1. BTC.D

In light of the fact that there appears to be almost a 100% correlation between BTC.D and the price action movement of THETA, add additional capital to THETA long trade immediately.

This is because BTC.D percentage movement has confirmed that it is still in a strong bearish percentage structure, and it is likely to continue declining at least to the lower part of its parallel channel.

Moreover, I actually think that BTC.D has a good possibility of breaking below its parallel channel due to the fact that it has a strong weekly timeframe declining Stochastic RSI.

2. THETA

Add additional capital to THETA long trade as soon as possible.

I am carrying out this trade, solely, because of the percentage action structure of BTC.D.

Therefore, if I was assessing the price action structure of THETA in isolation, I definitely would not be carrying out this trade.

It is also important to bear in mind that when the markets re-open at 2.30pm, they will have an affect on the price action of BTC.

If the broader market causes BTC to start declining, then I will be expecting this to have an adverse effect on my THETA trade – causing the price of THETA to also start declining, and BTC.D percentage to increase as BTC is a save haven asset in the crypto space.

Therefore, it may be important to take immediate profits out of THETA as soon as possible.

Let’s see how this all plays out.

3. BIIB

Start scaling into BIIB long as soon as possible.

4. SOXX – analysed: continuing its bullish price action structure as anticipated.

5. BTC – price action has not moved higher even though the SOXX has rallied higher than expected at this point.

This suggests that money is now being allocated to Altcoins by larger investors.

6. QQQ – QQQ has also unexpected risen in line with the SOXX.

7. SPY – SPY as per SOXX and QQQ.

8. RUT – RUT as per SOXX and QQQ.

9. US10Y – analysed.

10. DG – analysed.

11. SFM – SFM seems to decline whenever the broader market rallies.

This confirms that SFM is being treated by large investors as a safe haven stock.

12. PLTR – analysed.

13. NFLX

Similar to SFM, I am surprise to see that NFLX’s price action has fallen as the broader market is rallying.

Therefore, I am assuming the NFLX must also be acting as some sort of safe haven stock.

If I had known, then I would have kept my short position open.

Let’s see how this plays out.

14. USOIL – analysed: my analysis was correct.

15. NATGAS

In light of NATGAS’ price action returning back to the bottom of its parallel channel, increasing the odds that it will rally higher again, add additional capital to the UNG long trade as soon as possible:

16. UNG

Add additional capital to UNG trade as soon as possible.

17. BIDU – analysed.

18. TIGR – analysed.

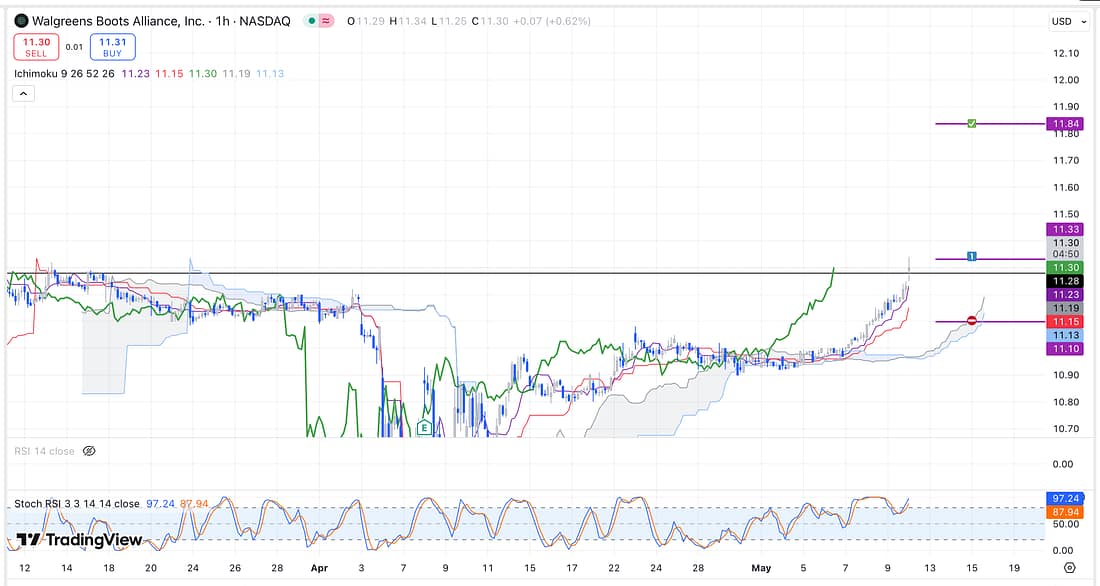

19. WBA

Start scaling into a WBA long trade immediately, and using a limit order.

Next Action

- Monitor BTC.D percentage action every 4 hours.

- Monitor THETA price action every 4 hours.

- Assess the US broader market as soon as they open today at 2.30pm.

- Be prepared to take full profits out of THETA immediately as soon as the market re-open today.

- Start scaling into a BIIB long as soon as possible.

- Add additional capital to UNG long trade.

- Start scaling into a WBA long trade immediately, and using a limit order.