Trading Watchlist:

- DG – exit position immediately as the price action appears to have broken its bullish structure on the 4 hour timeframe. It is now potentially trending sideways:

2. BTC.D – analysed.

3. BTC – analysed.

4. MARA – analysed.

5. SFM – analysed.

6. UAL – analysed.

7. AXP – analysed.

8. FDX – analysed.

9. CMG – analysed: I want it to pull-back more to the Kijun before I feel it would be worthwhile making an additional entry.

10. PALL – still no man’s land.

11. US10Y – right move to exit TLT yesterday, as US10Y has blown through the roof:

12. US10 – analysed.

13. UVXY – analysed.

14. BIDU – analysed.

15. TIGR – analysed.

16. SOXX – still ranging.

17. INTC – analysed: INTC’s price action reminds me that we must trade assets that move greatly and, ideally, stay out of anything that moves slow.

18. WMT – analysed.

19. COST – analysed.

20. USOIL – USOIL may be ready soon to breakout of its range to the upside. Let’s see what happens in the next few days. If it does, this should cause downward price action pressure on JETS and UAL.

21. JETS – Gareth Soloway drew my attention to the fact that I could use the parallel channel to make an early short entry when I suspect that an asset or market may be ready to turn or reverse. Moreover, if wrong, my own experience suggests that I should be able to exit the position without sustaining much of a loss at all, because the price action is unlikely to shoot pass my entry level without prior warning:

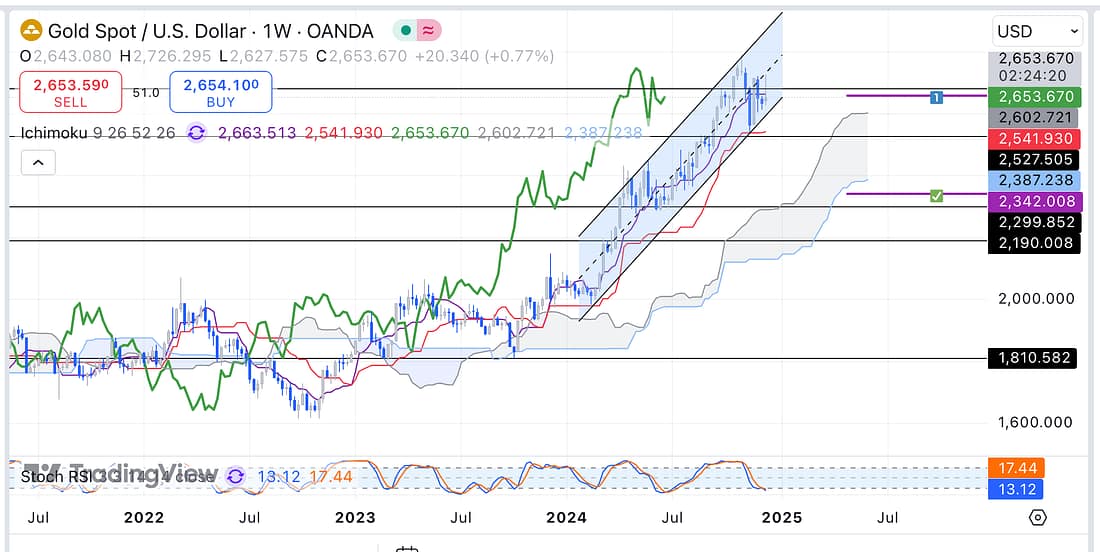

22. XAUUSD – analysing Gold’s chart today, I concluded that it is better to make an entry when the price action pulls back on the weekly timeframe (using the parallel channel) to increase the odds of the trade having a high-probability of success:

23. NATGAS – there is not a clear weekly trend as of yet.

24. DXY – ranging on the 4 hour timeframe so not a good market to trade at the moment.

25. XRP – analysed.

Learning Points

- With my trading style, it seem to really be all about being able to accept all of my first entry loses as I scale into a position. Winning trades seem to be those that enable us to add additional capital (at least once as the price action pulls back to the Kijun) before exiting. Therefore, this trading style favours assets or markets that have been severely beaten down, or have rallied tremendous that a substantial reversal is to be expected.

- To keep learning from more experienced traders on a daily basis as a priority.

- I am more efficient and effective at carrying out my trading journal analysis when I use my previous day’s post to quickly remind myself of what markets and assets to keep my eyes on.

Next Actions

- Exit DG trade as soon as possible.

- Watch Gareth Soloway’s latest trading video today to continue gaining valuable insights and improving your trading ability.

- Update new trading spreadsheet with latest DG losing trade.