1. US10Y

As shown above, the US10Y yield has re-entered the parallel channel on the 4 hour timeframe with tremendous strength.

As a result (intermarket relationship), I will be expecting the following:

(1) broader US market to experience a strong decline as soon as the markets open in the next 30 minutes.

(2) the VIX (UVXY) to surge to the upside as is to be expected when the broader market experiences a strong decline.

(3) the QQQ, COST, UAL, SAP, and JETS to all start declining greatly.

2. USOIL – analysed.

3. UCO – analysed.

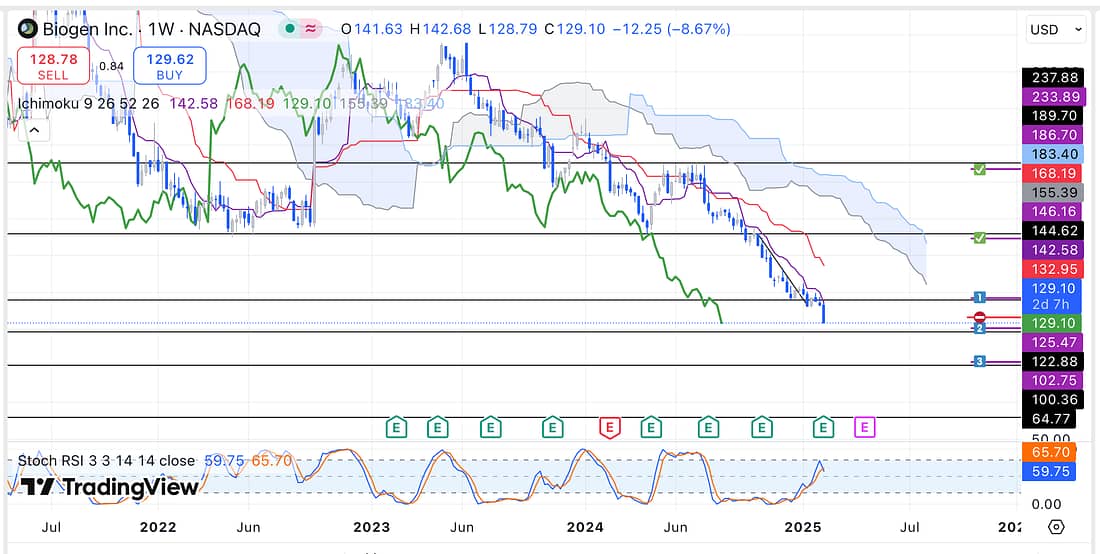

4. BIIB – stop loss triggered in regards to BIIB:

As a result, consider using a limit order to scale into a new long entry as soon as possible:

5. WOLF – analysed.

6. QQQ – analysed.

7. FFIV – analysed.

8. BIDU – analysed.

9. SOXX – analysed.

10. RUT – analysed.

11. FDX – analysed.

12. TLT – analysed.

13. MRNA – analysed.

14. DJI – analysed.

15. GE – analysed.

16. INTC – analysed.

17. CMG – ranging.

18. PALL – analysed.

19. UAL – analysed.

20. SAP – analysed.

21. COST – analysed.

22. JETS – analysed.

23. DG – analysed.

Learning Point

- Consider using the US10Y, everyday, to get an early indication of how the broader US market is likely to behave when it re-opens.

Next Action

- Consider scaling into a BIIB long (using a limit order) as soon as possible.