Trading Watchlist

1. UAL

2. QQQ – analysed.

3. BTC – analysed.

4. SPY – analysed.

5. RUT – analysed.

6. US10Y – analysed.

7. TLT – analysed.

8. SFM

Keep a close eye on SFM in order to exit the position as soon as the price action retraces back to the entry level.

9. UVXY – analysed.

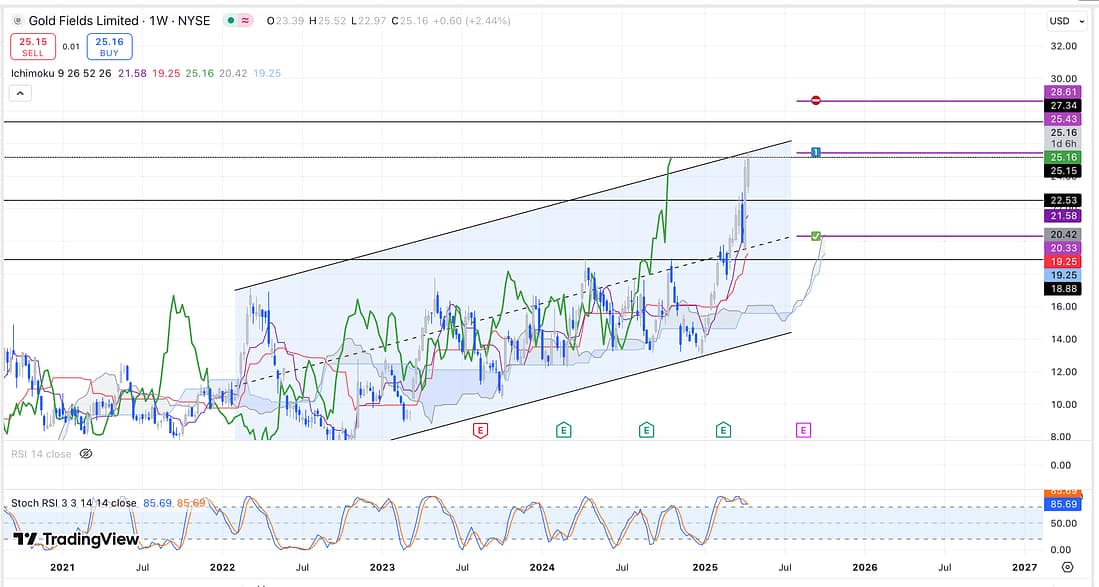

10. GFI

Based on technical analysis, start scaling into a GFI short position as soon as possible.

11. GDX – analysed.

12. XAUUSD – analysed.

13. SMCI

Exit SMCI immediately as it appears to have failed to establish a bullish price action trend on its 4 hour timeframe.

14. COST

Start scaling into a COST short, as soon as possible, in accordance with it bearish parallel channel on the daily timeframe.

15. AXP

Start scaling into a AXP short position, as soon as possible, in line with its declining parallel channel.

16. WMT – analysed.

17. SAP

Continue scaling into the SAP short as soon as the markets re-open tomorrow.

Learning Points

- My GDX trade reminded me today that when entering any trading position, it is extremely important that we assume that we are wrong in order to not form an attachment to any trade.

. - My latest trading book reminded me that, when trading, do not look for perfection as the markets will continue to behavour unpredictably. Therefore, “near” will always be good enough.

Better put, if the price action is “near” your target level, then take profit.

If the price action is “near” your stop-loss then consider exiting the trade.

If the price action is “near” your entry level then submit an entry, and so on.

. - Without going through my own trading watchlist, I would not have been able to identify numerous trading opportunities which were not even mentioned on “Verified Investing” or “Trading the Close”.

Therefore, slowly but surely, it appears that I am starting to outgrow Gareth Soloway’s trading experience and expertise.

Next Action

- Using a limit order, add additional capital to UAL short as soon as possible.

- Set a take-profit at the entry level for SFM as soon as possible.

- Start scaling into a GFI short as soon as possible.

- Turn “Phantom of the Pits” into an AI Podcast.

- Turn “Best Loser Wins” into an AI Podcasts.

- Exit the SMCI long immediately.

- Start scaling into a AXP short as soon as possible.

- Start scaling into a COST short as soon as possible.

- Consider adding additional capital to the SAP short as soon as the markets re-open tomorrow.

- Start scaling into a COST short as soon as possible.

- Start scaling into a AXP short as soon as possible.