Trading Watchlist:

1. UVXY

I closed the UVXY position for the following reasons… (1) the price action had reached around 70% in the vicinity of the second take profit level… (2) the QQQ, RUT, and SOXX sold off aggressively within the first 30 minutes of the markets opening today. This suggest that it was institutions that were selling, and so they are unlikely to continue their heavily selling for fear of crashing the market entirely (which would defeat their objective to further sell into the market in the coming weeks)… (3) the price action of the QQQ, RUT, and SOXX have approached, or are approaching key support levels on their daily timeframes. This increases the likelihood the price action will experience a short-term bounce before any possible further decline.

2. RUT – analysed: nearly at key support on the daily timeframe so look to take 50% profits off the table.

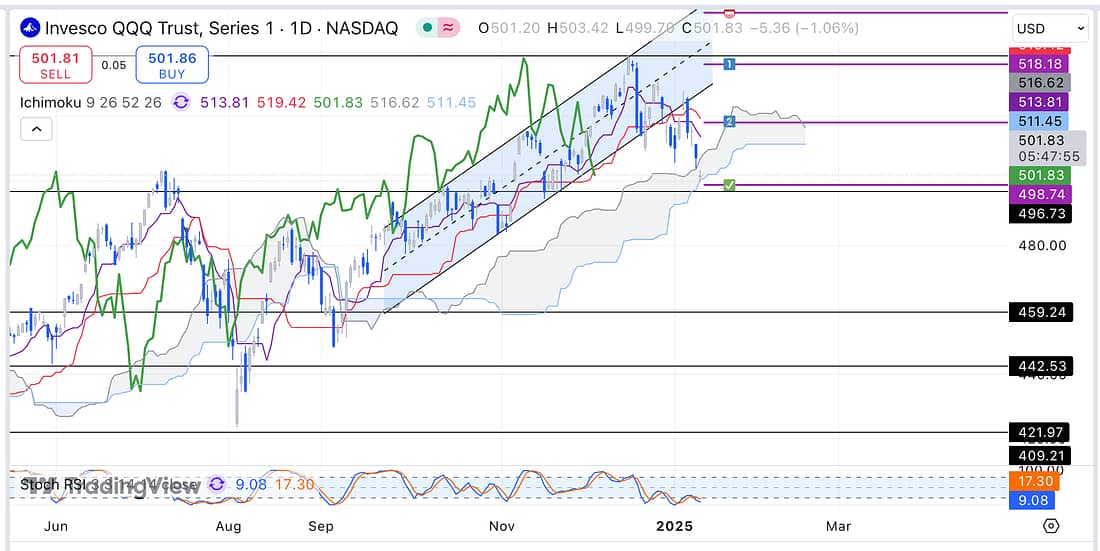

3. QQQ – (analysed) at key support level now so look to take 50% profits off the table:

4. SOXX – still ranging.

5. WBA – it seems like I had to fully exit my WBA position because I did not invest enough capital in order to be able to take partial profits:

6. CMG – CMG seems to be subject to unusual downward pressure (plus I am no longer able to partial profits), so I am going to let my short position continue to run.

7. DG – analysed.

8. WOLF – analysed.

9. INTC – no January pop effect for INTC, so close the long position as soon as possible in light of the broader markets continued decline:

10. BIIB – closed long position because there was no January pop as hoped for:

11. TIGR – analysed.

12. BIDU – analysed.

13. TSM – analysed.

14. MRNA – analysed.

Learning Point

- The markets did bounce at the key support levels as I had anticipated, so it was a brilliant trading decison to take partial profits earlier today.

- The above acts as strong evidence that Gareth Soloway’s approach, of using the daily timeframe to determine the most probable direction of the price action in the short-term, is the right one.

- And that going in and out of trades, and taking profits at the major support and resistance levels, on the daily timeframe may be a far more superior method of trading than holding the same trading position on a weekly basis.

- The above also stresses the importance of carrying out intermarket analysis before making any trading decisions to increase the probabilities of success (today I looked at the RUT, SOXX, and QQQ before making a decision).

- And having intimate knowledge about how institutional players are most likely to trade the same markets (for weeks, institutions have been selling heavily during the first hour of the market opening only).

Next Action

- Keep a close eye on the price action of BIIB everyday.

- Keep a close eye on the price action of WOLF everyday.

- Watch today’s “Verfied Game Plan”.

- Watch today’s “Trading the Close”.

- Update new trading spreadsheet with the latest winning and losing trades.

- Monitor MRNA everyday for a possible long entry when the broader market is ready to rally for a week or so.