1. SUI

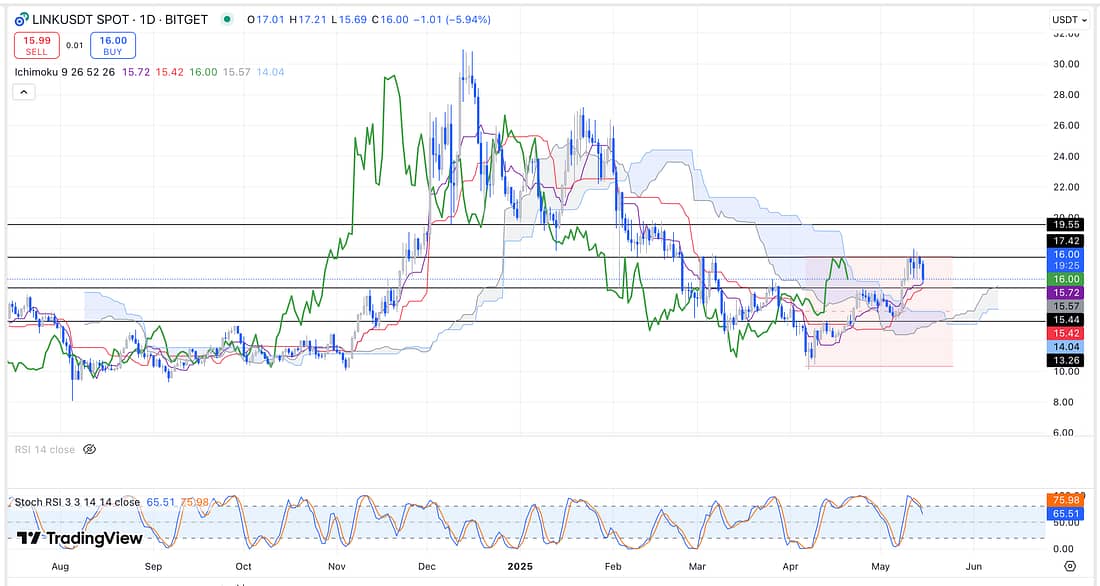

2. CHAINLINK

3. TON

4. MATIC

5. ADA

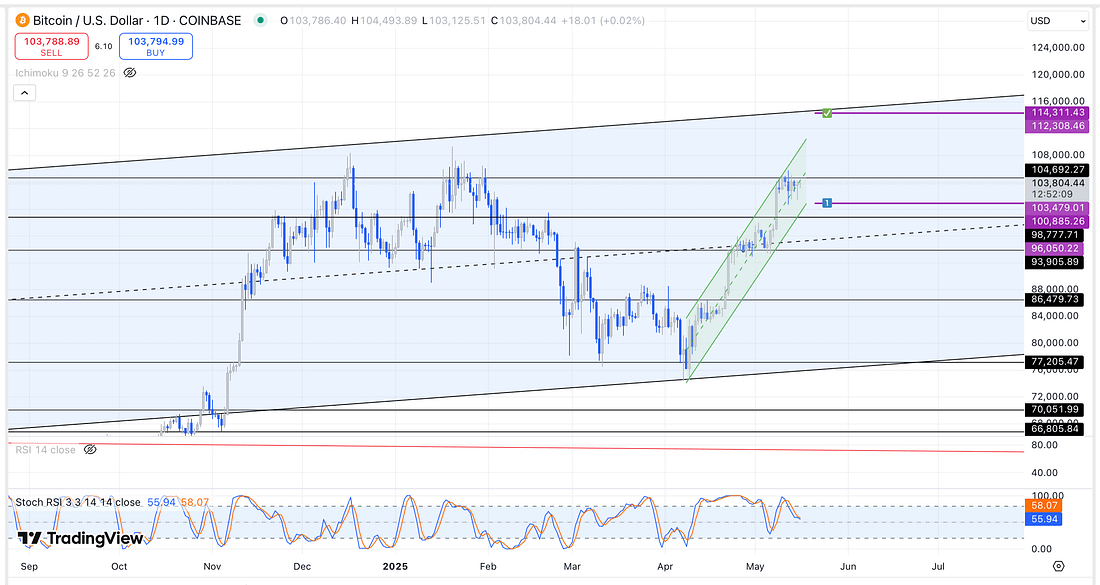

6. BTC

As can be seen above within BTC daily timeframe, the price action looks long overdue for a substantial pullback on the daily timeframe.

It is like the market makers and big institutional players are currently trying to lear in as many inexperienced traders as possible before they make their next major move.

Therefore, I guess the key thing would be to monitor the markets every four hours, everyday.

Possible Scenarios:

(1) If the SOXX pulls back strongly, then BTC may potentially decline also – flushing out weak hands.

(2) If SOXX continues to move sideways, then this will increase the possibility of BTC moving upwards over the weekend.

