Trading Watchlist:

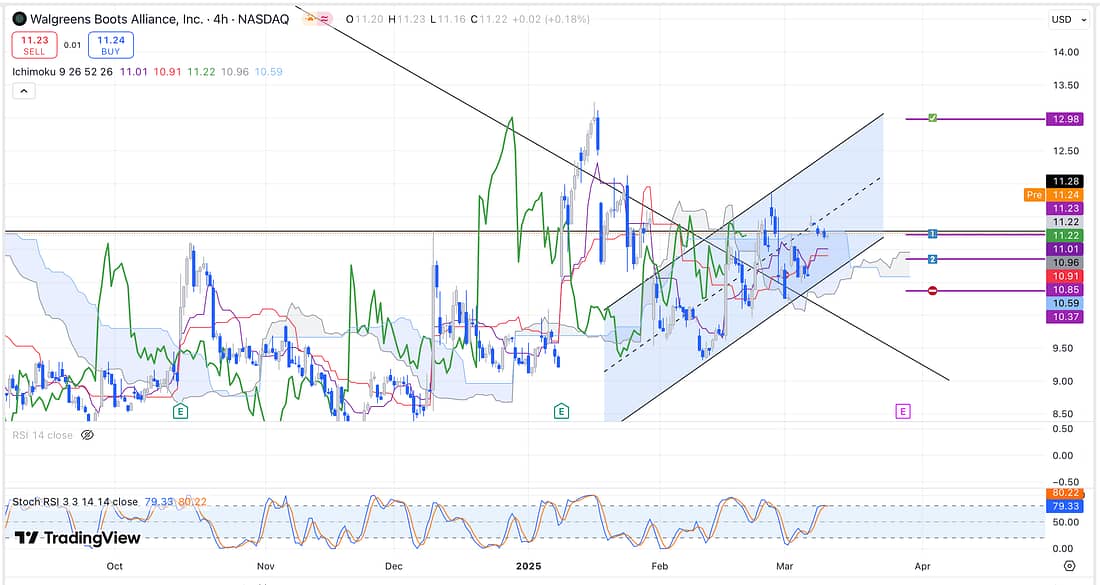

1. WBA

Start scaling into WBA as soon as possible.

2. NATGAS – analysed.

3. UNG – analysed.

4. JETS – analysed.

5. UAL – analysed.

6. BTC – analysed.

7. HOOD – analysed.

8. UVXY – analysed.

9. DG – analysed.

10. SPY – analysed.

11. US10 – analysed.

12. FFIV – (analysed):

Take partial profits out of FFIV, as soon as possible, because the price action has reached a major support level on the weekly timeframe.

And, in terms of inter-market analysis, the QQQ looks set to rise (highly probable relief rally) for the next week or so. Thus, continue to monitor the situation everyday.

13. SAP – analysed.

Learning Point

- The parallel channels combined with the drawing of major support and resistance levels on the weekly timeframe is proving to be of tremendous predictive value.

Moreover, when used with other indicators like the Ichimoku, Stochastic RSI, RSI, and Elliott Wave, the price action direction becomes easier and easier to anticipate.

. - Today, I acknowledged that the most important markets for me to monitor closely at the moment are BTC, QQQ, SPY, RUT, and US10Y as they will give me the heads up in terms of the overall market direction for inter-market trading opportunities.

It is, clearly, the growth of my inter-market analysis with my application of the parallel channels that is making the biggest difference to my trading success currently.

Next Action

- Start scaling into a WBA long trade as soon as the markets re-open.

- Take partial profits out of FFIV as soon as possible.

- Watch today’s “Trading the Close”.

- Continue to learn more about inter-market trading.

- Continue to use the parallel channel in combination with my other trading indicators to improve my trading ability.