Trading Watchlist:

1. BIDU – start scaling into a long position:

2. USOIL – analysed.

3. UCO – analysed.

4. BIIB – analysed.

5. WOLF – analysed.

7. WBA – analysed.

6. TIGR – analysed.

8. DG – start scaling into a long position based on DG’s monthly timeframe:

9. CMG – scale into a short position as the RUT (broader market) is likely to continue ranging (moving sideways) on the 4 hour and daily timeframe:

10. RUT

11. LLY – scale into a LLY short based on the daily timeframe Ichimoku lagging span and Kumo Clouds, and the trendlines:

The Ichimoku and the trendlines indicate that the price action on the daily timeframe is now more likely to decline than to breakthrough the resistance level and rally to the upside. Let’s see how this plays out.

12. TSM – analysed.

13. SOUN – analysed: take full profits as soon as possible when the market re-opens tomorrow.

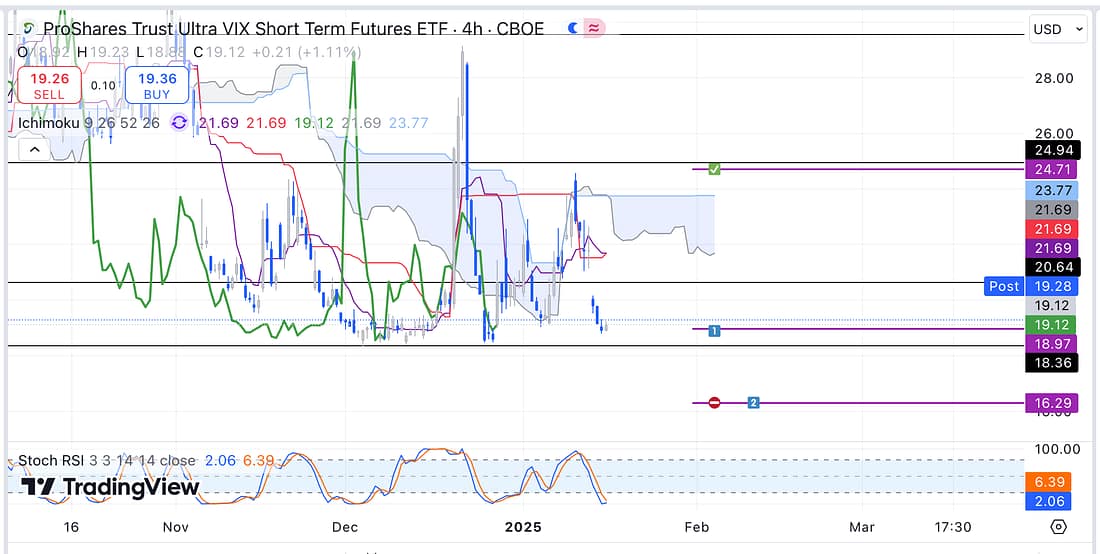

14. UVXY – start scaling into a UVXY long tomorrow as soon as the markets re-open tomorrow:

15. JPM – analysed: price action has hit my stop-loss causing me to sustain a small loss.

Learning Points

- USOIL – Although USOIL price action appeared to have broke though the resistence level on the daily timeframe, and was printing a bullish price action pattern on the 4 hour timeframe, the price still declined strongly today back to the previous resistance level which is now acting as support. This confirms the argument that the larger timeframe support or resistance levels or trendlines will always take priority. Plus, it is clear that they are going to require scaling in, and a lot of patience.

- I now appear to be diversifying my trading portfolio by having a combination of trading positions some in the short-term (daily timeframe) whilst others are in the longer-term (weekly and monthly timeframe).

- Today, I started ensuring that there is enough capital deployed within each trade that will allow me to take profits at least twice in order to ensure that I am fully developing my trading ability

- Many small technical bounces off of major support levels still move the price action in large percentage terms even though the actual price action pattern seems to hardly move.

- Very important to ensure that when adding additional capital to a higher timeframe trade that is moving against you, you have to increase the capital ratio in order for the overall trade to eventually be worth the risk. For example, if wish to risk $9 in total with a 3 to 1 RRR, then the first entry has to be $2, followed by the second entry at $3, and the final entry at $4. The result is that if the first two entries fail, but the final one is successful, then you would have made $7 in total ($4 x 3 – $5 = $7). So, the larger the final entry, the better in terms of profitability.

- JPM – this losing trade has taught me the importance of using the parallel channel or relevant upper trendline in order to lower the risk of shorting a rising stock early. Instead of having to wait for a declining price action signal provide by the 4 hour timeframe lagging span.

Next Actions

- Scale into a long BIDU position as soon as possible in accordance with the weekly timeframe.

- Scale into a long DG position as soon as possible in accordance with the monthly timeframe.

- Scale into a short CMG position as soon as possible in accordance with the daily timeframe.

- Scale into a LLY short position as soon as possible in accordance with the daily timeframe.

- Watch the latest “Verified Game Plan” to continue your accelerated learning process.

- Watch the latest “Trading the Close” to continue your accelerated learning process.

- Take full profits on SOUN as soon as the markets re-open tomorrow.

- Scale into a UVXY long position tomorrow as soon as the markets re-open.

- Record the JPM trading loss on the new trading spreadsheet.