(3) If SOXX surges to the upside, then BTC is likely to start moving up immediately – causing the Altcoins to do likewise.

In this respect, it may make sense to start scaling into suitable Altcoin long positions as soon as possible.

7. THETA – analysed.

8. SOL – analysed.

9. ALGO

Keep a close eye on ALGO as a good long Altcoin play.

10. SOXX – analysed.

11. QQQ – analysed.

12. SPY – analysed.

13. RUT – analysed.

14. UVXY – analysed.

15. US10Y – analysed.

16. XAUUSD – analysed.

17. GFI – analysed.

18. GDX – analysed.

19. SFM – analysed.

20. NFLX – analysed.

21. UAL – analysed.

22. JETS – analysed.

23. BIDU – analysed.

24. TIGR – analysed.

25. FDX – analysed.

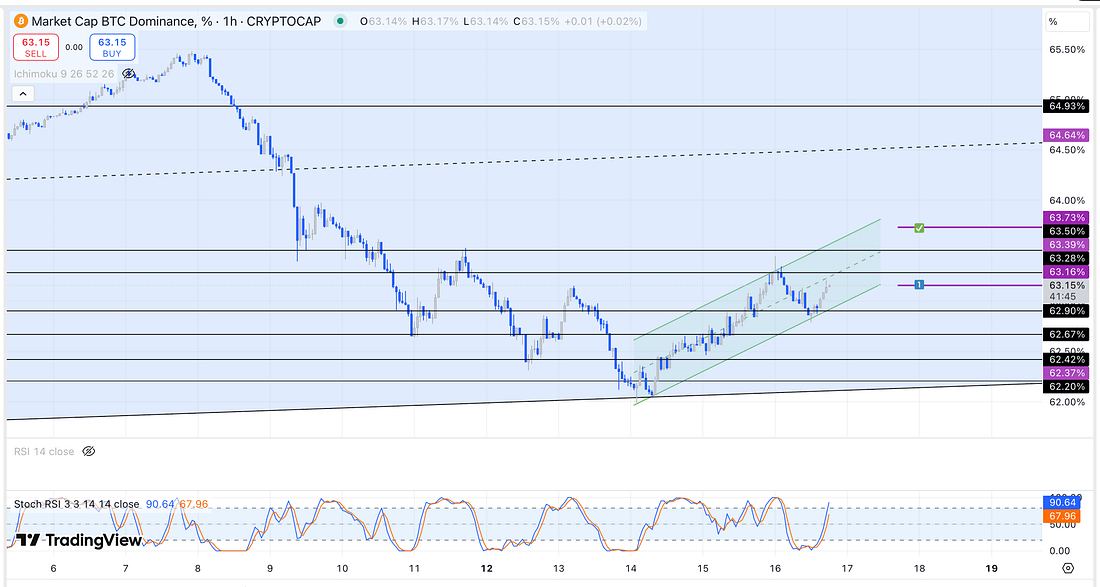

26. BTC.D

I am reminded that the Altcoins cannot rise if BTC.D does not fall.

As shown above, BTC.D is having a relief bounce after hitting the lower part of its parallel channel.

Incorrectly, I expected BTC.D price action to continue falling, however, it did not.

As a result, this is not the time to enter into any long Altcoin position.

Instead, ikeep a close eye on BTC.D every hour.

If BTC.D start to fall again out of its mini parallel channel on the 1 hour timeframe, then this could signal that it is time to long the Altcoins.

Let’s see how this plays out.

Learning Points

- Crypto is so volatile that it is the daily timeframe, as opposed to the weekly, that appears best for establishing the major resistance and support levels.

. - Sheldon at Crypto Banter still provides highly valuable information on a daily basis in regard to trading crypto so start watching his videos in order to get myself back up to speed.

. - When it comes to technical analysis, watching Sheldon’s trading video, today, allowed me to appreciate that I am no longer a newbie.

In fact, I have now developed an ability to carry out technical analysis to the extent that I am probably able to also teach Sheldon a thing or two.

. - In terms of getting back into trading crypto, Sheldon confirmed that I was right to pursue the strategy of trading blue chip crypto like ADA, SOL, AVAX, ETH and so on first.

. - What is missing from Sheldon’s analysis of the crypto market is its intermarket relationship with the broader US market (SOXX).

. - Sheldon made an excellent point: it is only when the Stochastic RSI is within the oversold area on the daily timeframe that the price action then often moves aggressively. However, this is not always the case so its just a factor to take into account.

- Sheldon also made another strong point: when the price action consolidates it typically speeds up just before the price action then rallies to the upside. Sometimes it will rally slightly and dump before it finally surges to the upside.

Again, this is not 100% guaranteed so always avoid trying to be too clever.

Next Action

- Watch the latest crypto trading video by Sheldon to get up to speed with what’s been happeniong in crypto as quickly as possible.

- Monitor the price action of BTC.D every hour or so.