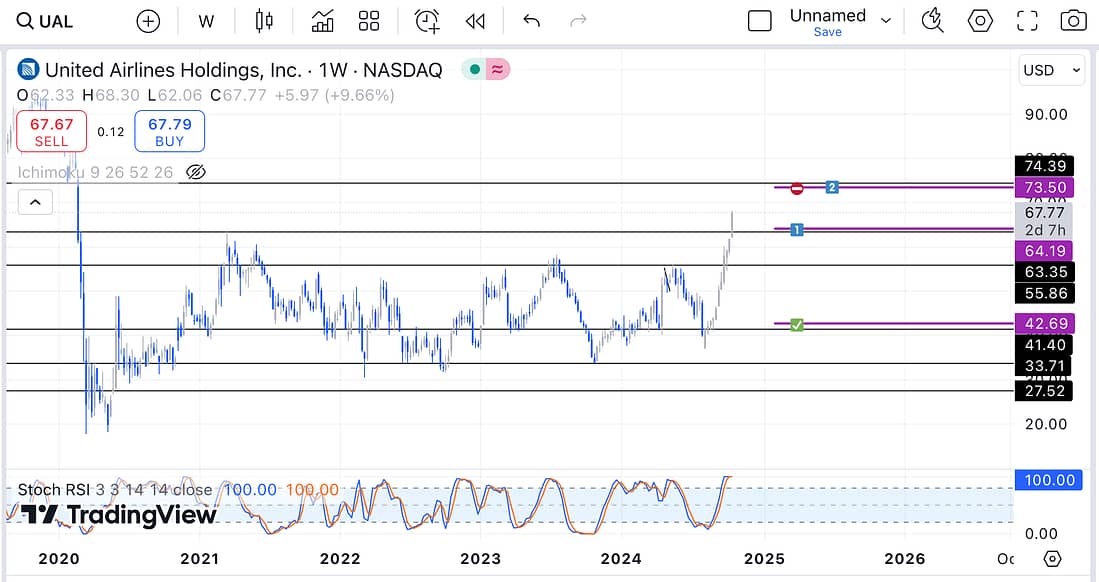

Today, I decided to start shorting UAL in accordance with it weekly timeframe (as can be seen above).

I scaled in using a 1/3 entry based on the assumption that my trade is wrong, however, I will add to my position if the price action proves the trade to be correct.

Learning Points

- This trade can be seen as a diversification of my JETS’ trade because they both concern shorting the airline industry. The difference being that JETS is the ETF for the entire industry, whereas UAL is just an individual airline stock like LUV.

- My playbook has two main strategies for shorting: (1) when the lagging span crosses a bullish diagonal trendline on the 4 hour timeframe, and… (2) when the price action hits key resistance levels on the weekly timeframe whilst its Stochastic RSI is in the overbought position. This is because there is only so long that the price action can continue to rise, after a parabolic rally, before it will decline greatly in accordance with the weekly timeframe.

- Important to consistently watch the daily trading videos of other experienced traders to obtain more trading ideas or opportunities.

Next Actions

- Continue to monitor the price action of JETS, and UAL, everyday.

- Continue to consistently watch the trading videos of experienced traders for trading ideas, and to further your overall learning.

- Continue to go through your trading watchlist everyday.

- Continue to ascertain and craft a high-probability trading playbook.